Who is Larry Williams?

Larry Richard Williams was born on October 6, 1942, in the 8,000-person small town of Miles City, Montana, USA. He attended Billings High School and successfully graduated from the University of Oregon School of Journalism in 1964.

He actively played football on the All-State Football Team. Larry Williams is the author of 11 books, most of which are about stocks and commodity trading.

Larry is the father of five children, with one of his daughters having more. Politically, he is a member of the Republican Party and ran for the US Senate twice (1978, 1982). He supported "Initiative 86" which made Montana the first state to adjust tax brackets to inflation.

In this video, Alex shows how Larry became the most successful trader of all time and how he greatly influenced the landscape of futures trading.

How Larry Williams Became One of the Most Successful Futures Traders in the World

During his studies, Williams was already involved in the financial markets. After four years of observation, he started trading in 1966, initially as a stock trader. At first, he relied almost exclusively on chart technical markers, but he gradually lost money with this approach. Then he changed his approach.

Larry Williams early on recognized the importance of properly using historical data. Since the infrastructure at the time was not even remotely comparable to today's, he began to calculate and record everything by hand.

However, this turned out to be an enormous advantage. As a result, Larry Williams developed an excellent feel for prices and charts. From this work, several of his indicators emerged, such as the famous Williams%R oscillator.

His new, more flexible approach allowed him to earn a sufficient income from his trading profits after about seven years. He found success in the method of combining the fundamental orientation of the markets with technically significant trading points.

Larry describes himself as a conditional trader. He associates this description with his evaluation of the overall picture in combination with individual trading setups. For him, the reaction of the "big ones" in the overall picture was always in the foreground.

Larry Williams on himself:

"I don't see myself as a technical trader, but as a conditional trader. That means, I orient myself with my setups according to specific if-then rules. For example, if my macro analysis shows that the market is likely to make another upward movement, then I choose my setups, position management and technical criteria accordingly and adapt them to this scenario. So I start with the big picture, the big picture, and then transfer my analysis to a shorter time frame...” Larry Williams in an interview with WHSelfinvest.

Larry Williams, the most profitable trader of all time

Larry Williams gradually built his model over the years. Instead of using the usual indicators, he developed new ones. These allowed him to make a faster and more accurate evaluation of a situation. The most well-known among these are the Williams %R, Williams Ultimate Oscillator and Williams VIX FIX.

In 1987, he entered the World Championships in Futures Trading WCFT with his trading approach. His system was already based on data from the COT Report and he determined the set-ups using his own indicators. This 12-month championship was the breakthrough for Larry Williams.

He achieved a return of approximately 11,300%. His trading account started with $10,000 and was valued at $1,137,600 after one year.

Although this value was never confirmed by bank statements, it is still recorded as the highest ever achieved return in the championship to this day.

Like father, like daughters...

10 years later, his daughter Michelle Williams took part in the same competition and won in 1997 with a return of 1,000%. This value is recorded as the third highest result, still surpassed by Ralph Casazzone in 1985 with 1283%.

Another daughter, Paige Williams, participated in the 2019 "Q4 Index & Interest Rate Futures" short-term event, which she won with a net return of 32.3%.

...and partially the son too

His son Jason also became intensively involved in the topic of "Trading". He did not become a world champion, but rather a psychologist. He wrote the book "The Mental Edge in Trading: Adapt Your Personality Traits and Control Your Emotions to Make Smarter Investments" about the topic of trading psychology.

How does Larry Williams' Futures Trading system work?

Larry Williams positions himself based on the fundamental data of the market. He aligns himself based on the COT Report and focuses exclusively on the positioning of the commercials. These are the professional market participants who hedge their business dealings against price risks through positions in the futures market.

In a broader sense, one can see that Larry Williams gives special attention to those in the market who trade for business reasons. He calls them the superpowers of the market himself.

Those who depend on earning money through the production and use of commodities will automatically have the best information available. Consequently, their market assessment will be the most accurate. This gives Larry Williams an advantage in his approach.

"Most market observers focus on charts, but you [as a future futures trader – my comment] focus on the concrete circumstances that cause price changes: the large purchases and sales as well as the supply and demand pressure, which you can observe every week when the successful billions of traders and pools enter the market.

[…] You will learn that there are actually superpowers in the market. […]"

from "Successfully Trading Stocks and Commodities"

He then uses technical chart analysis to determine key entry and exit points for his trade or positions. Basically, he only trades those commodities where the chance-risk ratio is the best.

Through his analysis, he simultaneously has a view of his exit points. He limits losses within the framework of a strict risk management and lets profits run with a trailing stop when they have fully developed.

Clear rules, limited time and most importantly proven to be successful!

The clear rules and consistent risk management result in a proven successful strategy. It is also popular because it can be set up efficiently and constant market observation is not necessary. This approach is therefore ideal for traders who do not have the time and/or do not want to invest in observing the market throughout the day.

The Larry's approach, which analyzes the COT data and positioning, aligns with the market forces. If the market develops counter to expectations, exit points are consistently set.

Many participants and winners of the World Championships in Futures Trading are students of Larry Williams, proving that his approach leads to sustained financial success in commodity trading. Those who make correct trades, limit losses and let profits run, can only have success.

Larry Williams System at InsiderWeek

Larry's system, a swing trading based on COT data, proves to be an ideal trading approach for those with a full-time job.

Many full-time workers are intimidated by trading on the stock market, and one of the main reasons is the time aspect. In addition to work and family, there is often not enough time to fully understand the matter. Swing trading based on the COT report offers the opportunity to reduce the time investment.

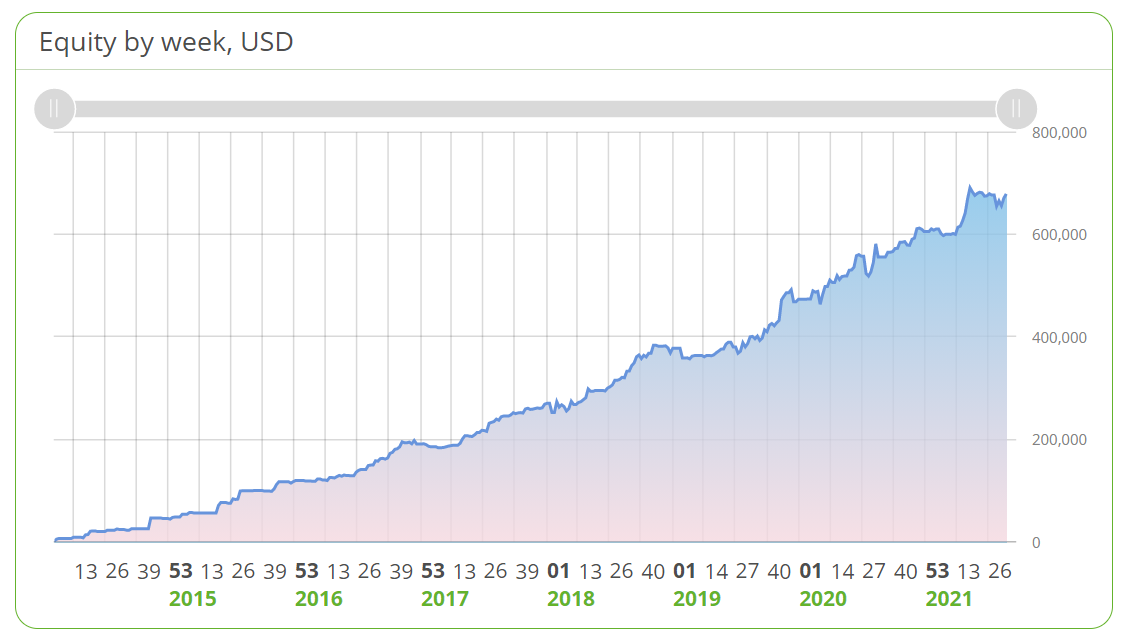

We have been successfully trading based on Larry Williams' approach for almost eight years at InsiderWeek, which we have developed for our own trading style. In his participation in the World Cup Championships of Futures Trading, Max placed third in 2017 and 2019 with a performance over the whole year that was significantly above 100%. In 2021, he was among the best five with 79%.

Together with his team, he has simplified the system and prepared the data so that full-time traders can trade with minimal time investment. Our service only requires a basic setup for the week.

We look at the potential trades, including entry and exit points, and position them accordingly. During the week, only minimal control and adjustments are necessary. With a holding time of just a few days, the trading runs almost automatically during the week. The time commitment and the associated mental stress are reduced to a minimum and the success proves us right.

Larry has extensively described his trading approach in his book "Successfully Trading Stocks and Commodities - How to Use the Knowledge of the Insiders!". In this lively written book, Larry lays out his trading fundamentals. It is a "must-read" for us at InsiderWeek, on which we have built our own system.

Unfortunately, this book is no longer available and is no longer being printed. Used copies are sometimes available at exorbitant prices on the internet. You should look for an eBook version - Google can assist you with this. The original edition can be found in the sources.

Do you want to learn more about how we use Larry Williams' system in our trading?

Then sign up for a free and non-binding strategy session!

We will call you back and provide comprehensive information about your opportunities and possibilities!

To the registration →Reading material and sources:

📖 Larry Williams: Trade Stocks and Commodities with the Insiders: Secrets of the COT Report, Wiley Trading Series; 1st Edition (29th August 2005)

📖 Larry Williams: Winning Recipe: Short-Term Trading - Expanded & Updated, FinanzBuch Verlag (11th January 2013)

📖 Jason Williams: The Mental Edge in Trading - Adapt Your Personality Traits and Control Your Emotions to Make Smarter Investments, McGraw-Hill Education; 1st Edition (27th November 2012)

🎤 Larry Williams: 50 Years of Successful Trading, Interview with WHSelfinvest/Trader and Strategies here

📰 Trading Guru - Larry R. Williams and his famous indicator at traderblattf.com here

Image Credit: Michelle Williams3 Berlinale 2010.jpg:, CC BY 3.0, https://commons.wikimedia.org/w/index.php?curid=18563386

Curious to learn more?

Get your hands on Max Schulz’s book by downloading it today! Free of charge.