Sugar as a commodity and trading in sugar futures

We know sugar in two different forms: as cane sugar and as beet sugar. Approximately 70% of the world's sugar production comes from sugarcane, which is grown in the tropics and subtropics, while in the northern hemisphere, sugar beet cultivation predominates. The average per capita consumption of sugar in Germany is around 38 kilograms per year.

Here are some interesting facts about "white gold," where it comes from, what it's made from, and how you can make money trading sugar futures on commodity exchanges.

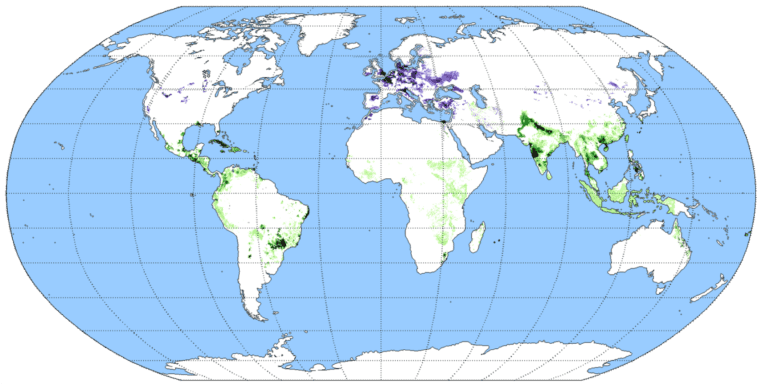

The map shows the areas where sugarcane cultivation (green) and sugar beet cultivation (blue) predominate.

How is sugar produced?

Although sugar is contained in the tissues of most plants, sugarcane and sugar beet account for the majority of commercially grown sugar for production. The sugarcane plant, a tall grass with thick stalks, accounts for about 70% of the world's supply, while the sugar beet plant provides the remaining 30%. Originally, only the sugarcane plant produced sugar, and in very small quantities. However, modern technology has increased the yield.

Although sugar is produced all over the world, the top ten producing countries account for about three-quarters of the total sugar production. Two countries, Brazil and India, produce about half of the world's supply. This concentration of production makes sugar a particularly volatile commodity.

Where is sugar produced?

According to a report published by Statista in 2017/2018, here is the list of the top 10 sugarcane-producing countries in the world.

1. BRAZIL

In recent history, Brazil has gained a significant share of its local economy through sugarcane production. Today, Brazil is the world's largest producer and exporter of sugar, accounting for 20% of global production and over 40% of worldwide exports. The Brazilian sugar industry brings in approximately $44 billion in revenue to the country each year and provides 1 million jobs to those working in this sector.

2. INDIA

India, the world's second-largest sugar producer, is also a global leader in sugarcane production. However, when alternative sweeteners such as Khandsari (a type of raw sugar) and Gur (Jaggery) are included in the mix, India would actually be the largest overall producer of sugar. Today, India accounts for almost 14% of global sugar production, with approximately 1,250 million rupees invested in the sugar industry. The main sugar-producing states in India are Maharashtra, Gujarat, Uttar Pradesh, Haryana, and Tamil Nadu.

3. CHINA

China, the world's third-largest sugar-producing country after Brazil and India, contributed more than 9% to total sugar production in the past decade. The Chinese sugar industry includes 270 operating sugar mills, including 233 sugarcane mills and 37 sugar beet mills. In addition, many products such as pulp, paper, alcohol, yeast, sugarcane juice, biomass, animal feed, and electricity are also produced from sugarcane. The Chinese sugar industry also contributes the majority to the socio-economic development of major sugarcane-growing areas, especially in Guangxi, Yunnan, and West Guangdong, with Guangxi being China's largest sugar producer.

4. THAILAND

With its relatively low domestic sugar demand and low shipping costs, Thailand has become a leading sugar exporter in the world. In recent years, the growth of sugar production has been largely attributed to expansion in the northern and northeastern regions, with a focus on introducing higher-yielding varieties and increasing the use of yield-increasing production inputs. According to the latest report from the United States Department of Agriculture (USDA), sugar production is expected to increase significantly in the coming decades.

5. PAKISTAN

Pakistan is also one of the major sugar producers in the world. The sugar industry in Pakistan is entirely dependent on sugarcane production, although sugar is also produced from sugar beets in the northern areas. Sugarcane cultivation in Pakistan provides partial and seasonal employment to 4 million people, which accounts for about 12.14% of the total agricultural workforce.

6. MEXICO

Mexico, the world's sixth-largest sugar producer, generates 0.5% of Mexico's GDP with sugar production. With an area of approximately 1.6 million hectares, sugar occupies the second-largest area of cultivation, after corn. Veracruz is the leading Mexican state in terms of the area of sugarcane fields, followed by Jalisco, San Luis Potosi, and Oaxaca. In addition, Mexico has an domestic market consumption of around 4.5 million tons per year.

7. COLOMBIA

According to the Food and Agriculture Organization of the United Nations (FAO), Colombia is the seventh-largest producer. In Colombia, 80% of sugar production is carried out on farms with less than 5 hectares of land, and approximately 120 thousand subsistence farmers are employed throughout Colombia. As one of the world's largest sugar producers, the Colombian sugar industry is scattered with thousands of low-technology plants throughout Colombia.

8. PHILIPPINES

The Philippines is the eighth-largest sugar producer in the world, according to the FAO, and the second-largest sugar producer among the Association of Southeast Asian Nations (ASEAN) countries, after Thailand. The Philippine sugar industry provides direct employment to approximately 700,000 workers spread across 19 sugar-producing provinces. Sixty percent of Philippine sugar production comes from the island of Negros, a traditional sugar-growing area.

9. INDONESIA

With a production of 2.5 to 2.7 million tons per year, estimated to cost around 25 trillion IDR, the sugar industry in Indonesia plays an important role in the country's economic growth. Currently, there are 63 sugar factories in Indonesia, owned by 18 companies. However, most of these factories are old and have low productivity due to underinvestment. The government has planned to revitalize the existing sugar units, expand the sugarcane area, and build some new sugar units in collaboration with the private sector to make the country self-sufficient.

10. USA

The United States, one of the largest sugar producers and consumers in the world, is responsible for 8.4 million tons of domestic production and twelve million tons of annual consumption. Sugarcane is grown in crop rotations with other field crops, primarily in Wyoming, Montana, North Dakota, Minnesota, Michigan, Colorado, Nebraska, Idaho, Washington State, Oregon, and California, with an average yield of 28 tons per hectare. However, significant differences in sugar production can be observed from region to region.

Who consumes sugar and for what purpose?

70 to 80% of the produced sugar is consumed in the respective country of origin. The main reason for this phenomenon is that many countries heavily subsidize their sugar farmers and impose tariffs on sugar imports. The largest sugar consumers are India, the European Union, China, the United States, and Brazil. Sugar not only sweetens food but also helps to maintain and preserve the freshness of many foods.

Some of the key applications of sugar in food include:

Main uses of sugar

| Use of sugar | Description |

|---|---|

| Baked goods | Sugar inhibits the growth of certain microorganisms. This, in turn, slows down the spoilage of baked goods and helps them retain their moisture. Sugar also makes baked goods softer. Sugar is also the primary food source for the growth of yeast. |

| Jellies and Preserves | Sugar enhances the colors and flavor of many fruits, making it ideal for use in jellies and preserves. Sugar also supports the gelling process, which helps these products maintain their texture. |

| Candy | Sugar is the main ingredient in most candies. Its solubility makes sugar perfect for the molding and shaping of candies. |

| Cooking | Sugar is an important ingredient for desserts and other dishes in many cultures. |

| Other Uses | The fermentation process used to produce alcoholic beverages uses sugar. Certain pharmaceuticals contain sugar. The textile industry uses sugar for sizing and finishing fabrics. Sugar slows down the setting of cement and adhesives. Additionally, sugar can be used to produce biofuels. |

What influences the price of sugar?

1. Global supply

The most significant driving force for sugar prices is the worldwide production of the raw material. The typical cultivation cycle from planting to harvesting of sugarcane takes 12 to 18 months. During this cycle, farmers must prepare the soil, plant, irrigate, and harvest. If farmers expect a favorable demand climate, they plant more, and if they expect weak demand, they plant less. When demand exceeds or falls short of supply, prices react accordingly.

2. Global demand

An important component of global demand is the correlation between prosperity and sugar consumption. Since sugar is generally viewed as a luxury rather than a necessity, wealthier economies tend to have higher consumption levels than poorer economies. The emerging economies in Asia and South America are the fastest-growing consumers of sugar, so sustained strength in these economies is positive for prices, while a recession in the emerging markets could put downward pressure on prices.

3. The Brazilian Real

Brazil produces and exports such a large percentage of the annual sugar crop that currency fluctuations can have a major impact on sugar prices.

When the Real is weak, Brazilian farmers have an incentive to produce more sugar for export to countries with strong currencies and greater purchasing power. When the Real is strong, Brazilian farmers are more likely to sell on the local market, where sugar is used to make ethanol, and receive Reals for their sugar.

A weak Real means a greater supply on global markets and lower prices.

4. Government subsidies

The sugar industry has a long history of government subsidies and tariffs used to protect local sugar producers. Subsidies and tariffs distort the market by creating an artificially high supply and pushing down prices. If the largest sugar-producing countries were to stop subsidizing producers, production could decrease and prices could rise.

5. Weather

Successful sugar crop production requires frost-free conditions and ample rainfall during the growing season. Because sugar production is heavily concentrated in a small handful of countries, poor weather conditions in one or more of these countries can have a significant impact on supply.

6. Health Concerns

Sugar consumption has been linked to diabetes, obesity, heart disease, tooth decay, and other health problems. Governments are under pressure to address high disease rates, which could lead to taxes and restrictions on sugar-rich products. Health concerns could lead to a decrease in sugar consumption and a drop in prices.

7. Ethanol Demand

Sugar can be crushed and used as an ingredient in the production of ethanol. As ethanol competes with gasoline as a fuel source, its demand often moves inversely to oil and gasoline prices. A decline in oil prices could dampen demand for ethanol from sugar, while higher oil prices could increase demand.

8. The US Dollar

Like other commodities, sugar is quoted in US dollars. Sugar sellers receive less dollars for their product when the US currency is strong, and more dollars when the currency is weak. A strong US dollar puts downward pressure on sugar prices, while a weak US dollar lifts them.

World Sugar Markets vs Domestic Sugar Markets

If you trade in commodities or follow their prices, you have probably seen two different quotations for sugar traded on the US futures markets.

The two sugar futures markets are:

- World Sugar #11(https://www.theice.com/products/23)

- US Sugar #16 (https://www.theice.com/products/914)

The price discrepancy is due to subsidies and a tariff program supporting US sugar farmers.

The sugar production in the USA has been in existence for several hundred years, but the climate in the USA is not well-suited for growing the raw product. Therefore, it is more expensive to produce sugar in the USA than in other countries such as Brazil and India, which have a more suitable climate for production.

The complex details of sugar subsidies are the subject of heated debates, as the government guarantees a lucrative price for sugar producers and limits sugar imports from other countries. US companies are required to purchase US sugar at inflated prices.

The high price of US sugar may be responsible for changes in production. Companies such as Coca-Cola have switched to high-fructose corn syrup as a substitute for simple sugar.

Corn is the main component of ethanol, leading to an increase in demand for corn in the United States. Corn is also the main component of high-fructose corn syrup. Therefore, US taxpayers artificially support high prices for sugar and corn. Subsidies lead to higher prices for corn- and sugar-based products that we buy in the supermarket, so taxpayers are paying double.

Consumers have been the ultimate losers when it comes to corn and sugar subsidies. The price of sugar is not a matter of national security. Raw material markets are efficient; agricultural staples grow in areas where the climate is suitable to grow the best crops at the lowest price. However, this is not the case when it comes to sugar production in the USA.

The US sugar market is an example of the impact of politics and government policy on raw material markets.

Sugar Futures

The New York Mercantile Exchange (NYMEX), which is part of the Chicago Mercantile Exchange (CME) (https://www.cmegroup.com/trading/agricultural/softs/sugar-no11_contract_specifications.html) and the Intercontinental Exchange (ICE) offer a contract for sugar, which settles in 112,000 pounds of world sugar #11, which is the global benchmark for raw sugar. The CME contract is traded worldwide on the CME Globex electronic trading platform and has a maturity of March, May, July, and October. Futures are a derivative instrument that allows traders to make leveraged bets on commodity prices. If prices fall, traders must deposit additional margin to maintain their positions. At expiration, contracts are settled financially at the NYMEX and physically at the ICE.

http://www.fao.org/faostat/en/#data/QC

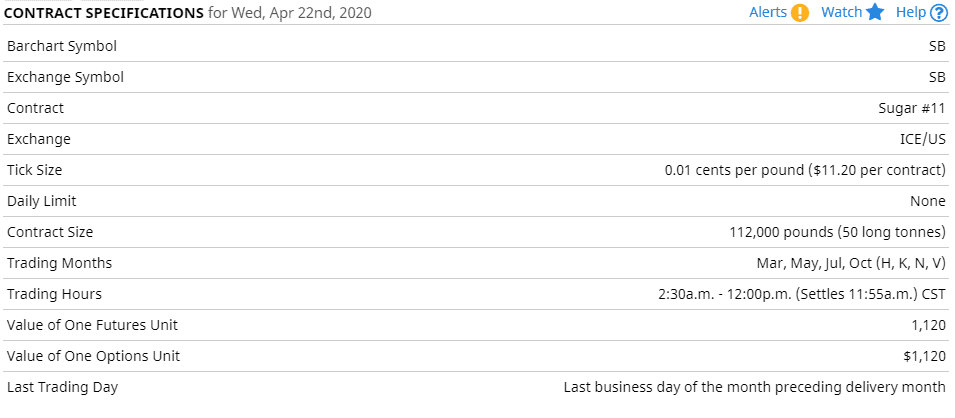

Contract specifications Sugar No.11

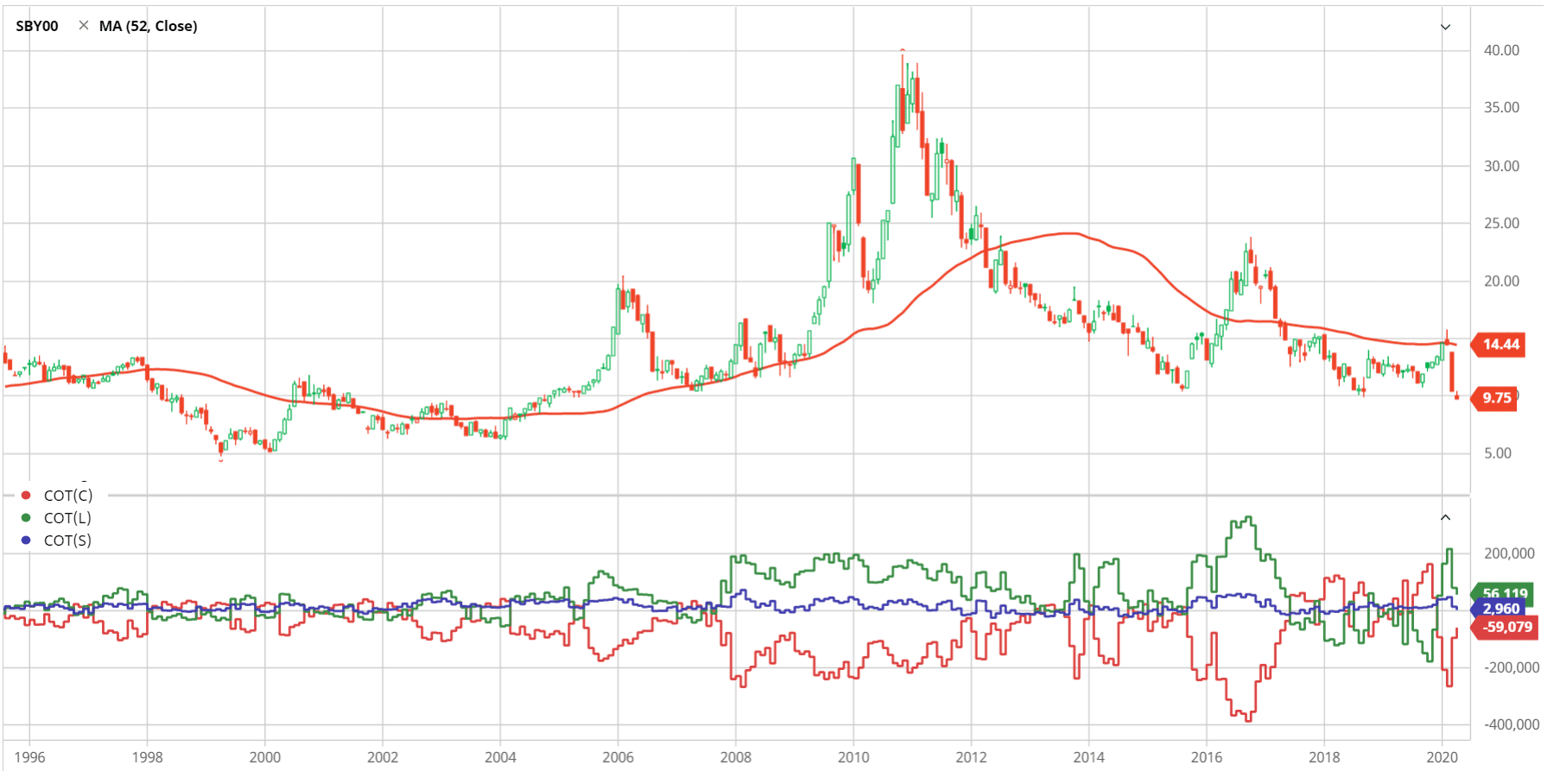

The price development of Sugar No. 11 from 2000 - 2020

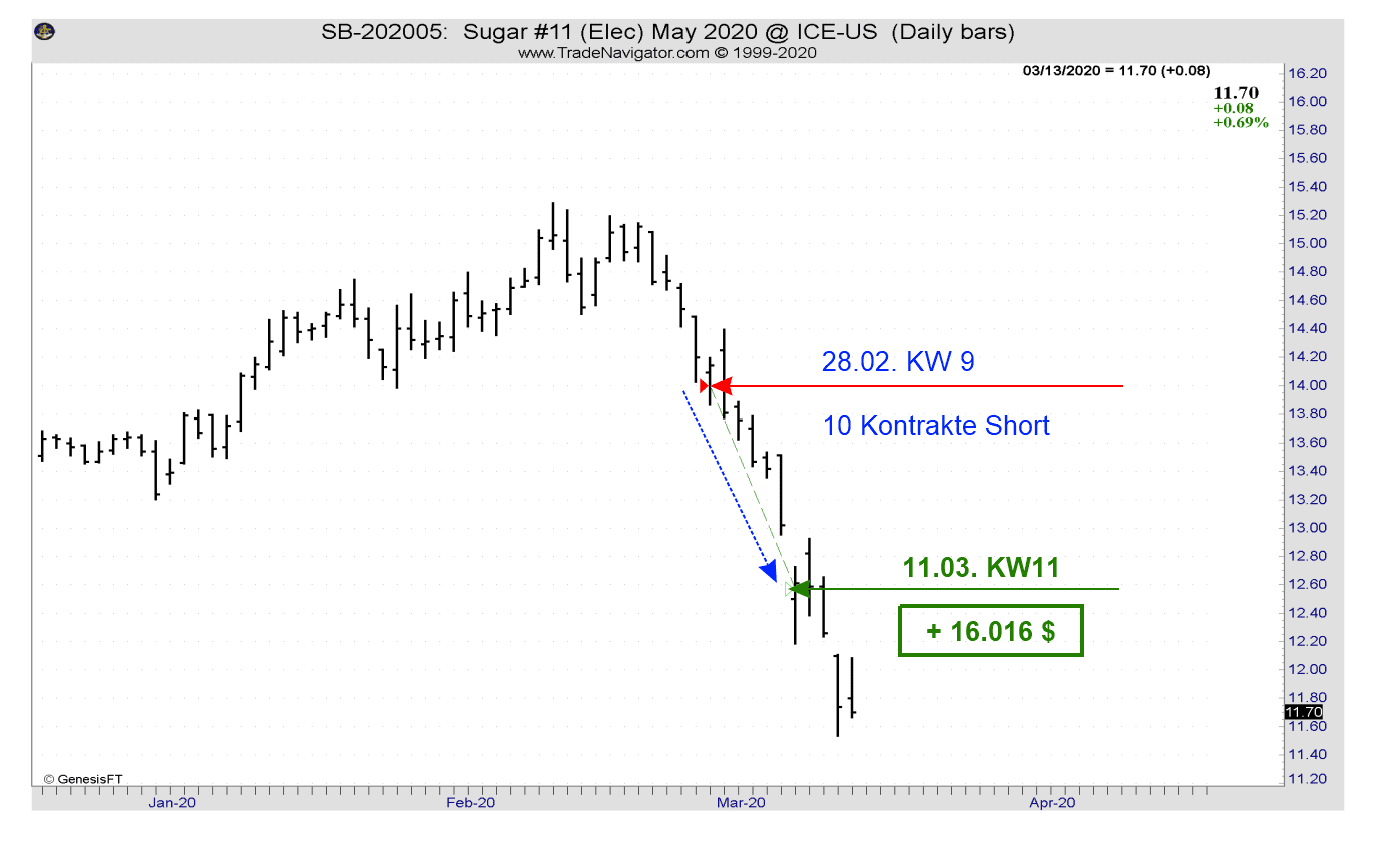

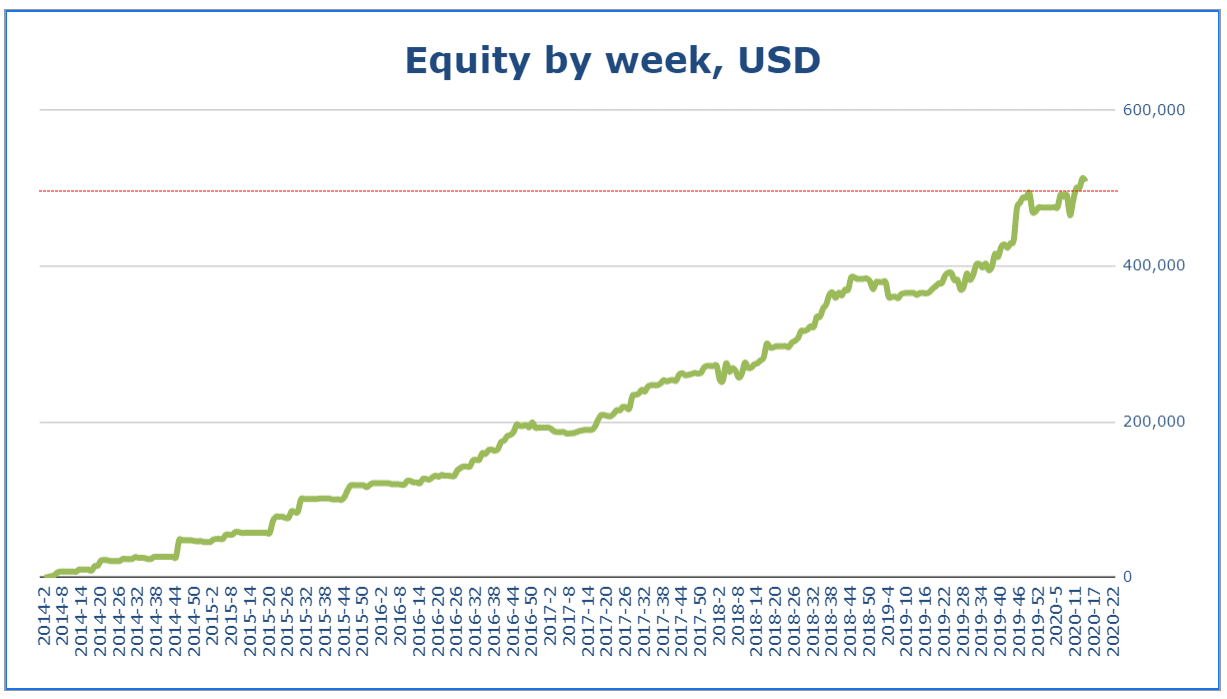

How did we trade Sugar Futures during InsiderWeek?

In calendar week 05-2020, we received a COT short signal against the weekly trend in Sugar Futures. However, we saw that the seasonal trend was strongly declining and we observed the market. We actually had to wait: our entry pattern did not form until four weeks later, and we could assume a trend reversal; on February 28th, at the end of the ninth calendar week, we were then taken short into the market with 10 contracts.

The price briefly swung up again and then ran cleanly in our direction.

On Monday, March 11th, the market opened with a gap. We took advantage of this situation to close our position.

The realized profit of +$16,016 had another significance: it lifted our account balance above the magical threshold of $500,000, a threshold at which it had previously bounced back twice.

If you want to learn everything about our trading and want to 'look over our shoulder' while trading and learn from us, then become a member.

Learn moreSource Citations

Photos: https://pixabay.com/de/

Contract Specifications, 25Yr.-Pricechart:https://www.barchart.com/futures/quotes/

Curious to learn more?

Get your hands on Max Schulz’s book by downloading it today! Free of charge.