What are trading strategies? An overview of the 4 most common trading styles

Have you ever questioned what lies behind the different trading styles and trading strategies? Maybe you are also currently deciding on a trading style and need a simple comparison. In this article, you will learn about the four most common trading styles. I will show you the pros and cons, and explain where you should pay attention and when you decide on one of these trading styles.

If you would speak to traders of different asset classes, you would quickly realize that everyone follows their own philosophy of trading and sometimes wants to sell it as "the only right one." One loves "quick money" with day trading, the other prefers to take it a little slower.

There is something for everyone. Because the financial markets have become more diverse and you can now trade on the stock exchange from ultra-short-term to long-term - in different time frames. You just have to find out what suits you. This article gives you a first idea of this. With a trading style that suits your personality and your abilities, you will have more success in trading.

1. What is Scalping and who are Scalpers?

Scalping is the shortest form of trading. Scalpers are in the position for a few minutes, in extreme cases only a few seconds. If the position is held longer (20-30 minutes), it is no longer called scalping, but day trading.

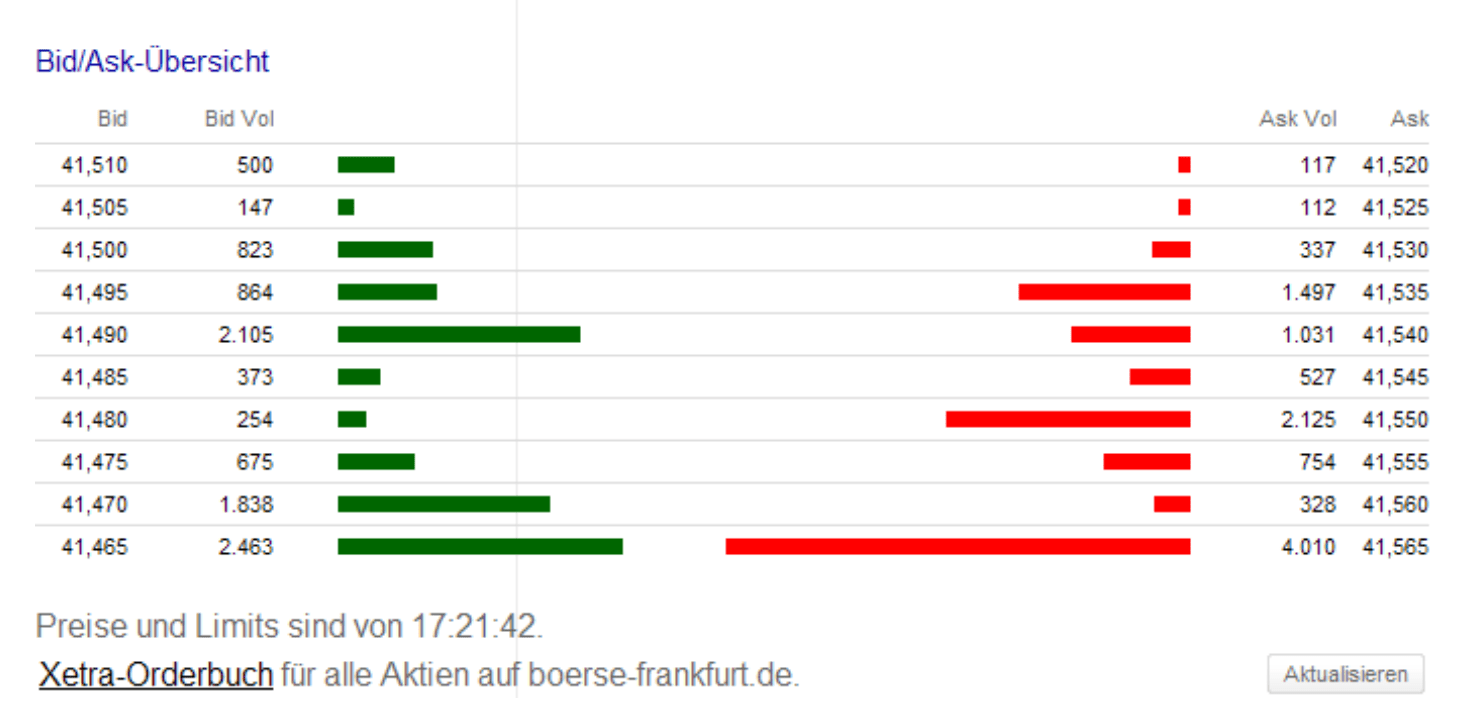

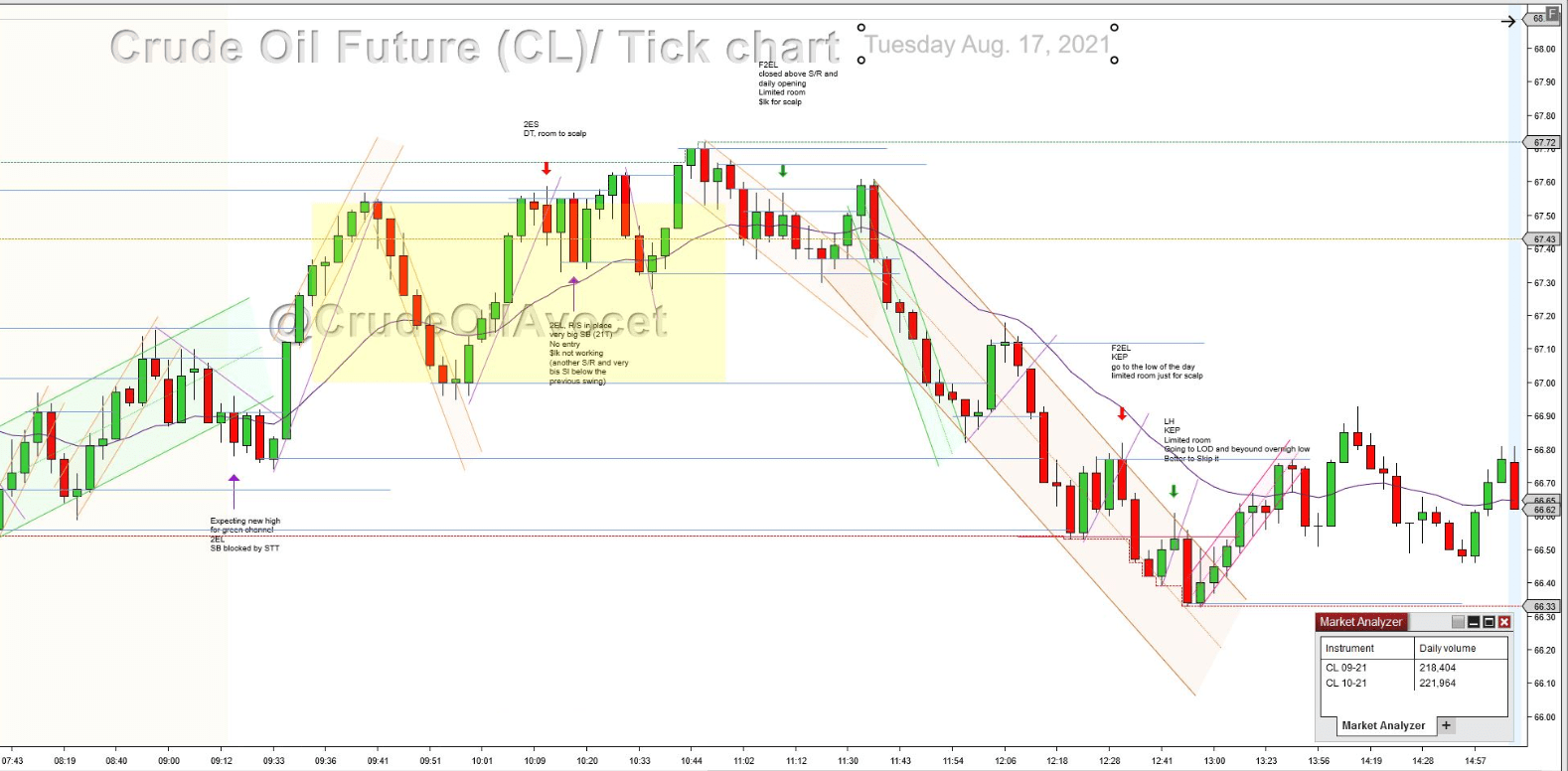

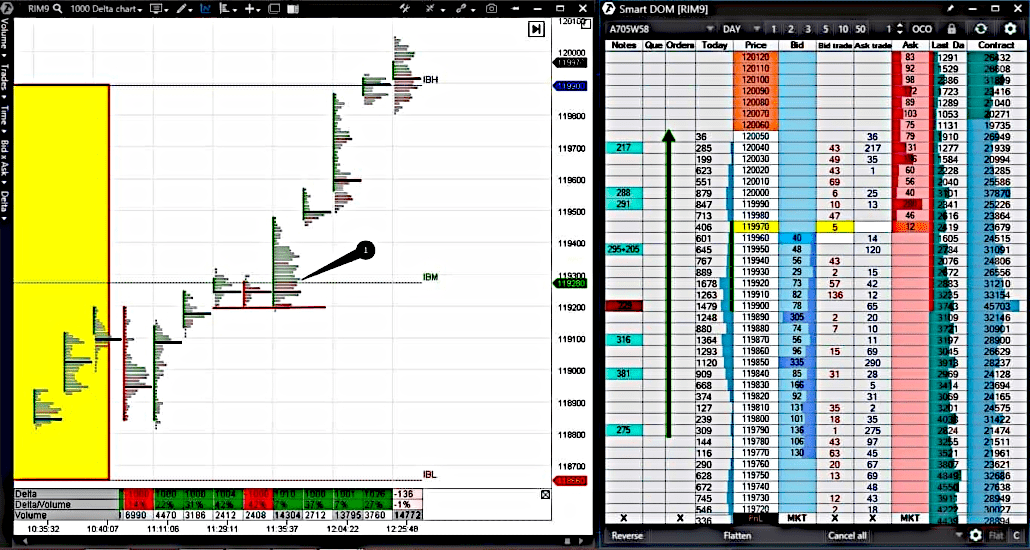

The goal of scalpers is to profit from short-term impulse movements in the market. These traders move in the minute or second chart, often using the tick chart or the order book.

A tick chart initially looks like a regular bar or candlestick chart. The main difference is that the tick chart does not have a time axis. A new candle is not created after 15 minutes or an hour like in a 15-minute chart (M15) or one-hour chart (H1). In a tick chart, a new candle is created after a specified number of transactions (trades). there is no difference if one contract, 10 contracts, or 100 contracts are traded in a transaction.

Tick charts show when the market is most active and when it is sluggish and barely moving. They provide a logical way to measure market volatility.

Scalping is a relatively popular trading style because there are many trading signals for entries within a day. But it is extremely demanding. And it can be time-consuming and mentally taxing. Scalpers must be present and focused during main trading hours. Seconds can decide between victory or bankruptcy. Discipline and mindset are a basic requirement for survival in the market, which is why this trading approach is only suitable for experienced traders.

Scalpers need special software, a fast and stable internet connection, and real-time data feed (CQG). Additionally, you must be able to handle the technique in your sleep as a scalper; you cannot afford to spend a long time searching for a button or function. Scalping is for stress-resistant full-time professionals who can relax in a heavy metal disco.

1.1. How do Scalp Traders make money?

Scalpers wait for the smallest price movements. When a market is highly volatile and there is a large momentum, these price movements can be achieved within fractions of a second.

Scalpers are satisfied with the slightest profits. In Forex trading, this often means profits of 1 to 5 pips, which are changes in the fourth decimal place. To make real money, large positions and many trades are needed.

At the end of a trading day, it is possible that you will have made 100 or more trades when scalping.

1.2. What sets a scalping strategy apart?

Scalpers pay attention to specific indicators (such as the SMA indicator, EMA indicator, MACD indicator, Parabolic SAR indicator, and Stochastic Oscillator indicator). They also pay attention to chart formations such as breakouts from a range or triangle. Additionally, the respective volumes are important factors.

Scalp traders also closely monitor the market at specific times, such as before or during the release of important economic data. In conjunction with the release of data such as the Consumer Price Index (CPI) or Non-Farm Payrolls (employment numbers) in the US, the nervousness of traders and thus the volatility in the market increases.

Statistical data in general form the fundamental basis of a scalping strategy. Technically, scalpers work with very tight stops and small chance-and-risk ratios (CRRs).

1.3. What financial products (assets) does the scalper trade?

Scalpers generally trade all financial products whose market is highly volatile and liquid. Leveraged products are preferred. The classic markets are the CFD, FOREX and stock market, where the focus is on risky assets.

However, the commodity market also offers good trading opportunities at certain times, especially when sudden events such as weather and natural disasters or political events (wars, trade embargoes) pose the risk of extreme supply or demand fluctuations.

2. What is Day Trading and what is a Day Trader?

Day traders are scalpers on vacation 😉.

Much of what I just discussed for the scalper also applies to the day trader. Day traders are also short-term traders and trade in a short-term timeframe, but less extreme: a position is open for several minutes to several hours. There is no exact time limit where scalping ends and day trading begins.

The most important characteristic is that day traders close their positions at the end of the trading day - that is, before the end of the trading day - (position flattening). Overnight positions are avoided and protect day traders from events that happen overnight.

2.1. What characterizes a Day Trading Strategy?

Day traders trade on the minute chart or on the 1 hour to 4 hour chart. They take advantage of movements that last for several minutes to hours. Trend markets are preferred as sideways (range) markets generate too few signals.

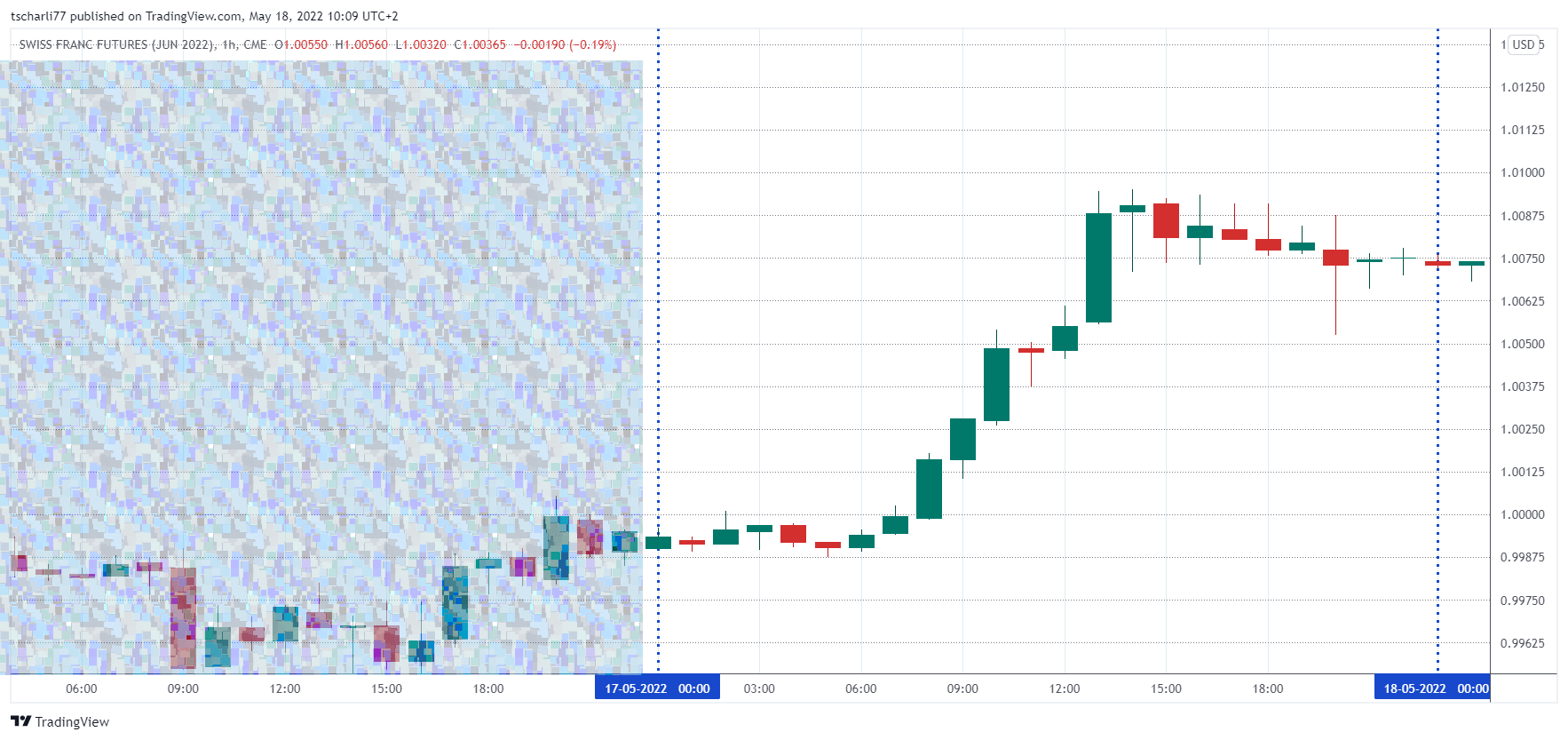

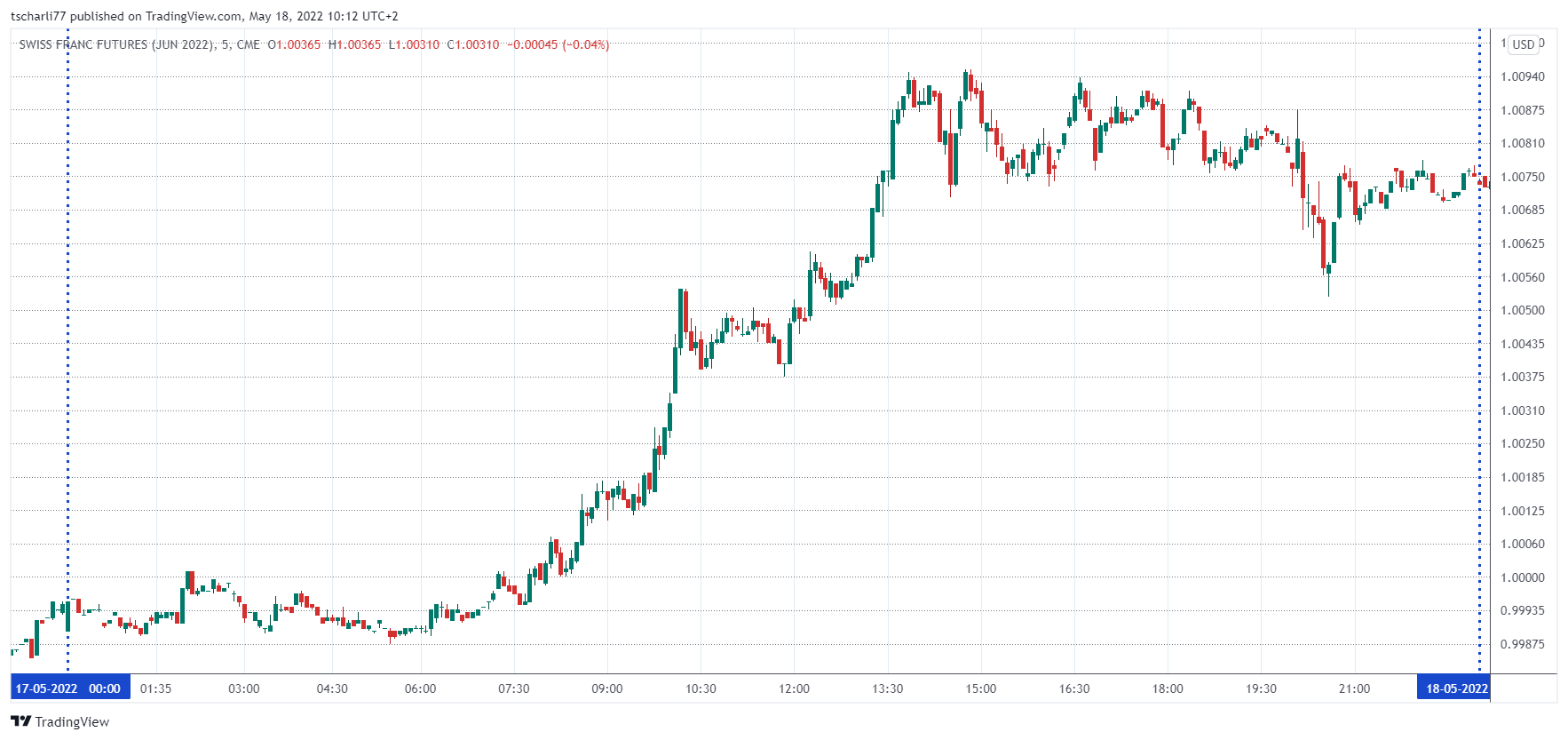

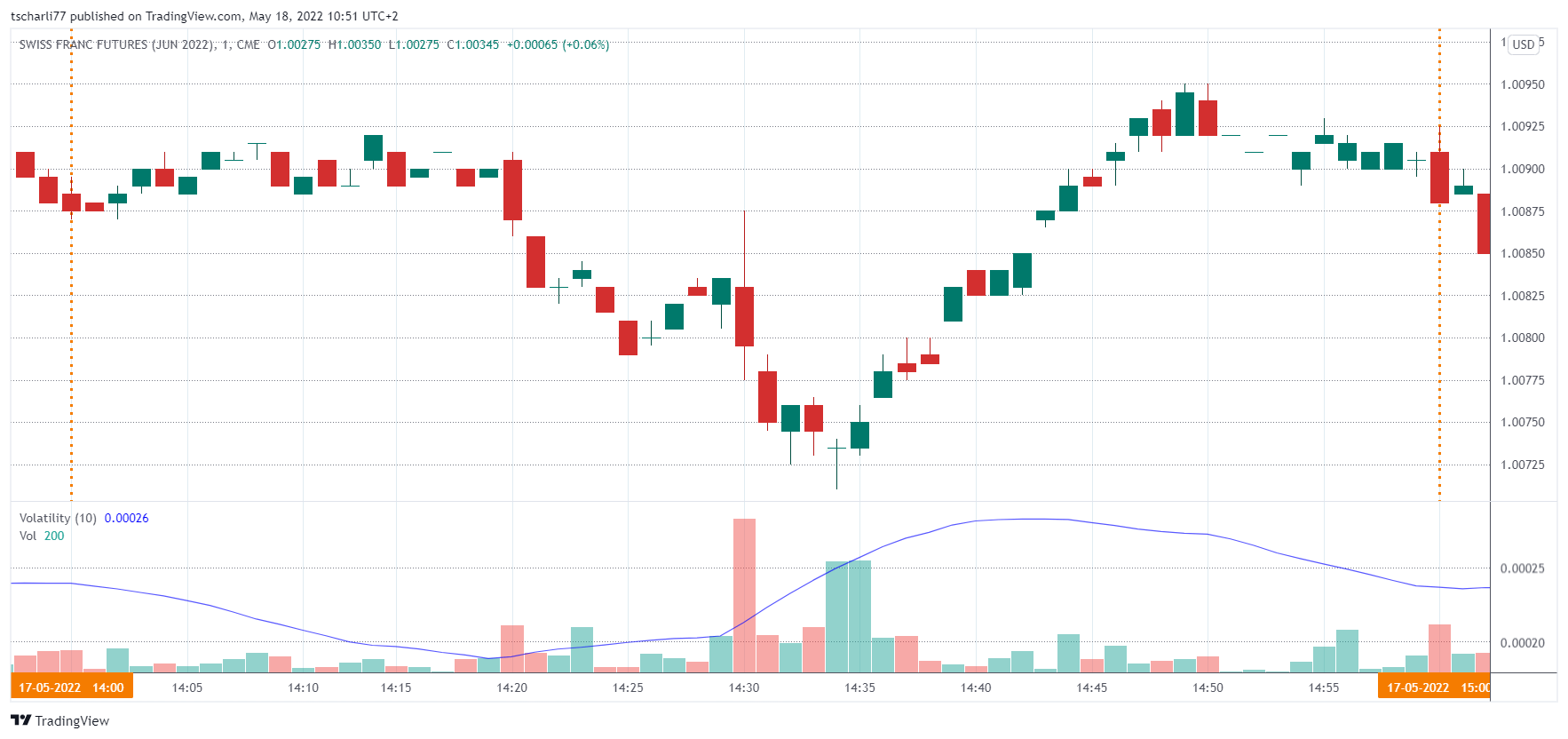

A snippet of the chart: The time from 2:00 PM to 3:00 PM (CET) in the 1-minute chart with volume (bars) and volatility indicator (line)

The above charts are the foundation for the day trader's analysis. The hourly chart shows the overall trend and the minute chart determines the timing.

2.2. How do Day Traders make money?

The profit margins in Day Trading are similar to Scalping, although not as low. Nevertheless, Day Traders also use leveraged products and use large position sizes. In Day Trading, the trading frequency can reach up to 20 trades per day compared to Swing Trading, which is still relatively high.

Day Trading also requires a permanent presence in front of the screen, at least during the main trading hours. Especially the period of market opening and the last minutes before market close are the busiest trading spans. Therefore, this trading approach is not suitable for employed traders.

Day Trading can lead to substantial profits, especially on hectic and volatile days, but it can also cause high psychological stress. In my opinion, this trading style is also not suitable for beginners.

2.3. What financial products do day traders trade?

Similar to scalpers, day traders look for assets that have high liquidity and volatility. Especially CFDs and FOREX, but also stocks and, as previously mentioned, occasionally commodities are classic day trading products.

3. What is Swing Trading and what is a Swing Trader?

Swing Trading refers to a medium-term trading approach. A position is held for several days, sometimes one to a maximum of two weeks. In volatile market phases, the position is often closed at the end of the week. This is done to avoid opening with a gap at the beginning of the week. Swing traders aim to profit from larger price movements and swings.

This trading style is less time-consuming and less stressful than Scalp Trading and Day Trading, as Swing Traders rely more heavily on fundamental data (such as the COT report) and seasonal price patterns in their preparation.

3.1. How do Swing traders make money?

Expectations for profits, depending on the financial product being traded, are significantly higher with this approach than with day trading or scalping strategies.

Swing traders require less time for their trading as the planning of swing trades occurs on the weekend. Positions are placed in the market using stop-orders. Daily trading activities in swing trading are limited to monitoring price developments, adjusting or occasionally prematurely closing a position.

Swing traders focus on end-of-day data (EOD data), they are not interested in intraday data. The daily time commitment is 20-30 minutes and can be done in the evening hours. This leaves enough time for a job and family - the ideal trading approach for part-time and busy traders.

3.2. What characterizes a Swing Trading strategy?

Swing Trading as a strategy refers to trading that takes advantage of the larger movements or swings of a price chart. Financial products do not have linear price charts but rather zigzag lines of impulse and correction phases. These are also referred to as Swing Highs (high prices) and Swing Lows (low prices).

Swing traders trade on the daily and weekly charts, where they find overall trends. With a Swing Trading strategy, you can use weekly, monthly and annual trends.

The Swing Highs and Swing Lows are used to plan entries, set stop losses and trading targets. In addition, fundamental and technical analysis form the basis of a Swing Trading strategy to make rational decisions.

The soybeans in the above day chart show a stable upward trend. The marked smaller and larger swings can be used for timing of entry points as well as setting stop and target levels.

With this trading approach, risk management is particularly important as the course of the price is not monitored during the day. Therefore, extreme price crashes such as unexpected political events like the Russian invasion of Ukraine in February 2022 must be protected by stop-loss.

3.3. What financial products (assets) do swing traders trade?

Swing trading is suitable for any financial product. You can trade stock indices (DAX, S&P500), ETFs or CFDs as well as currencies/FOREX or commodities. Especially liquid markets and markets with seasonal patterns are suitable. Extremely volatile markets are avoided as the risk of being stopped out during the trading day is very high.

4. Position Trading - Buy-And-Hold and Waiting

The fourth trading approach, position trading, is often described with the term Buy-And-Hold. It is a trading style focused on long-term investing. A financial product is bought and held for months, sometimes years (hence the term Buy-And-Hold).

4.1. What financial products (assets) do position traders trade?

This trading style can be realized with long-term securities such as stocks, bonds or debt securities. There are two types:

Fixed-income securities

These include bonds such as corporate bonds, government bonds (Eng. Bonds), covered bonds, bonds and debt securities.

These financial products promise the creditor the right to repayment of the face value and payment of agreed-upon interest. The buyer "lends" the issuer capital, which he receives back at the end of the term with interest. Unlike a stock, a buyer of a corporate bond does not acquire a share of the company's equity, and therefore has no claim to company profits.

Stocks

These securities establish a co-ownership relationship with a company. They establish the equity of the issuing company (bonds, for example, are external capital) and promise the owner membership rights (e.g. a vote in the annual general meeting) and property rights (e.g. a dividend claim).

The stock trader's expectation of profit therefore extends to the stock price development and regular payments from dividends or premiums.

ETFs are also suitable for this strategy but not futures. Due to the limited term of a futures contract, it would be necessary to "roll" the contract into a subsequent contract, which can lead to roll losses in addition to fees if the subsequent contract is traded at a higher price than the current "front contract."

4.2. Diversification with Buy and Hold

However, a recommended strategy arises due to the ability to mix medium-term investment instruments such as futures with long-term investments such as stocks and bonds. This allows diversification of your portfolio.

Because in futures trading, due to margin regulations, often only up to 30% of the total capital is tied up, it is possible to incorporate "unused" capital into longer-term investments.

Another aspect is that lendable securities, such as stocks or bonds, can be used as collateral in futures trading. This means that stocks can be used as margin.

5. Summary

The following table gives you an overview of the most important aspects of the four trading styles Scalping, Daytrading, Swing Trading, and Position Trading (Buy-And-Hold) with the most important differences.

| Scalping | Daytrading | Swingtrading | Positionstrading Buy-And-Hold |

|

|---|---|---|---|---|

| Time horizon | Ultra-short-term trading | Short-term trading | Medium-term | Long-term |

| Holding period | Seconds ► few minutes | Minutes ► few hours, no overnight | a few days ►a few weeks | Months, years |

| Chart basis | Seconds/minutes chart Tick charts, order book |

Minute / hour chart | Daily chart, superordinate weekly chart | Daily chart at position opening |

| Profit margins | very low | low | Relatively high in some cases | — |

| Trade frequencies | extremely high | high | low | — |

| Position sizes | very large | large | medium ► large, depending on position management | — |

| Fundamental basics | Important daily events, report publications | Daily events, recurring appointments, reports, statistics | Market reports (COT), seasonal events, seasonal fluctuations of supply/demand | Economic reports, company reports, annual financial statements, general publication |

| Chart technique | Market order, no or very tight trailing stops | Market/limit orders, tight trailing stops | Limit orders, stops according to market technique, strict risk management | Long-term trading targets, trailing stops |

| Software/hardware requirements | very high | very high | low | — |

| Time burden | extremely high | very high | low | extremely low |

| Mental stress | extremely high | very high | very low | — |

| Preferred markets | FOREX, volatile shares, CFD | FOREX, volatile shares, CFD | FOREX, Equities, Futures/Commodities, ETF | Shares, Bonds, ETF |

| Suitable in part-time tandem | No | No | Yes | Yes |

Curious to learn more?

Get your hands on Max Schulz’s book by downloading it today! Free of charge.