Trading futures? 10 answers that explain futures trading simply

You are looking for a definition of futures and an explanation of futures trading? In this post, I will present you with the 10 most common questions asked by beginners and provide you with simple explanations. You will understand what futures are and know what to consider when trading futures. Additionally, I will reveal what you really need for successful futures trading.

1. What are futures and what is futures trading?

Futures or forward contracts are standardized tradable products on the stock exchange, whose prices are based on real trading products such as commodities.

Therefore, two trading partners have entered into a contractual agreement - known as a forward contract - in which they have agreed on the following:

- A certain amount

- A certain commodity

- A future date

- A price valid at the current time

At the agreed-upon date, a certain amount of a certain commodity is delivered or received and paid for at the predetermined price. This allowed for a reliable expense/revenue calculation.

Finally, Futures arose from Forwards. The conditions were obligatorily defined by the exchanges (market operators), and thus standardized. This made it possible to trade Futures, the contract itself, on exchanges like security.

In addition to commercials (producers, processors), speculators also started trading Futures. The difference is that they are not interested in actual commodity trading, but rather want to make money by buying and selling Futures contracts on Futures exchanges.

Speculators enable a liquid Futures market with transparent pricing at all times. Thus, Futures trading, the exchange-traded trading of Futures contracts, was born.

2. What is a futures contract?

A futures contract, also known as a futures or forward contract, is a derivative that can be traded on the stock exchange. Each futures contract is based on an underlying asset such as commodities, currencies, or stock indices. Therefore, you are not trading real commodities, but futures contracts that are settled in cash. As a trader, you don't have to worry about the physical delivery of the goods.

Did you know?

Only about 3-7% of futures contracts are settled through delivery. The rest is used for hedging or speculation.

Futures contracts have the same characteristics as contractual agreements (forwards) entered into between two real trading partners: It includes information about the commodity, the quantity, the future date, and the price.

Did you know?

The only difference between futures and forwards is that futures are traded on a futures exchange, and the specifications are therefore set and standardized by the exchange.

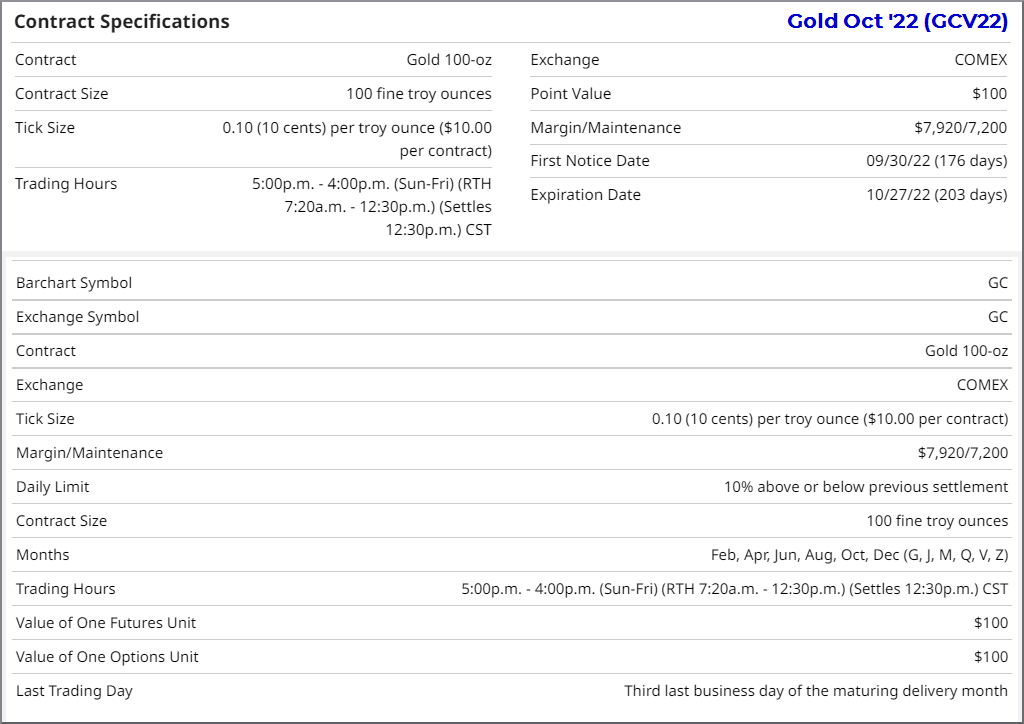

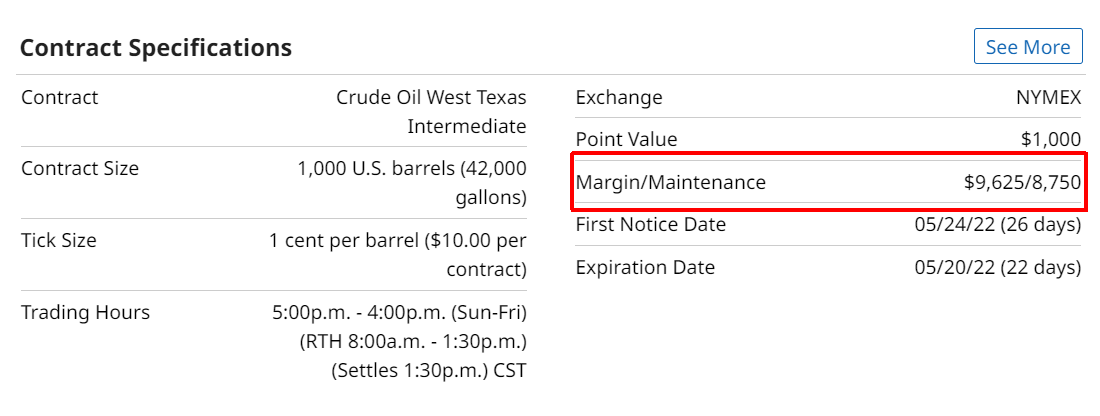

Futures contracts are standardized by the exchanges where they are traded. This means that the exchange sets the contract specifications. As a trader, you need to know these contract specifications.

Contract specifications for futures contracts establish the following:

- Type and quality of the commodity

- Quantity per contract

- Minimum price fluctuation (value of a tick)

- Futures expiration date

- Margin

- Settlement

- Trading hours

- Price limits

Tip

For you as a futures trader, the most important contract specifications are margin, tick value, and expiration date.

3. What futures exist or on what can you trade futures?

The classic sector in which futures are traded is the commodity sector. Commodity futures are divided into agricultural commodities, energy commodities, and metals. You can also trade futures on currencies, indices, bonds, and crypto.

Did you know?

Do you want to trade stock futures? Then index futures are exactly right for you. Because strictly speaking, you cannot trade futures on stocks.

There are only futures on indices such as S&P500 or Nasdaq, whose stock market prices are based on stock values. There are also mini and micro futures on indices. So, for example, you can trade Dax futures with a small account.

- Agricultural Commodities

- Grains — Wheat, Corn, Soybeans, Oats, Rice

- „Softs“ — Coffee, Cocoa, Orange Juice, Sugar, Cotton, Lumber

- „Livestock“ (Meat markets) — Live Cattle, Feeder Cattle, Lean Hog…

- Energy Commodities — Crude Oil, Natural Gas, Heating Oil, Gasoline…

- Currencies — Dollar, Euro, Yen …

- Metals — Gold, Silver, Platinum, Palladium, Copper…

- Indices — S&P500, NASDAQ

- Government Bonds — T-Notes, T-Bonds

- Cryptocurrencies — Bitcoin

InsiderWeek trades in the sectors listed above. There are others, but they are less liquid: milk, butter, eggs, coal, steel. You could even trade weather derivative futures on the futures exchanges CME in Chicago or LIFFE in London.

4. What are futures exchanges? When and where are futures traded?

A futures market or also known as a derivatives market is an exchange where futures contracts are traded. Only futures are traded on futures exchanges.

Did you know?

There is also a market where the raw material is traded directly - that is, goods for money. This market is called the spot or cash market.

Futures exchanges are often specialized in specific sectors and markets. For example, at the CBOT (Chicago Board Of Trade), agricultural products (Wheat, Corn, or Soybean Futures) and financial futures (E-mini Dow Jones, micro E-mini Dow, T-Bonds, T-Notes) are traded, while at the New York Mercantile Exchange (NYMEX), energy and crude oil futures, as well as metals, are traded.

The most important futures exchanges are

- CME Group with its individual exchanges

- CME (Chicago Mercantile Exchange)

- CBOT

- NYMEX/COMEX (Commodities Exchange)

- ICE (Intercontinental Exchange) with various trading venues, e.g.

- ICE Futures U.S.

- ICE Futures Europe

- ICE Futures Singapore

- ICE Futures Abu Dhab

- EUREX (European Exchange)

- LME (London Metal Exchange) - the LME determines daily reference prices for the cash market (direct trading) of metals worldwide.

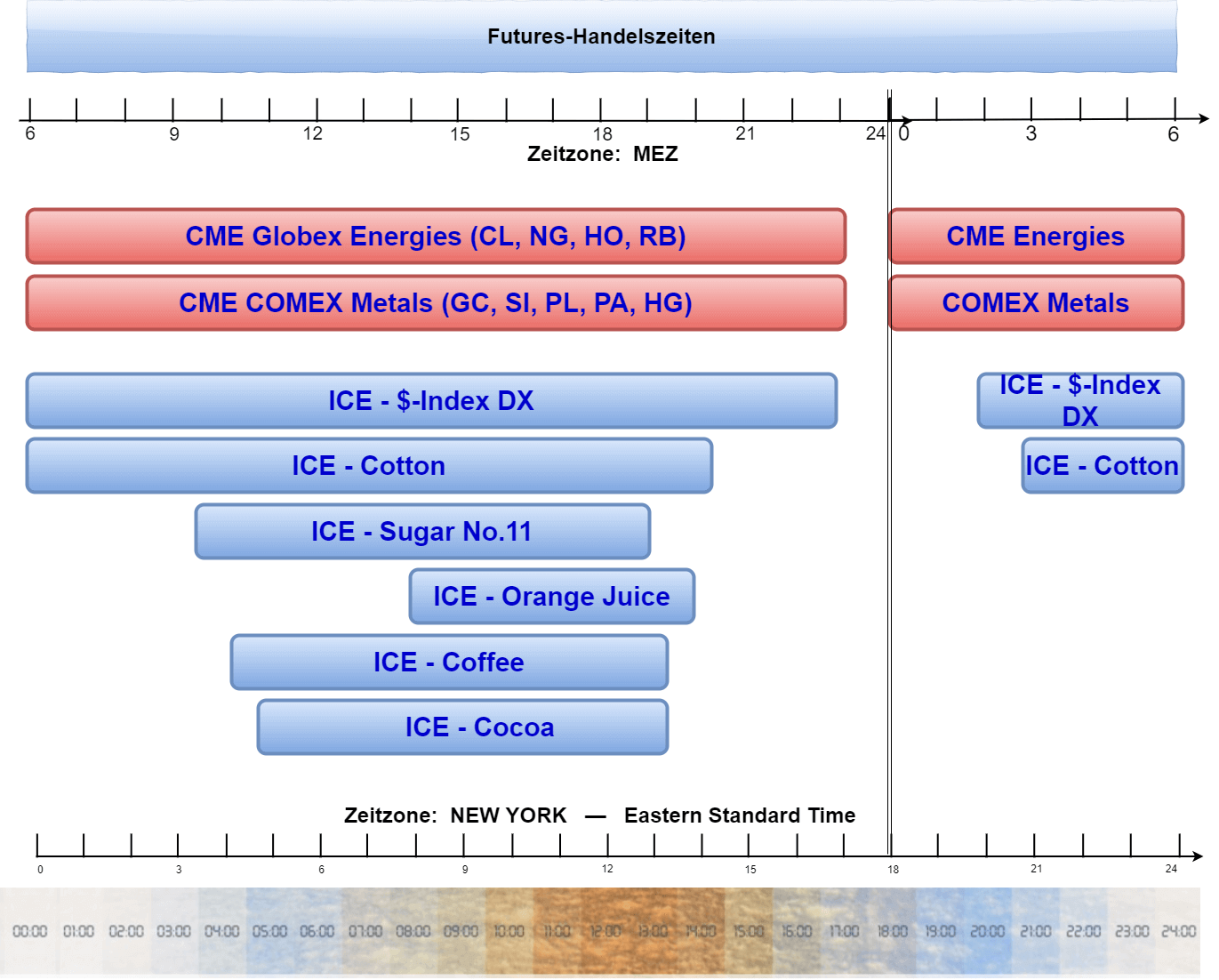

Trading on the futures markets is now completely electronic. Unlike most stock markets, trading can take place 24 hours a day at a futures exchange. But not all of them.

Futures trading in the grains, softs, and livestock sectors is not available around the clock. In addition, the trading hours of the exchanges for these sectors differ. It is also important to consider the exchange trading hours on holidays.

5. How is the price of a futures contract determined?

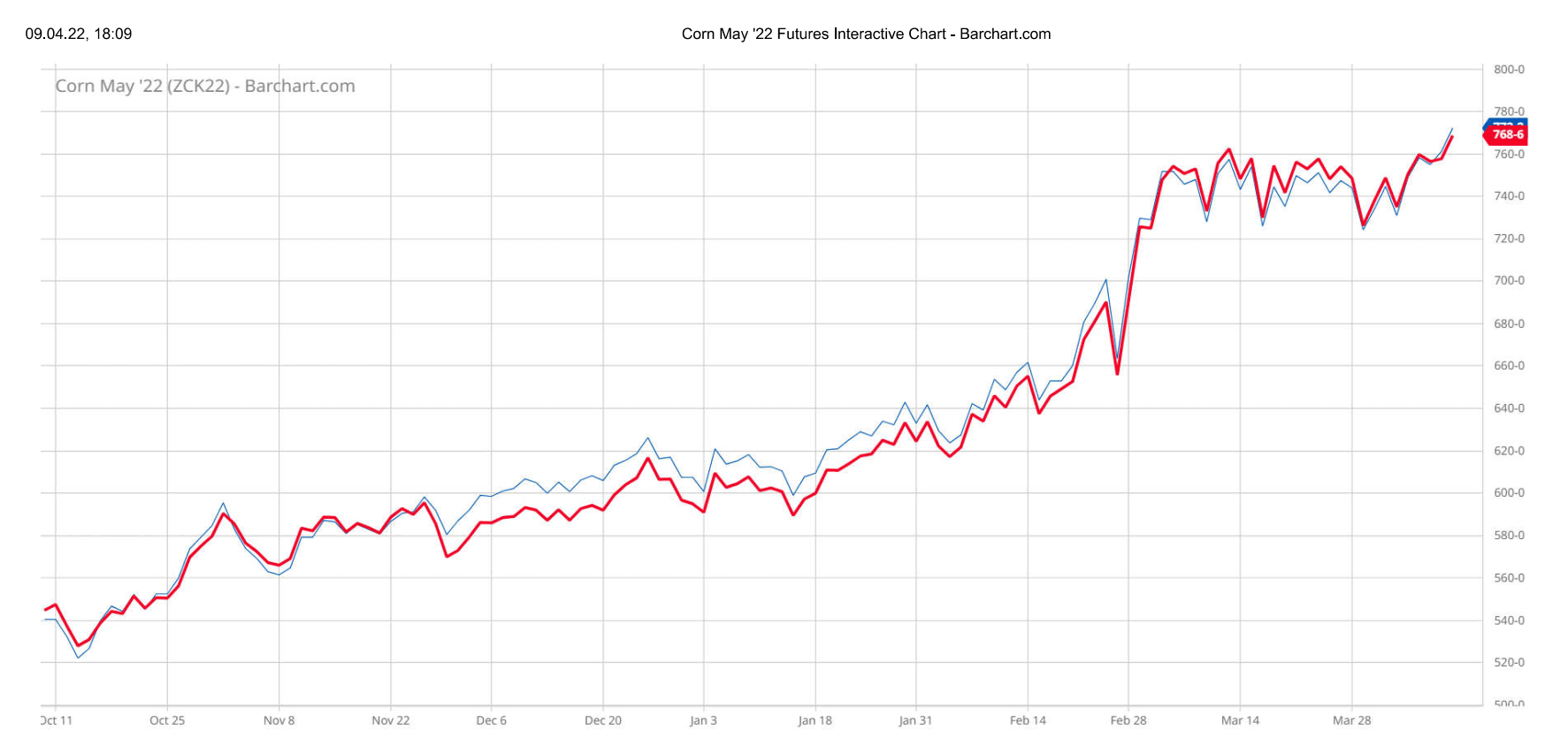

You already know that a futures contract represents a real product. Therefore, the price of the futures contract is tied to the price of the underlying product and largely follows it:

So the question about the price of the futures is more specifically: How does the price of the underlying commodity or financial product come about? Commodity prices as well as prices in other sectors are determined by the major market participants (commercials, large speculators).

Unlike with CFDs, for example, prices are thus determined based on supply and demand. The price rises when demand becomes greater than supply (scarcity of the good) and when supply is greater than demand, the price falls (oversupply of the good).

Did you know?

With CFDs, options and certificates, the bank (issuer) sets the price. Of course, banks claim that they always offer transparent pricing based on the underlying financial product.

However, this is not true for critical periods such as stock market crashes or highly volatile market phases during crises (war, pandemic, economic crises). This means that you trade CFDs, options and certificates against the bank and not with a real market participant. And the bank's interest is to make money, not to make you rich.

The supply of commodities depends on many factors. Agricultural commodities, for example, have a clearly seasonal price trend, which is additionally influenced by external factors such as weather or biology (crop failures due to plant diseases/ pests).

Weather conditions also affect the production or extraction of other commodities such as metals or energy resources.

On the demand side, social factors (customs, fashion trends, social movements) or events such as the coronavirus pandemic influence consumer purchasing behavior.

In addition, commodities, whether agricultural or energy resources, are used as political leverage and pressure. Embargoes, sanctions, or trade restrictions in the form of tariffs and levies largely steer prices.

6. Are Futures Risky Financial Products?

Ultimately, all financial market products involve inherent risks. The question, therefore, is whether futures are riskier financial products than other assets.

Futures are less risky because demand is constant.

The price of any product in a free market is determined by a combination of supply and demand. While the supply of many commodities fluctuates wildly, demand is typically constant or even increasing.

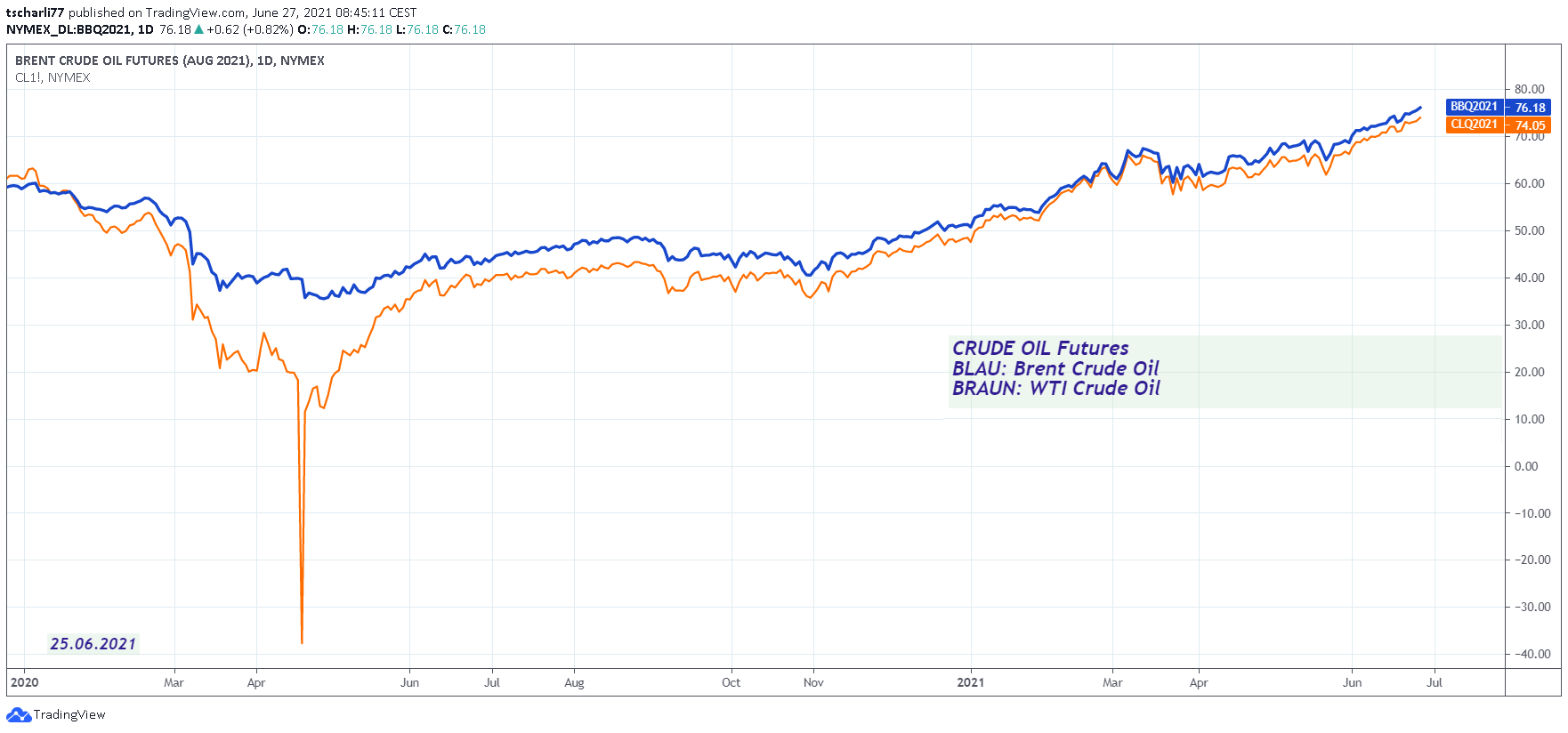

Since demand for the commodity will not suddenly disappear, the price will not suddenly drop to zero and cause a sudden total loss. An exception was when the WHO declared COVID-19 a pandemic in 2020.

The demand for crude oil and its derived products has drastically decreased, leading to an immense oversupply - tanks were full and no buyers were in sight. The result was an unimaginable crash in prices.

These events are not typical risk factors of futures trading. With a robust money risk management strategy, which is always necessary regardless of the geopolitical situation, very high losses can be avoided even in these cases.

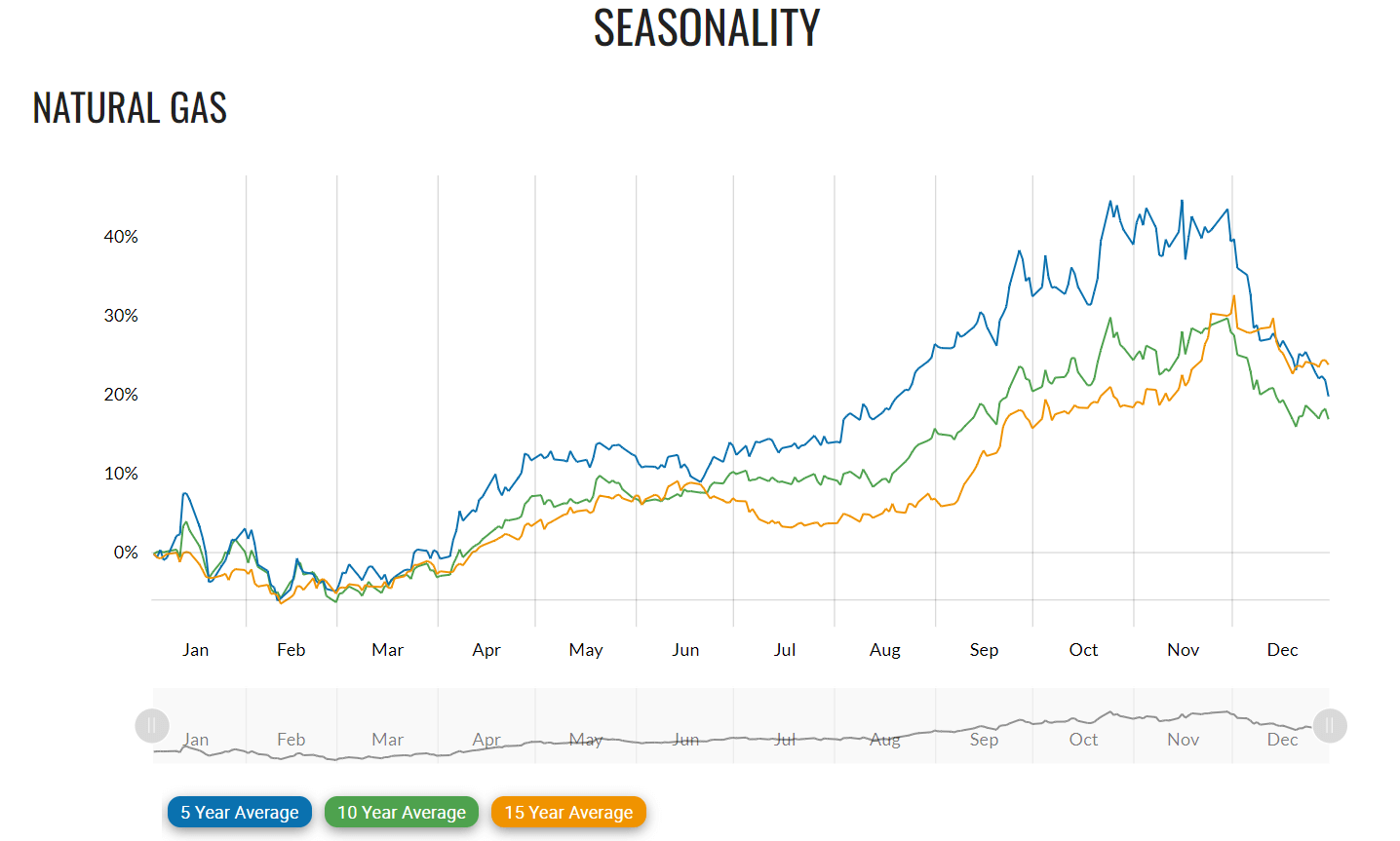

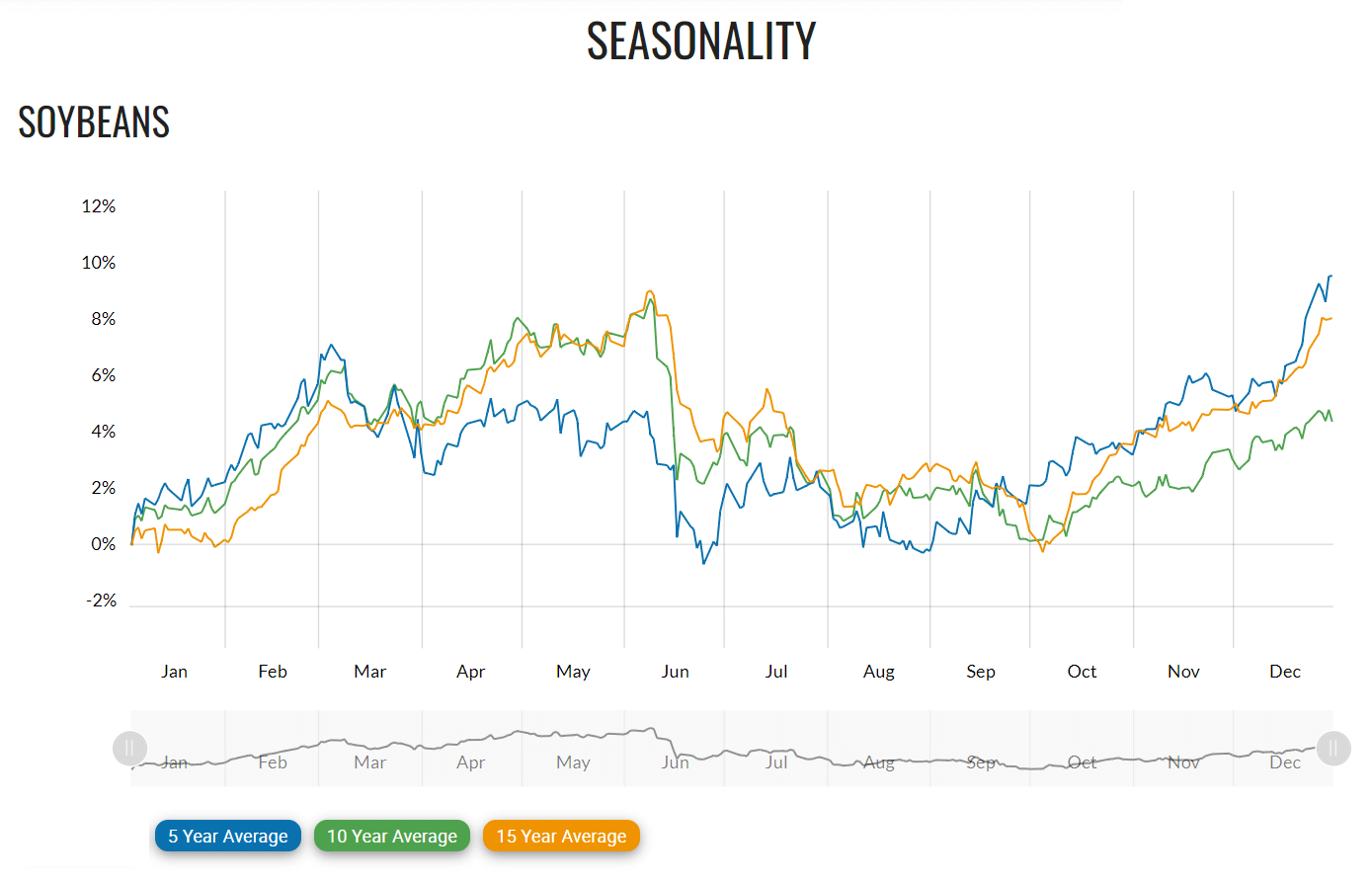

Futures are less risky because commodities follow seasonal patterns.

This is easiest to explain in the case of agricultural commodities: the recurring cycles of planting, growth, and harvest determine the availability of the commodity and thus its price.

But energy commodities (crude oil, natural gas) also exhibit these cycles. At certain times of the year, demand for electricity (air conditioning) and heating oil is significantly higher.

This knowledge of seasonality makes planning easier and greatly supports you in your trading decisions.

Futures are less risky because they are transparent.

At least, this applies to the futures markets in the USA, and these are the only ones we trade at InsiderWeek. Here, all market participants who hold or exceed a certain number of contracts are required to report their positions to the Commodity Futures Trading Commission (CFTC) - a government regulatory authority.

The CFTC publishes these numbers in a weekly market report called the Commitments of Traders (COT) report. This publicly available report shows how the major market participants (commercials, large speculators) are positioning themselves, indicating how they assess the market situation.

An analysis of the COT report provides valuable insights and helps you make trading decisions.

Futures are risky because commodities are used as a political tool.

The current situation - the war in Ukraine - clearly illustrates this, and history is full of other examples: Commodities, particularly agricultural products (wheat, rice, sugar, cotton) and energy resources (oil, gas), are used as political leverage.

This makes trading with futures highly risky at certain times. However, these risks can be avoided: Avoid trading during highly volatile periods, no matter how tempting it may seem. Trading opportunities are like trams - the next one is guaranteed to come!

7. How to Trade Futures?

Futures can be traded using three different trading styles, which have different time frames and trading strategies.

Time frame

The shortest-term trading style is scalping, followed by futures day trading. A scalper trades futures on a minute-by-minute basis, while a day trader trades on an hourly basis.

In swing trading, futures are traded at the end of the day after the market closes. Although a buy-and-hold strategy like that used for stocks and ETFs is not applicable to futures trading, it can be combined with other strategies.

Trading Strategien

Each trading style has its own trading strategies. Well-known futures trading strategies include the Pullback Strategy, Trading the Range, Breakout Trading - very popular in day trading, Spread Trading, Fundamental Trading Strategy, Buyer and Seller Interest, Trend-Following, and Counter-Trend Trading.

If you don't want to spend the whole day in front of screens and experience little mental stress - as is the case with scalping and day trading - I recommend the Futures Swing Trading style with the strategy from InsiderWeek.

It is based on the knowledge and experience of Larry Williams, uses the COT report and COT data as a basis, and uses market technical approaches for timing entry and exit positions, while securing a robust money risk management. With this trading strategy, you can trade profitably in the futures markets with minimal time commitment.

8. Things to Consider in Futures Trading

In futures trading, you need to pay attention to the contract duration, margin requirements, and tick value.

Expiration Date

The expiration date of a futures contract is the time period between the current date and the expiration date. Prior to the expiration of the contract, you will be notified by your futures broker on the first notice day to close your position. The expiration day and first notice day are specified in the futures contract specifications.

Did you know?

The expiration date of a futures contract is the time period between the current date and the expiration date. Prior to the expiration of the contract, you will be notified by your futures broker on the first notice day to close your position. The expiration day and first notice day are specified in the futures contract specifications.

That means you don't determine the duration yourself. The futures exchanges have standardized this for traders. You only select the futures contract and can buy or sell it as often as you like during the term. So, you decide when to enter and exit or open and close a position.

Did you know?

At the end of the term, it can happen that prices rise or fall sharply because there are almost no market participants trading the futures contract shortly before the expiration date. That means trading volume is very low and price setting is unfavorable.

If you hold your position until the expiration date, your broker will close your position at the current price (liquidate futures). The price at which your position is closed is likely to be worse than the price before the end of the term.

Depending on whether you are long or short, you may need to buy your futures contract at a higher price or sell at a lower price than the previous day. You may lose more or win less than you could have if you had kept the expiration date in mind.

Tip

Anticipate your futures broker. Close your position yourself. And for higher profits and lower losses, you should always keep an eye on the expiration day and the first notice day.

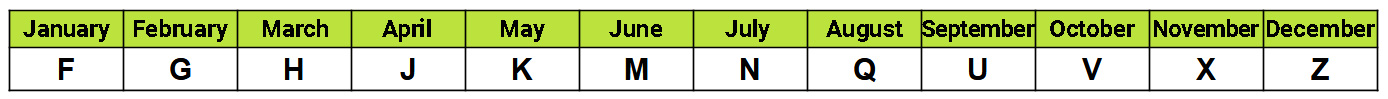

All futures have different expiration dates, which are named after months (expiration months or contract months). If a futures contract expires on May 13th, traders refer to it as the May contract. Each future has a different number of expiration months.

For example, wheat has five established expiration dates, or five maturity months (March, May, July, September, December). Contracts expire in these months. In contrast, natural gas has 12 expiration months, or 12 defined expiration dates.

You could, for instance, open a position in the Wheat May contract in April and would need to close that position by no later than May 13th (the expiration date for Wheat-May).

Did you know?

The contract months are indicated with an abbreviation and the corresponding year. The abbreviation for a futures contract always consists of a symbol for the relevant (raw) material and a specification for the contract month. For example, you can recognize the January 2023 contract for natural gas by the abbreviation NGF23.

We have compiled a list of the most important notations for you to download.

Tip

Look at the abbreviations for a futures contract in your trading software and with your broker where you trade. Notations may differ from each other.

Futures Margin

Unlike in the stock market, margin in futures trading refers to the collateral required to open a position (short or long). The margin is not actually paid, but rather blocked on your trading account.

When you close the position, the margin amount is released or offset against the loss from the position. So if you exit the trade with a profit, you will receive your margin back in full, plus the profit from the trade. If you close your position with a loss, that loss is subtracted from the margin.

There are two types of margin. The initial margin is a certain amount blocked by the broker on your account when you open a position. If a position is held overnight, many brokers also require an overnight margin.

The maintenance margin is the minimum amount on your account that must not be breached in the event of a loss from the futures position. The amount of this margin can be up to 90% of the initial margin.

If you breach the maintenance margin because your position is going against you and you are incurring high losses, you will receive the dreaded margin call. You must now replenish your account to the original margin level, otherwise your position will be automatically liquidated. This in turn incurs costs in the form of fees.

Did you know?

Margin is part of the contract specifications. However, the actual amount and type of margin is determined by the broker. Therefore, you will learn from your broker what margin and what amount you are dealing with.

9. Why trade futures?

In futures trading, you must pay attention to the contract expiration date, margin requirements, and tick value.

Many sectors

There are many liquid futures that are classified into the sectors of Stock Indices, Financials, Currencies, Grains, Energies, Metals, Soft, Meats, and Crypto.

Trading Futures Long and Short

Futures can be traded Long and Short, meaning you can profit from both rising and falling prices.

Hedging and Leverage

Futures are excellent for hedging long-term investments. On the other hand, you can diversify your futures portfolio with other financial products. Futures are leveraged products (margin trading), so not all of your capital is tied up in one product.

Calculable Risk

Futures trading offers a relatively safe and calculable risk (see above).

10. What do you need for successful futures trading?

Before you start futures trading, it's best to consider the following things.

Are you really ready?

You can achieve anything with trading, but you must be willing to put in the effort. The path to becoming a successful trader who requires little time for their trading is not a walk in the park.

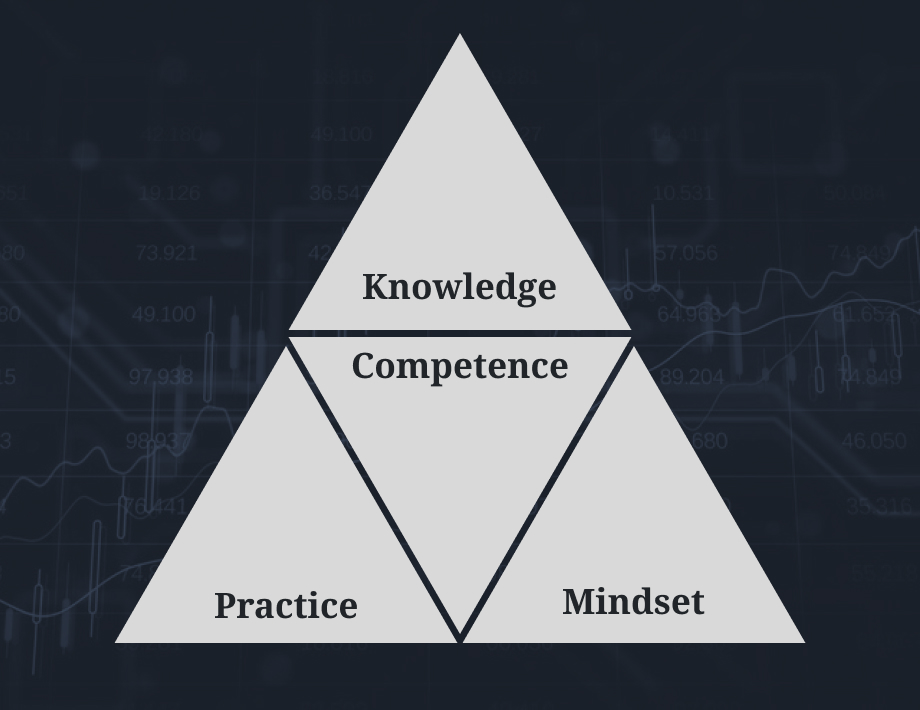

It means working on yourself, because your success in this business depends on your competence.

You need the necessary knowledge and a certain mindset to be successful in futures trading. It is important to first learn the theory and then gain experience in the markets - preferably first in demo trading and then in live trading.

If you are willing to consistently and disciplinedly work on your skills, you are on the right path to becoming successful in trading.

Do you have enough starting capital?

Ideally, your trading account should be larger than €50,000. You need this much money because futures contracts can be expensive. Additionally, you need money for the margin. A high starting capital will also help you with diversification and risk management.

If you have less than this amount, your options for trading futures will be limited. You won't be able to trade every future as a mini- or micro-contract. If you have a small account, you will need to pay special attention to your money risk management.

Do you have the right environment?

The journey as a lone wolf is difficult. Surround yourself with an environment that shares your interests and supports you in your goals. One that can catch you and help you get back up when things don't go well!

If you answered yes to all the questions, you can start learning about futures trading. It's best to find a trading education that also offers a community, or start with a beginner's trading course. If you're still interested after that, you can look for a futures trading broker.

Link list: Further information and tools

https://www.barchart.com/futures — Charts and specifications of the most common US and European futures

https://www.tradingview.com/chart/ — Comprehensive online trading software with an extremely large number of indicators and options (e.g. historical testing)

https://www.cftc.gov/MarketReports/CommitmentsofTraders/index.htm — CFTC (Commodity Futures Trading Commission) page for downloading COT reports

https://www.cmegroup.com — CME Group homepage with all futures traded on the CME with current prices and specifications

https://www.cmegroup.com/openmarkets.html — Analyses and reports from the CME

https://www.theice.com/index — Intercontinental Exchange ICE homepage

https://finviz.com/futures.ashx — Best market screener with current prices

https://www.investing.com/analysis/commodities — Analysis, reports, and opinions on commodities and futures

https://seekingalpha.com — News, comments, reports, and analyses from the financial world

Curious to learn more?

Get your hands on Max Schulz’s book by downloading it today! Free of charge.