Cognitive distortions - how they disrupt and destroy your trading

(Professional Trading Mindset Part IV)

Our observations and actions are prone to erroneous views and cognitive biases. This is also the reason why we make erroneous decisions in trading.

It belongs to the nature of trading that we are exposed to the dangers of mental pitfalls. That is why we should have well-defined and workable trading guidelines. Our rules and investment objectives are a first line of defense. It keeps us from slipping into irrational thinking and steers us toward disciplined trading.

In decision-making situations where information is poorly structured, contradictory and ambiguous, and stress is high due to time constraints and social pressure, mistakes can happen. We want to talk about some of these mistakes, errors and distorted views here.

What are "Cognitive Biases"?

Cognitive biases are "systematic faulty tendencies in perceiving, remembering, thinking, and judging. They usually remain unconscious and are based on cognitive heuristics (→ Wikipedia)"

This essentially paraphrases a behavioral pattern we tend to adopt when it comes to assessing situations, gathering information, and making decisions.

"We make the world as we like it! Dideldummm" (quote: Pippi Longstocking).

How do these cognitive distortions arise?

Cognitive distortions arise in our subconscious mind. Experiences and memories are stored there deeply hidden. Information from upbringing, social environment or even unconsciously absorbed information create thought worlds that influence our perception, thinking, judging and acting.

Especially when quick decisions are required and too much information is available at once or too little meaning is revealed, we get caught up in its undertow.

The consequence: uncomfortable, "unsuitable" information is faded out, suitable and comfortable information leads to the well-known "gut decisions". Sometimes you may be right, most of the time you ask yourself afterwards "How could I...?"

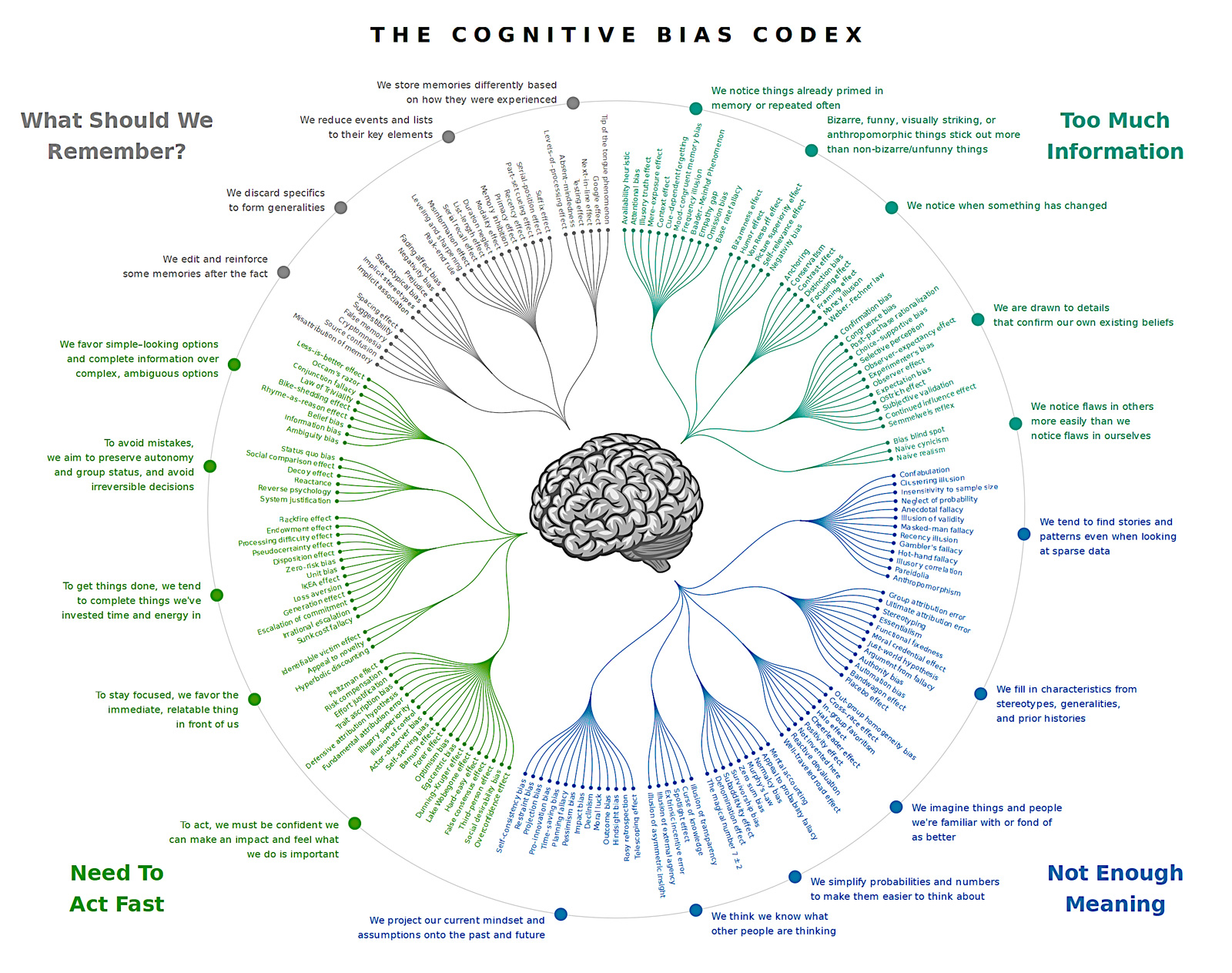

What cognitive distortions are there?

From the incredible number of Cognitive Biases that behavioral psychology lists, I would like to pick out just a few that preferentially afflict us traders (and I don't want to exclude myself).

A more comprehensive overview of all possible cognitive biases can be found in Wikipedia (look here). I have made this overview available for download as a PDF. You can find the link at the end of this post.

Confirmation Bias

This is a widespread distortion of our view of reality: we humans look for confirmation. Especially when we are overwhelmed by a lot of information, some of it contradictory.

In this case, we are more inclined to pick out and accept the information that confirms our existing hypotheses, opinions, and prejudices.

Data that deviate from this are brushed aside rather than questioned. They are dismissed as irrelevant, manipulative, or - more recently - as "conspiracy theory."

This leads, as a next step, to a targeted search for information that confirms our preconceived opinion. In extreme cases, this leads to a pronounced selective perception in which arguments that run counter to our own view of things are completely blocked out.

Texas Sharpshooter Effect

Results are interpreted after the fact and manipulated if necessary to fit into an expected scheme. Results that do not meet expectations are hidden or deleted. If that is not possible, they are explained and put into perspective with arguments pulled out of thin air.

Imagine a shooter firing wildly at a barn door. Then he looks at the bullet holes. Around those that are very close together, he paints the circles of a target and carves them out.

A testament to his superior sharpshooting skills!

You can sometimes see these skills by following the reports of very successful traders on the net: exorbitant profits within a very short time! These people show you the sawed out target, they hide the barn door.

When they have shown their target long enough and finally believe themselves what an outstanding shooter they are, it will come to the

Dunning-Kruger effect

in which individuals with inadequate skills, expertise, or experience tend to overestimate their abilities or knowledge.

The Dunning-Kruger effect is often misunderstood as a general overestimation of oneself by people with low intelligence. However, it actually refers to the specific self-overestimation of people who are unskilled at a particular task.

The consequence of this self-overestimation is not only that these people want to convince outsiders of their views. Rather, they are also unable or unwilling to critically examine the task area and learn.

Loss aversion and Sunk-cost Fallacy

Both fallacies are closely related and are common in trading.

We humans hate losses. Therefore, we value a loss more than a comparable gain and try to avoid it with all our might. If a trader is involved in a losing position, the thought of the capital already invested and the time spent prevents him from picking himself up and closing the position.

He doesn't want to lose his dead horse that has cost him so much, so he doesn't get down yet.

Add to that the hope that, yes, the animal might get back up and keep running.

The "sunk-cost fallacy" can also be observed in everyday life, when companies hold on to the development of a product because of the investments they have already made, even though it is clear that the development has no prospects.

Or municipalities that continue to build a road even when there is no longer any need for it, just because "so much money has already been put into it now."

Wishful Thinking

And this brings us to the next reality distortion: closely related to loss aversion and sunk-cost fallacy is wishful thinking. People love beliefs based on a pleasant imagination. Instead of making decisions based on facts and rationality, they drift into a "will be fine" or "everything will be fine" mentality.

This causes the trader to enter trades that "look good" and "look promising" - without sober analysis of the situation.

Sunk-cost Fallacy and Wishful Thinking can be mutually dependent and reinforce each other and in the end degenerate into a loss spiral.

"Bandwagon" effect

The "bandwagon" effect is a very common behavior in the financial markets - but not only there!

Humans are "herd people" (not to use the term "herd animal"). We feel comfortable in community, if everyone is doing the same thing, it can't be SO wrong! Most importantly, if everyone is buying and the price shoots up, then wouldn't it be more wrong NOT to buy now?

However, jumping on a moving train can end badly.

The bandwagon effect is further promoted by the seemingly authority and expertise of the "forerunners". In this context, one can add a quote from perhaps the greatest German-speaking thinker, Immanuel Kant:

Base your decisions on your own analysis, not on what "experts" or "insiders" tell you. Don't run after the pack, but look around to see WHERE they are all going.

And if "people who should know" are advising you to buy Bitcoin or Deutsche Bank stock now, look at those people; ask yourself what benefit they might gain from your following their advice.

Jesse Livermore (1877-1940), one of the very great stock traders, says in his book:

"A man must believe in himself and his judgment if he is to make a living at this game. ... No one can make big money by what someone else tells him."

What can you do about cognitive biases?

The mentioned errors and distortions are of course only a small part of a universe of parallel worlds, in which our subconsciousness drifts around. The PDF for download, which I have linked at the end, gives an insight into what cognitive psychology has found out.

I just wanted to point out some of the mental pitfalls that we traders fall into all too often.

But in conclusion, I want to give you 4 tips for dealing with these cognitive distortions.

1. Make yourself aware of your own mental aberrations.

Cognitive distortions have their origin deep inside our subconscious. From there they penetrate upwards, run unconsciously and unfold just thereby a particularly large effect.

If you become aware of the fact that they also influence your thinking and your actions, you have already gained a lot. You can then bring them from the subconscious to the surface.

Question the information that reaches you. Question also - and especially - the information that fully corresponds to your view and conviction.

From whom does this information come? What could be the intentions of the informant? Are they objectively verifiable facts (with sources) or subjective evaluations?

So the alarm bells always ring for me when someone is presented to me as an "Internationally recognized expert for [X] (← insert any subject area)." While I'm not immune to the aforementioned misconceptions either, I then wonder if there isn't another "expert" who has found out just the opposite?

2. Take time to make decisions.

There is a rule of thumb that has always helped with important decisions: Sleep on it for a night.

Unfortunately, this doesn't always work for trading decisions. Nevertheless, you must make it a rule not to make important decisions and assessments under time pressure or emotional tension. Under stress and tension, thinking errors have a particularly easy game.

Spontaneous decisions are often decisions that are regretted afterwards. You can avoid them by planning and controlling your actions.

Analyze your markets, plan your actions in advance. Of course, take into account your trading style. A day trader cannot make weekly plans. But daily plans. Plan your daily routine, set yourself fixed task blocks - and don't forget the breaks.

Set binding rules for opening positions, managing trades, and exiting positions. Cheat your unconscious by acting consciously.

3. Gather more information.

You already know everything?

Systematic thought errors happen all the more easily the less real information we have at our disposal. And pay attention: valuable information also illuminates the back of an object that lies in the shadows, not just the brightly shone front.

4. Exchange information with other people.

It is a special characteristic of us humans that we notice mistakes most easily when others make them. If we make them ourselves, they are rarely noticed.

Therefore, the best way to recognize and avoid our own mistakes and bad decisions is to have them pointed out to us by other people we trust.

Therefore, regularly exchange ideas with other people whom you trust but who are not exclusively in your "filter bubble".

When making decisions, consult people in your environment, for example friends, family members or colleagues. But make sure that you don't want to hear WHAT you should do, but HOW you should do it - or better NOT do it.

Also be specific that you want to hear if the person you're talking to thinks you're making a mistake in your thinking.

Ray Dalio, former CEO of Bridgewater Associates, one of the largest global hedge fund firms, writes in his book Principles:

Conclusion

Cognitive distortions can not only disrupt your trading, they can destroy it.

If you know about this danger, you have the first step already behind you to avoid these mental stumbling blocks! If you realize that these errors and confusions creep out of the unconscious and take over your conscious thinking, you can avoid them.

By observing yourself, getting to know yourself, and then targeting the "trigger points" where you "take a wrong turn," you can make it so that your conscious mind takes over!

Our whole team wishes you Toi-Toi-Toi!

Sources:

- Robert Koppel: “INVESTING and the IRRATIONAL MIND, Rethink Risk, Outwit Optimism, and Seize Opportunities Others Miss”; McGraw-Hill Education Ltd (2011)

- Edwin Lefèvre: “Jesse Livermore - Reminiscences of a Stock Operator”, Mockingbird Press 2019

- Ray Dalio: “Principles: Life and Work”, Avid Reader Press / Simon & Schuster (2017)

- Wikipedia: https://en.wikipedia.org/wiki/Cognitive_bias

Download the overview here: https://insider-week.com/uploads/2023/03/27/cognitive.pdf

Curious to learn more?

Get your hands on Max Schulz’s book by downloading it today! Free of charge.