COT Data for your FOREX Trading - How does it work?

Can you use COT data for FOREX trading?

Are you an experienced FOREX trader looking for additional information to support your trading decisions?

Or are you already trading futures and looking to expand your portfolio by trading FOREX?

In either case, this article will show you how using published COT data for currency futures can provide valuable insights for your trading decisions.

What is the significance of currency futures?

Futures serve to hedge against price risks in trade transactions. Currency futures fulfill this task in international business. Let's take a large US corporation, for example, Boeing, which enters into an agreement with Swissair, the Swiss airline, for the delivery of 10 aircraft. Payment is to be made in USD.

Of course, it will be in the interest of both parties to make the prices and costs calculable.

If Swissair fears a strong expected increase in the dollar exchange rate, it will try to hedge against it. This is where futures come into play.

Swissair buys Dollar Index futures. If the dollar continues to show strength, the business will be more expensive for the Swiss, but the future will also increase in value. By selling the future, the Swiss can offset the additional cost.

Find more useful information on futures at our website insider-week.com. I have summarized a few links for orientation under the article!

How do you read a currency future?

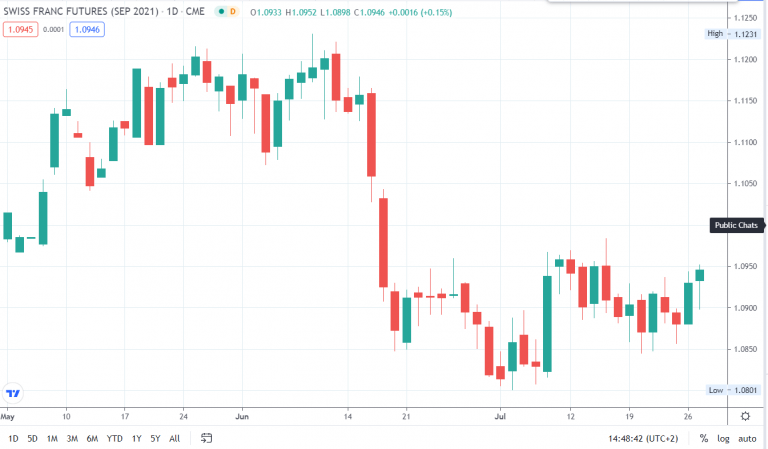

As a FOREX trader, the quote of a currency future may seem unusual to you. You are used to a quote in the form of USD-CHF or CHF-USD. And now you only find one currency mentioned? There are futures on the Swiss franc, British pound, or Japanese yen.

At the core, however, it is entirely comparable to what a trader from the FOREX world knows, only that the second currency is always the US dollar. The future based on the British pound (GBP) corresponds to the currency pair GBP-USD.

A future therefore answers the question:

"How many US dollars correspond to one unit of the foreign currency?"

The foreign currency therefore constitutes the base currency of a currency pair, and the quote currency is always the US dollar.

The price of the future is closely tied to the price of the underlying currency.

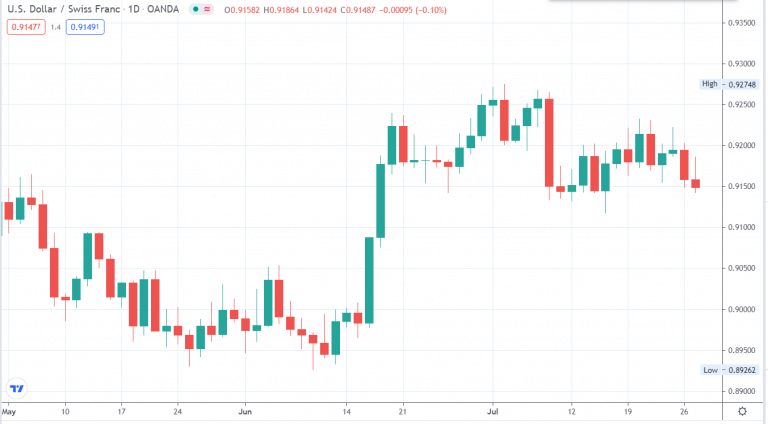

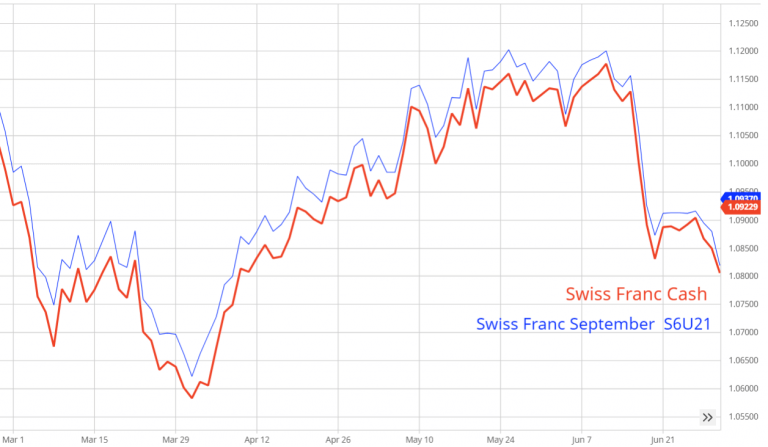

Fig. 3: The price of Swiss Franc futures, September contract (BLUE) compared to the price of the currency in the spot market (RED) according to the FOREX pair CHF-USD.

The following currency futures are traded at the US futures exchange CME:

Examples of the use of futures in FOREX trading

If you want to trade currency pairs in the FOREX market, where one currency is the US dollar, you can immediately access the information from the futures. In this case, you may need to "rethink" a little, depending on which currency pair you are trading.

What insights do the COT data and report provide?

Let's delve into the most crucial question:

"What is the advantage of including futures in my investment strategy?"

Great Question - Quick Answer:

The advantage lies in the COT Report!

The CFTC, the government regulatory body for US futures markets, releases a weekly report called the COT report for currency futures. This report provides valuable information for your trading strategy through the included COT data.

Delving into the details of this report goes beyond the scope of this video and article. Our website is dedicated entirely to this topic.

Below, we have included some useful tips to get started on this topic. Here's a brief overview: The COT report lists the positions of major and significant market participants in the US futures markets every week.

These market participants fall into two main categories, the commercials and the large speculators.

Our two examples from the introduction, Boeing and Swissair, would be considered commercials in this context.

What role do the COT data and commercials play in this?

By analyzing the positions of the commercials, one can draw conclusions about the market situation and the expected price movement of a future. Commercials can be multinational corporations, government institutions, or the largest and most important organizations in an economic sector.

They are at the forefront of events, have insight into developments before they become public knowledge (inside information), and can influence prices through their market power.

Understanding the actions of the commercials can provide valuable hints for your trading strategy. One final example:

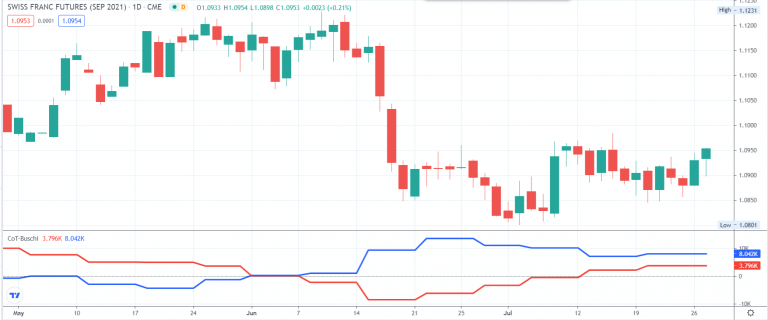

The image shows the September contract of the Swiss Franc futures, below are the net positions of the two groups (Commercials in red, Large Specs in blue).

For example, we can see that the commercials started to reduce their long positions in May. They began building short positions in early June and the price went down shortly thereafter. Currently, they are building up long positions again, which suggests a recovery in the price.

You should also take a closer look at our website for more information!

Good to know

In a currency future, the exchange rate of the foreign currency is always referenced to the US dollar. So, the currency future always represents the forex pair foreign currency-USD in essence. But what about the dollar index itself? That would then be the currency pair USD-USD, right?

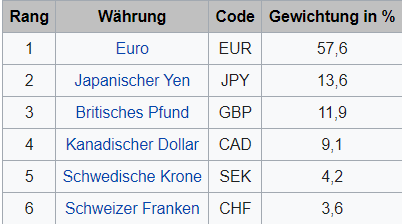

How is the dollar index rate determined?

The dollar index represents a computational value determined by the US central bank by comparing the USD to 6 major currencies: EUR, yen, GBP, CAD, SEK, CHF. The exchange rates of these currencies are weighted according to a specific scheme in the calculation. The weighting:

Conclusion

You can see that considering currency futures can support you in your trading decisions for the FOREX business. Currency futures ultimately represent a FOREX pair with the USD as the quote currency.

In contrast to Forex, the futures market is strictly regulated, and the government agency CFTC releases weekly market reports of the futures markets. Analyzing these COT reports gives you a deep insight into the market situation and the expected market development in the currency markets.

This means a small additional effort but is definitely worth it in the end.

Book free demo sessionSources and Charts:

All charts created with TradingView https://www.tradingview.com/chart

Links for deeper understanding of the content:

As a beginner in futures trading, you should watch the contents of our futures basic education in order. Here, we offer a complete introduction to the topics of trading, futures, and the COT report: https://insider-week.com/en/beginner-trader/

Curious to learn more?

Get your hands on Max Schulz’s book by downloading it today! Free of charge.