Learn swing trading: how to start swing trading step-by-step

You want to start learning how to trade, but you have no idea what exactly and where to learn it. Swing trading is the most viable trading style for professionals and other busy people. But even for less busy people, swing trading is a good choice. You will understand why and you will learn how to become a profitable swing trader.

1. What is swing trading?

There are three main trading styles for trading on the financial markets. In terms of their time frame, they are divided into short-term trading (day trading/scalping), medium-term trading and long-term trading (investing).

Swing trading belongs to the medium-term approach. A swing trader concentrates on the daily and weekly chart in his planning; the price data at the end of the day (End-Of-Day, EOD) are important to him. A position can be held for a few days up to – in exceptional cases – two weeks.

Swing trading has several advantages:

- It allows you to trade in less time. You don’t need to spend all day monitoring the market.

- Trading decisions (entry, closing the position) can also be made outside of stock exchange trading hours.

- Permanent presence at the screen is not necessary.

- The mental load is significantly lower than with short-term trading styles.

2. What can I trade with swing trading?

Swing trading is not limited to specific financial products. You can basically trade any asset with this trading style, such as stocks, forex, CFDs or futures.

InsiderWeek has specialized in futures and futures trading. Futures are the financial product I recommend to you as a trading beginner. There are three main reasons for trading futures.

- Futures are only traded on exchanges. This makes them a reliable financial product with a uniform price in terms of price setting, independent of the broker (in contrast to Forex, for example).

- The futures contract price is based on the price of the underlying commodity or other trading objects such as currencies and stock indices. By analysing and observing the price development of these commodities and their influencing factors, the price development of the futures become more transparent and predictable.

- US futures (that's the only one we trade at InsiderWeek) are regulated by the government's Commodity Futures Trading Commission (CFTC). The CFTC publishes a weekly market report, the Commitments of Traders Report (COT Report), whose COT data is used as the fundamental basis for our trading decisions. No other financial product offers comparable market transparency.

3. Which swing trading strategy is suitable?

There are different swing trading strategies, and each has its own proponents. If you follow discussions among traders, you might conclude that there are two divided camps: the technicians and the fundamentalists.

Technicians only consider the chart for their trading planning and try to recognize geometric patterns and mathematical laws in the price development. The fundamentalists ignore the price chart and rely mostly on political, social, and economic news, plus some recurring events and anniversaries.

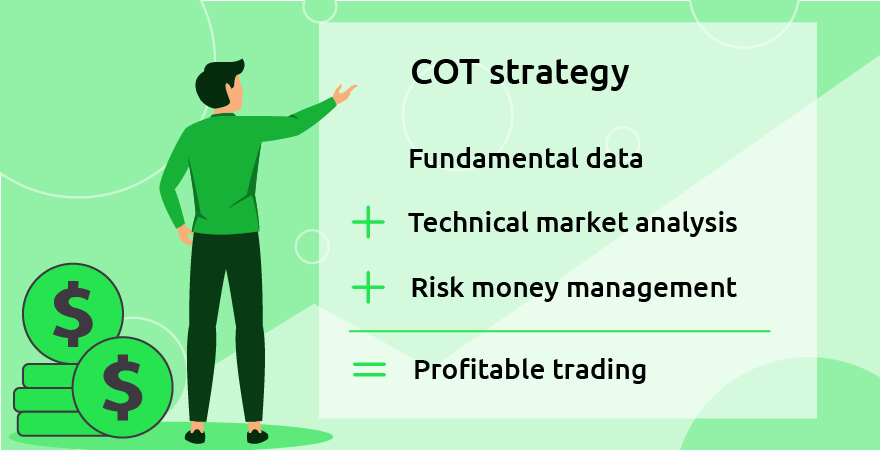

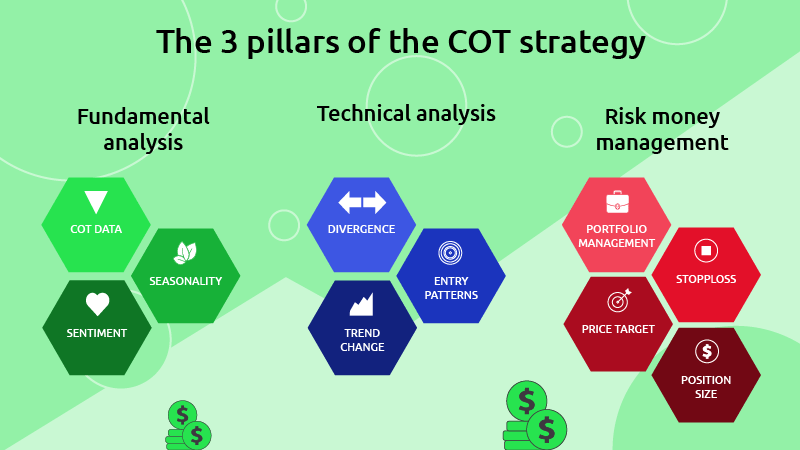

It is a fact that a robust and profitable trading strategy combines both technical and fundamental analysis approaches. There is also a third factor that is unfortunately often neglected: risk money management. The fact that an estimated 80% of all traders fail can be traced back to the absence of this component.

InsiderWeek's successful COT strategy is based on these three pillars, which act like the legs of a three-legged stool: if one leg is too short or missing, the thing falls!

4. What is the COT trading strategy?

Fundamental data

The COT data of the COT Report form the basis. In addition, we evaluate historical price developments, as many commodities follow seasonal cycles. We include this seasonality and the resulting seasonal trades in our trading. Another aspect that is included in our planning is the sentiment, the "mood on the market". We also take external factors into account, such as the weather, which also influences the supply and demand situation of a commodity.

Technical analysis

The evaluation of the fundamental data, especially the COT report, gives us information about the direction in which the market will move. However, it does not give us any indication of when this may happen.

Tip

The COT report is not a timing instrument! For this we use the trading tools of technical analysis and methods that market technology makes available to us.

Using the trading tools, we analyse the trend and look for corrections and trend changes. Indicators such as moving averages show us the most favourable entry points.

Risk money management

The third pillar is risk money management. Based on a maximum accepted risk, we determine our position size. We pay attention to correlations to determine our portfolio or set stops and price targets.

You can’t avoid losses in trading. The most important task of risk money management is to limit these losses and thus to ensure long-term survival on the market and to secure profits.

5. Where and how can I learn swing trading learn?

With us you can learn futures trading with the COT strategy. Our COT strategy, based on the strategy of Larry Williams, uses all the advantages of swing trading:

- low time requirement

- low mental load

- an optimized workflow

How can you learn it now? Take these three steps to success!

5.1. Learn the basic

Gather information and find the answers to the following questions:

- What are futures and how are they traded? How do they differ from other financial products? What are their special features?

- What is the COT Report all about? How does it support you in your trading?

- What basic knowledge and techniques do I need to master as a trader? What does the market technique tell me? What is behind the term risk money management in trading? Which indicators do I need to know? What are stops? What is stop loss?

The whole thing looks pretty much like a mountain full of work. But it is by no means so. It's more of a puzzle where you quickly notice how one piece fits into the other.

Start here with our basis trading course for beginners. Spend a few hours on this free basic trading course and you'll soon be at step 2.

5.2. Get into practice

It's like driving a car: you learn all the rules, you get skilled in first aid and know all the traffic signs, but you can't park in backwards yet. We learn that in the second step.

Open a demo account with a broker, for example Interactive Brokers (IB), and start with simple exercises on this demo account. Ideally, you are already looking for a futures broker (not all brokers offer futures, especially US futures) with whom you can set up your real money account later. Test this broker thoroughly. Your later success also depends on your broker choice.

In this phase you do not need any professional software such as the TradeNavigator. Use the software that the broker provides free of charge (e.g. the Trader Workstation at IB) or use the Tradingview service on the web. Here you will find an almost professional trading environment that not only provides you with all the necessary trading indicators and data, but also enables comprehensive demo trading and backtesting.

Take your time for this step! Get to know the futures, their special features and rules. Learn to plan entries and stops. Look at the courses in the past and do historical tests (backtesting). You will very quickly become enthusiastic about the markets.

Tip

Start recording your thoughts and insights, your demo trades and their results systematically in a trading diary or trading journal already in this phase! A trading journal will be an immense help for you and will accompany you throughout your entire trading life.

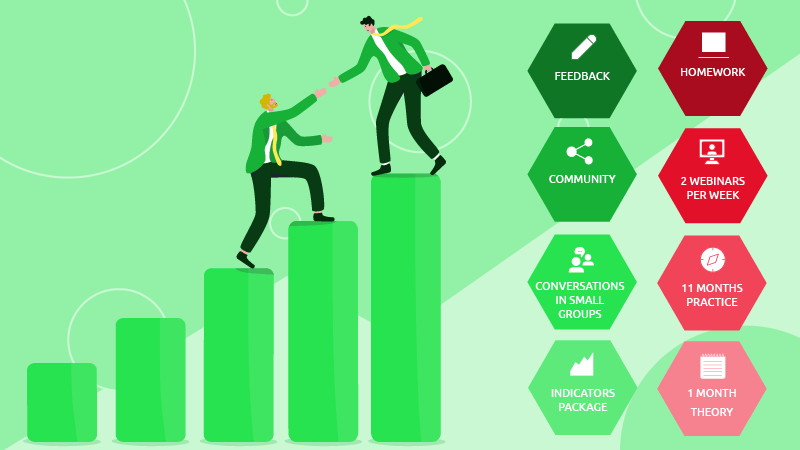

At this point we recommend that you invest in a trading education. In our experience, for successful trading you need knowledge, experience, and the right mindset.

If you want to trade profitably on the stock markets, it is important to understand the markets and to know the different influencing factors. Trading is a complex subject and at the beginning it is unknown and confusing.

You may think that you can read up on the necessary knowledge and then gain your own experience. You will, but with a trading coach or trading expert by your side you will have a steeper learning curve and gain confidence faster. According to our experience in the field of trading, the research online is often time-consuming and can lead you on wrong paths.

Markus Winkler

„Self-learning takes a lot of time and energy. You can watch 100,000 YouTube videos. That will get you further in the beginning because you learn the basics. But you won't find a profitable strategy. You need fundamental data, and you can find it on the internet, but you don't know what to do with it. And that's what is impossible to find online. In your own research you will give up because you don't make any progress.”

Trading is a psychological matter. Emotions have no place here. Greed and fear can have fatal effects on your trading. Here it is important to train the right mindset.

For profitable trading, you need to gain confidence in dealing with financial products. You can only build up this confidence if you practice and gain experience. A role model or a coach can show you in different market situations what he would do now. So, you constantly learn from successful traders.

It's about your money. Trading is risky and you can lose a lot of money. To keep your losses low, it is important to get a trading education and to trade by certain rules. With a trading education you create a foundation on which your trading is built. Exactly that, plus your endurance and motivation to internalize and apply the coaching content and rules of the strategy, will lead you to success in the long run.

In addition, you should join a community of like-minded people right now. This will support you from the start and encourage you when things don't go quite right.

5.3. Start earning money

Third, if you haven't already done so in step 2, you need to find a real futures broker. You can also find help and relevant key points for this crucial step in our free basic trading course. With this broker you open a real money account and start into the world of futures traders.

Tip

Get help right from the start. You are walking a path that many have walked before you. And who got lost in the process and had to find their way back onto the right path. Those who are still in business today have found their way back. And they can help you avoid getting lost in the first place.

Trust in the experiences of those who have been successful in this profession from the start. Get the support you need and deserve. And stay consistent on the path that leads to success. Don't get side-tracked because everything looks hard in the beginning before it becomes easy!

Always watch you risk money management because this is the key to success in trading. Good luck and stay tuned.

Curious to learn more?

Get your hands on Max Schulz’s book by downloading it today! Free of charge.