US stock market trading hours: the 4 most important US futures exchanges

At InsiderWeek, we only trade US futures. You can find the trading hours of the most important US exchanges in this article.

1. When are the US stock markets open?

The tables show you the electronic trading hours of the most important US futures exchanges:

| Indices | Trading venue | Trading hours (CET) |

|---|---|---|

| E-Mini S&P 500 | CME Globex | 00.00 – 22.15 22.30 – 23.00 |

| E-Mini NASDAQ 100 | CME Globex | 01.00 – 23.15 23.30 – 24.00 |

| E-Mini DOW | CME Globex/ECBOT | 00.00 – 22.15 22.30 – 23.00 |

| Financials | Trading venue | Trading hours (CET) |

|---|---|---|

| 30 Year US T- Bonds | CME Globex/ECBOT | 00.00 – 23.00 |

| 10 Year US T- Notes | CME Globex/ECBOT | 00.00 – 23.00 |

| Currencies | Trading venue | Trading hours (CET) |

|---|---|---|

| Euro FX | CME Globex | 00.00 – 23.00 |

| E-Mini Euro FX | CME Globex | 00.00 – 23.00 |

| Swiss Franc | CME Globex | 00.00 – 23.00 |

| British Pound | CME Globex | 00.00 – 23.00 |

| Australian Dollar | CME Globex | 00.00 – 23.00 |

| New Zealand Dollar | CME Globex | 00.00 – 23.00 |

| Canadian Dollar | CME Globex | 00.00 – 23.00 |

| Japanese Yen | CME Globex | 00.00 – 23.00 |

| Mexican Peso | CME Globex | 02.00 – 23.00 |

| US-Dollar Index | ICE | 02.00 – 23.00 |

| Metals | Trading venue | Trading hours (CET) |

|---|---|---|

| Gold | CME Globex COMEX | 00.00 – 23.15 |

| Silber | CME Globex COMEX | 00.00 – 23.15 |

| Platin | CME Globex COMEX | 00.00 – 23.15 |

| Palladium | CME Globex COMEX | 00.00 – 23.15 |

| Copper | CME Globex COMEX | 00.00 – 23.15 |

| Energies | Trading venue | Trading hours (CET) |

|---|---|---|

| Crude Oil | CME Globex NYMEX | 00.00 – 23.00 |

| RBOB Gasoline | CME Globex NYMEX | 00.00 – 23.00 |

| Heating Oil | CME Globex NYMEX | 00.00 – 23.00 |

| Natural Gas | CME Globex NYMEX | 00.00 – 23.00 |

| E-Mini Crude Oil | CME Globex NYMEX | 00.00 – 23.00 |

| E-Mini Natural Gas | CME Globex NYMEX | 00.00 – 23.00 |

| Brent Crude Oil | ICE | 02.00 – 24.00 |

| Grains | Trading venue | Trading hours (CET) |

|---|---|---|

| Corn | CME Globex CBOT | 02.00 – 14.45 15.30 – 20.20 |

| Wheat | CME Globex CBOT | 02.00 – 14.45 15.30 – 20.20 |

| Oats | CME Globex CBOT | 02.00 – 14.45 15.30 – 20.20 |

| Rough Rice | CME Globex CBOT | 02.00 – 14.45 15.30 – 20.20 |

| Soybeans | CME Globex CBOT | 02.00 – 14.45 15.30 – 20.20 |

| Soybean Oil | CME Globex CBOT | 02.00 – 14.45 15.30 – 20.20 |

| Soybean Meal | CME Globex CBOT | 02.00 – 14.45 15.30 – 20.20 |

| Softs | Trading venue | Trading hours (CET) |

|---|---|---|

| Cotton | ICE NYBOT | 03.00 – 20.20 |

| Cocoa | ICE NYBOT | 10.45 – 19.30 |

| Sugar #11 | ICE NYBOT | 09.30 – 19.00 |

| Coffee | ICE NYBOT | 10.15 – 19.30 |

| Orange Juice | ICE NYBOT | 14.00 – 20.00 |

| Lumber | CME Globex | 16.00 – 22.05 |

| Fleischmärkte | Trading venue | Trading hours (CET) |

|---|---|---|

| Live Cattle | CME Globex | 15.30 – 20.05 |

| Feeder Cattle | CME Globex | 15.30 – 20.05 |

| Lean Hogs | CME Globex | 15.30 – 20.05 |

2. What do you need to know about trading hours?

2.1 Main Trading Hours

Main trading hours are a relic from the days of floor trading, when stock traders executed orders through hand signals and shouts.

Nowadays, electronic trading has almost completely replaced floor trading. The advent of computers, the expansion of product offerings, and globalization have changed stock trading.

However, trading hours have been expanded as a result.

2.2 Trading Hours of the Major US Futures Exchanges

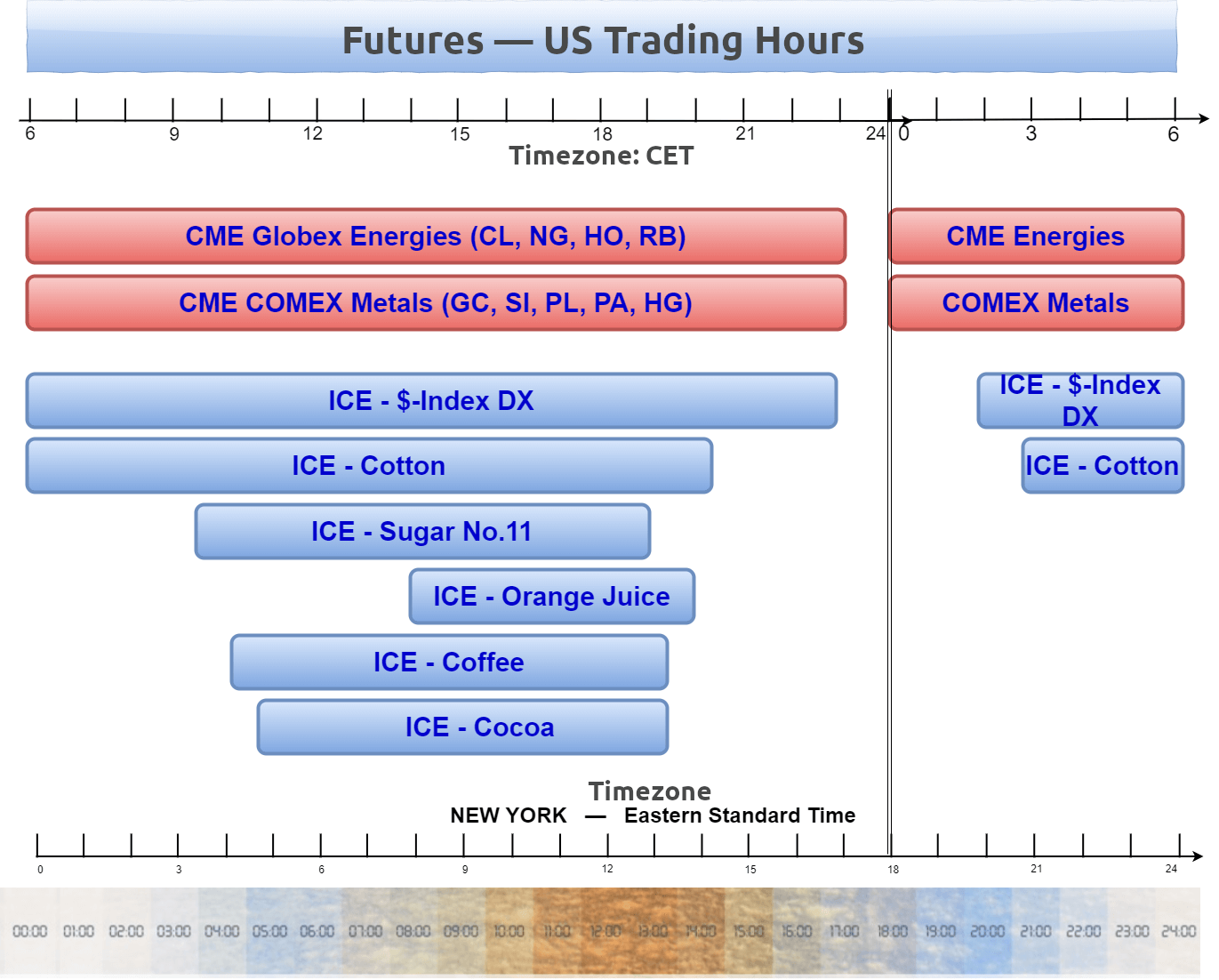

The chart shows (a part of) the trading hours at the major futures exchanges in New York and Chicago in the USA. The time indications are based on Central European Time (CET). You can see that the exchanges in Chicago and New York have different trading hours. In New York, trading hours for individual commodities also differ from each other.

You can see that electronic trading at the futures exchanges in the USA is possible in many markets almost 24 hours a day.

Sources:

Website of CME-Group: https://www.cmegroup.com/

Website of Intercontinental Exchange: https://www.theice.com/index

Curious to learn more?

Get your hands on Max Schulz’s book by downloading it today! Free of charge.