3 Factors that determine your Professional Trading Mindset

Many traders who are new to the subject experience a nasty surprise after a short time: the dream of making a quick buck is shattered, and the Lamborghini they ordered has to be canceled.

Why do so many newcomers fail?

Is it just the lack of luck? Do successful traders have secret inside information? What is different about the people who have trading success?

It is the way he

- looks at the markets and approaches trading

- reacts to price changes

- how he deals with profits and losses

- knows himself and

- finally has himself under control in short: HIS

A loose sequence of articles will help you to establish such a Professional Trading Mindset. We will be looking in detail at:

- What really matters when trading the financial markets?

- What mindset will set you on the path to success?

- Which mental "adjusting screws" do you have to turn in order to develop from a "loser" to a "winner"?

Today we will show you the 3 essential factors of this trading mindset. In the next articles I will go into each of them intensively and in detail. Today first the overview.

Preliminary remark: What does "MINDSET" mean?

It is

- your thoughts and ways of thinking

- your values and beliefs

- your belief patterns and

- your behavior patterns

Your mindset is part of your subconscious and your unconscious behavior.

However, it is possible to observe and analyze this behavior. By doing so, you become aware of your unconscious behavior and can train it. The subconscious becomes conscious.

What are the three essential factors that will be at stake?

Factor no. 1) Trading: a game of probabilities

We humans love certainty and security. Uncertainty is uncomfortable and frightening. But this absolute certainty does not exist in the financial markets. The development of a stock price or commodity price can be predicted in some cases. In most cases, however, things turn out differently than expected.

In the financial markets, a game of probabilities is played out, which often holds many surprises.

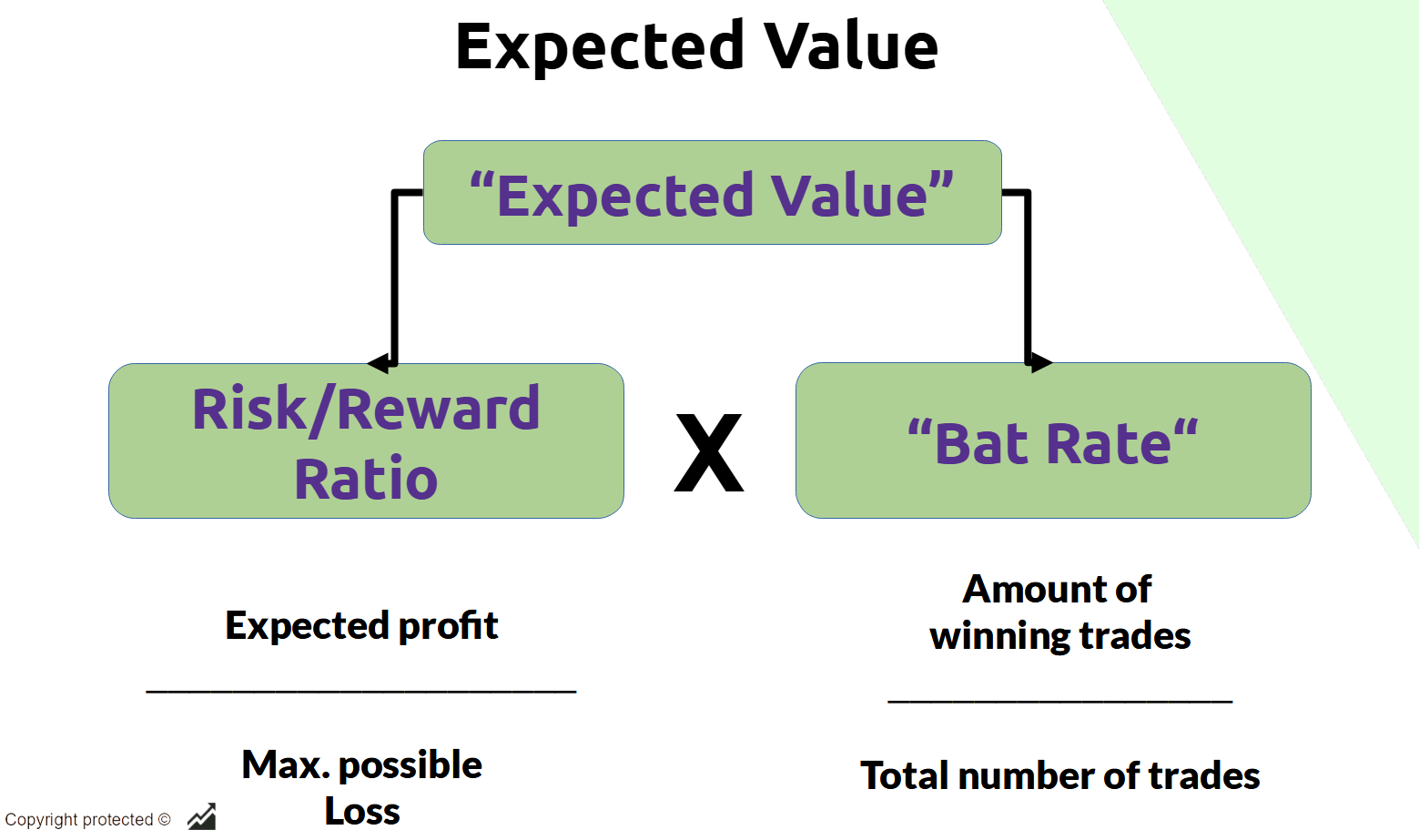

The most important concept in trading is the expected value. This Expected Value (EV) is a value that expresses the probable success of an action or action.

The EV depends on two factors: the "risk-reward ratio (RRR)" and the possible hit ratio.

The RRR is quite easy to determine: it is the ratio of the possible profit that a trade can achieve to the largest possible loss that could occur. You expect a possible profit of 3.000$. Your maximum loss is 1,000$. Now you have a risk-reward ratio of 3:1.

How to calculate your possible profit and maximum loss will be the subject of one of the next articles. Here it is all about recognizing and accepting the principle.

To find the expected value, the second thing you have to consider is the hit rate. This value, also called "Bat Rate", is the percentage of winning trades in relation to the total number of all trades. So you have to include the probability in your considerations, how often the winning or the losing case will occur.

As with all statistical values, the same applies here: The more cases you consider, the more meaningful the result. The hit rate therefore depends to a large extent on your trading experience.

As you can see, the value of the Expected Value is not an exactly arithmetically calculable value. Although there is a simple formula, it remains an estimated value. This is where your experience comes in and your knowledge of the market you are trading. And of course the way HOW you trade these markets.

This leads to the second factor

Factor No. 2) Your Mindset and Emotions

As important as emotions are in human life - they have no place in trading!

When dealing with money and trading financial products, you can be hit by a whole barrage of emotions.

The two main emotions that determine the trader's psyche are fear and greed. The two often influence each other. Greed

► ("I'm going to rake in at least $1,000 in profit today!") ◄

goes hand in hand with the fear of missing a trade.

And when the price suddenly turns, fear germinates: the fear of losing something you already seem to have for sure.

► ("This is MY money, I'm not giving it away anymore!") ◄

Where do these emotions lead?**

- You take too much risk

- You execute too many trades in too little time

- Your trading decisions are not based on rational considerations but on (gut-)feelings

- You exit a trade too early in case of sudden, minimal price fluctuations

- You hold on to losing positions for too long ("being married to the position")

These wrong decisions are reinforced by the "principle of hope":

- You hope, that the price will return.

- You hope, that the trend will continue.

- You hope, that the next trade will make up for your loss.

You often hope in vain!

If you want to set out on the path to success and stay on this path, you must know which emotions influence you and how, and how you can get these emotions under control.

Factor #3) Your Mindset and your Strategy

A method to keep your emotions under control in trading: you develop a trading strategy that fits your personality. To do this, you examine yourself and your current mindset.

You need to identify your strengths and weaknesses and what emotions are preventing you from being successful in the markets.

- Can you wait patiently until your chance has come?

- Are you a very impulsive type?

- What triggers your rash impulses?

- In which situation do you leave "the straight path?"

Or

- Are you more hesitant, indecisive?

- Are you reluctant to make decisions?

- At what times of the day do you have a performance high, when a performance low?

- What influences does your environment have on you? Does it inspire you or hinder you?

All these questions and aspects must be included in your strategy. Out of this you have to develop a strategy that you can implement in any situation.

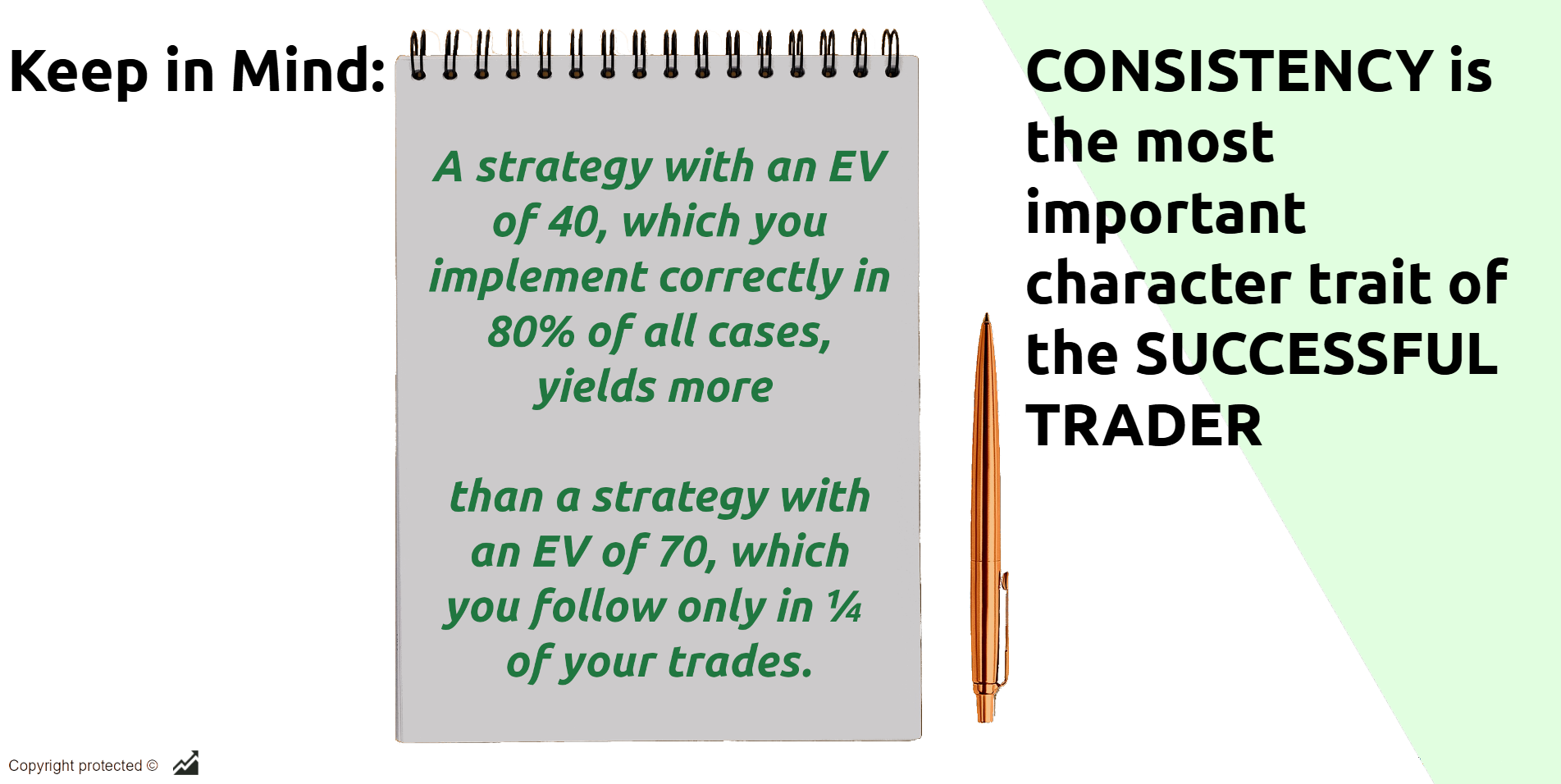

And then, of course, it is necessary that you also adhere to these rules. Always keep in mind:

A strategy with an EV of 40 that you implement correctly 80% of the time will earn you more in the long run than a strategy with an EV of 70 that you only stick to in ¼ of your trades.

And finally, you train yourself to stick to that strategy and eliminate obstructive emotions.

Developing and consistently implementing such a strategy is the secret behind winning traders. It is not luck, it is not talent that brings about success. Consistency is the essential character trait of the Successful Trader.

Only a conscious approach to a task and consistent implementation of a strategy will bring you success. It is your mentality, your mindset that determines your results!

Conclusion

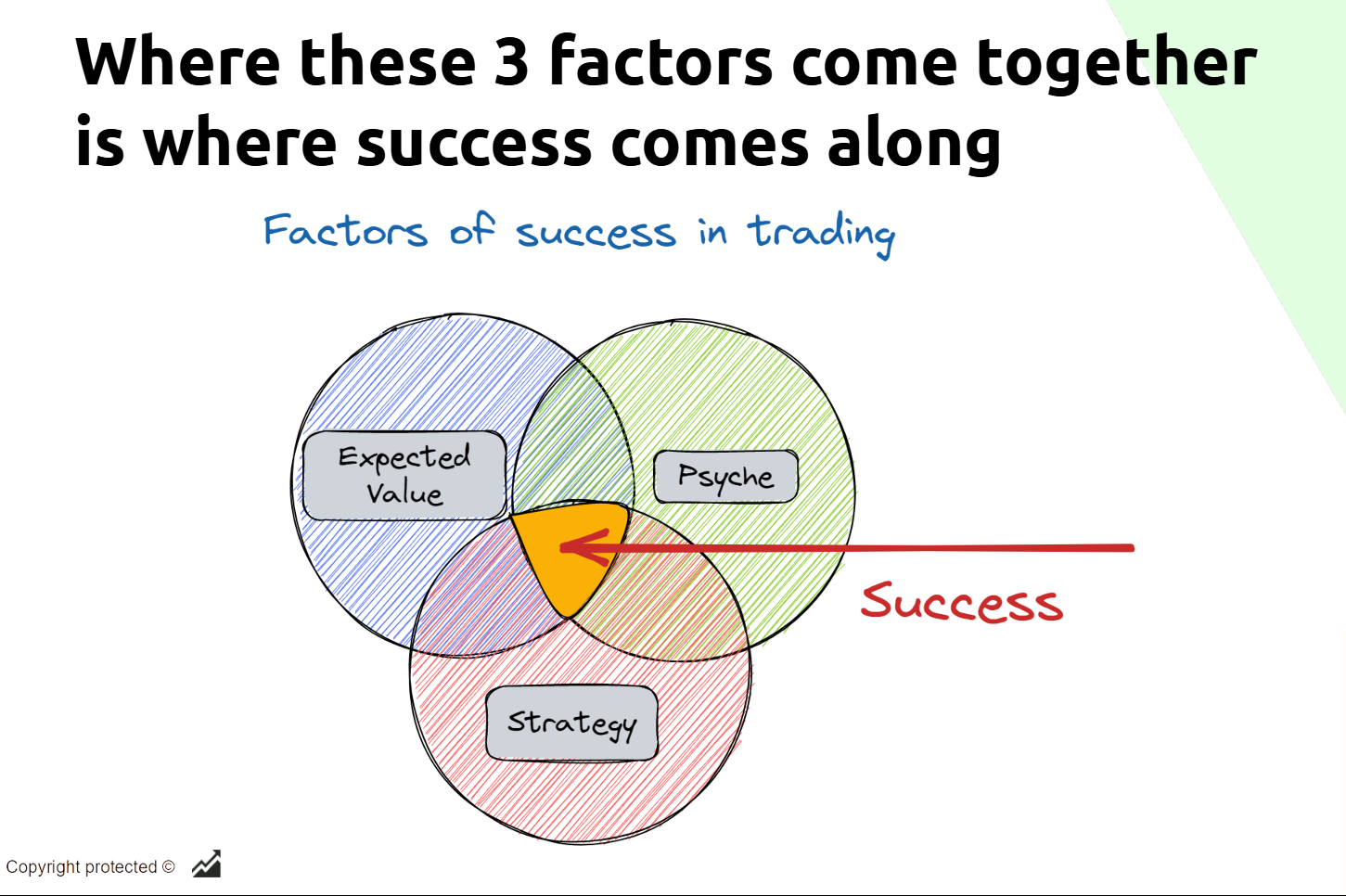

The 3 most important factors for developing your professional trading mindset:

- the expected value: the thinking in probabilities.

- your psyche: your strengths and weaknesses

- your strategy: and your consistent adherence to it

In the next article on this topic, we will take a closer look at the first factor mentioned and give you the necessary tools for your path to success.

Images: Storyset.com https://storyset.com/; own creation

Curious to learn more?

Get your hands on Max Schulz’s book by downloading it today! Free of charge.