Gold Rush Friday – A simple yet effective strategy

One of the relatively stable patterns in the gold market is the so-called "Gold Rush Friday." The trading idea is relatively simple: we buy gold on Friday at the opening and sell at the end of trading.

The "Gold-Rush-Friday" - Pattern

In this article, we want to verify the results in the first step and in the second step find out if the results can be improved by using a stop loss.

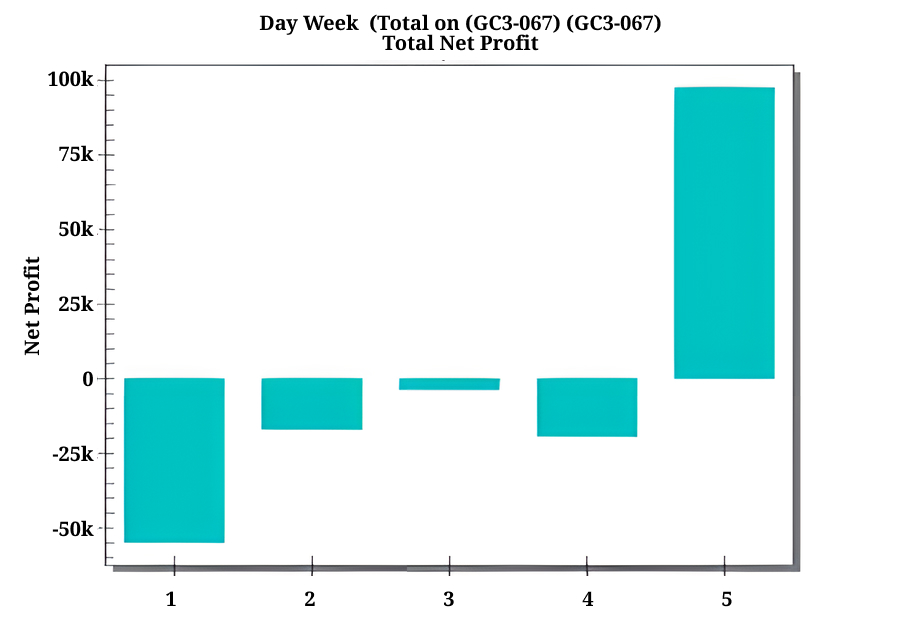

In the following analysis, we see the distribution of profits by days of the week. Therefore, Friday stands out compared to other days of the week and confirms the claim that gold is better suited for long trades on Friday than on other days of the week.

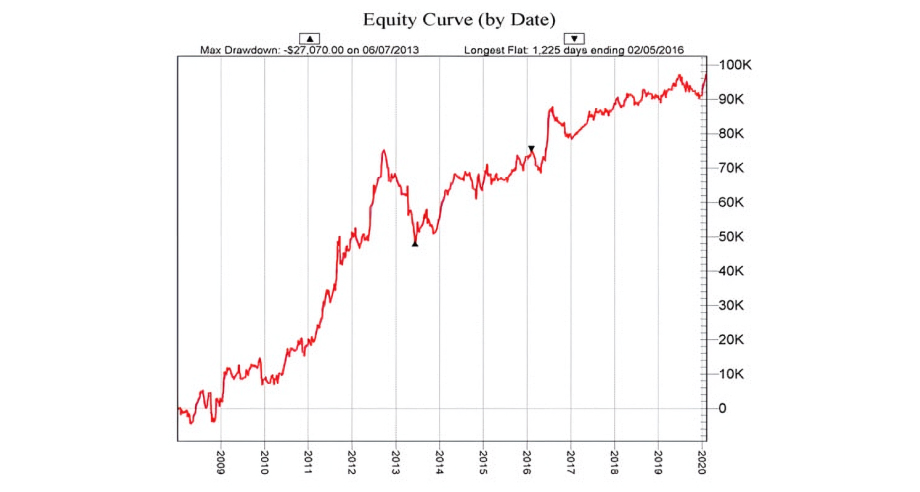

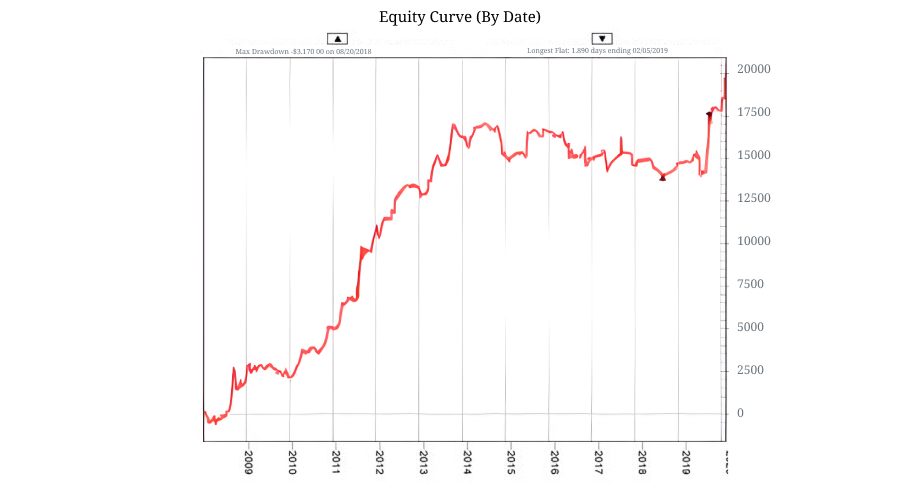

Next, we will examine the equity curve and the performance report

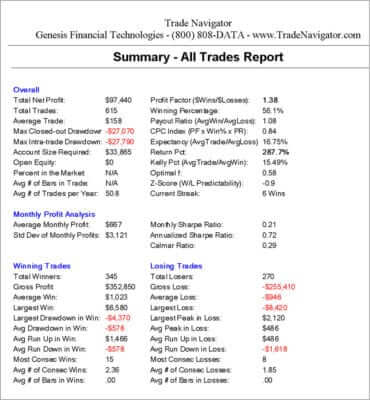

Is Gold Rush Friday really profitable? In the analysis, we proceeded as follows: a long position was opened every Friday at market opening and closed again at the end of the same day. No stops or filters were used. The evaluation period covers Jan 2008 to Feb 2020.

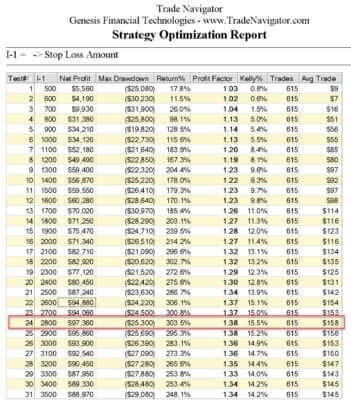

The use of a stop loss

As shown in the following table, the use of a stop loss of $2,800 resulted in a reduction of the maximum loss trade from -$8,420 to -$2,800 and the drawdown from -$27,000 to -$25,300, while almost maintaining the same profit of $97,360.

Does it make sense to hold the position over the weekend?

Next, we want to clarify whether it makes sense to hold the position over the weekend. To do this, we will do a simple test. We will buy on Friday at market close and sell on Monday at market opening.

As can be seen from the statistics, the profit per trade is +$32. Therefore, one earns +$32 more per trade if one exits the market at market opening on Monday. However, upon closer examination it can be seen that the capital curve does not look stable. From 2014 to mid-2019, it would have been more profitable to exit the market at market closing on Friday instead of keeping it over the weekend.

The gap risk can be inferred from the largest loss and gain. Since gold is considered a safe haven and something often happens over the weekend, the gap advantage is greater than the gap disadvantage. This is also confirmed by the largest gain, which stands at +$1,740 compared to the largest loss of -$1,070.

Stay tuned!

The information in this article should not be understood as a finished system! We are only sharing our observations and ideas.

Curious to learn more?

Get your hands on Max Schulz’s book by downloading it today! Free of charge.