3 Swing trading strategies for professionals and very busy people

You want to trade the world's financial markets successfully, but you have the problem that your job restricts your time, and your family environment and leisure activities also set time limits. You can't just check your positions or open new ones.

Swing trading is a trading style that allows you to trade successfully alongside your job with little time investment. You still have time for your job, your family, and your free time activities. At the same time, you use trading strategies that work.

1. Swing trading compared with other trading styles

Swing trading is different from day trading, scalping and investing. The main difference between these approaches is the timeframe in which you trade and how long you hold a position.

1.1. Swing Trading

In swing trading, a medium time frame is used. This trading style is based on the daily chart, whereby only the closing prices of the day (End-Of-Day, EOD) are interesting. A swing trader holds a position for a few days and in exceptional cases for 2-3 weeks.

In swing trading, only the end-of-day prices, which are published once a day after the market closes, are important. This means that positions are checked, adjusted or parameters changed once a day.

Swing traders protect themselves against sudden price explosions in the other direction with money risk management. This avoids large losses.

1.2. Swing Trading vs Investing

Investing involves trading a financial asset over a longer period. This "buy-and-hold" strategy is especially common in the stock and bond markets.

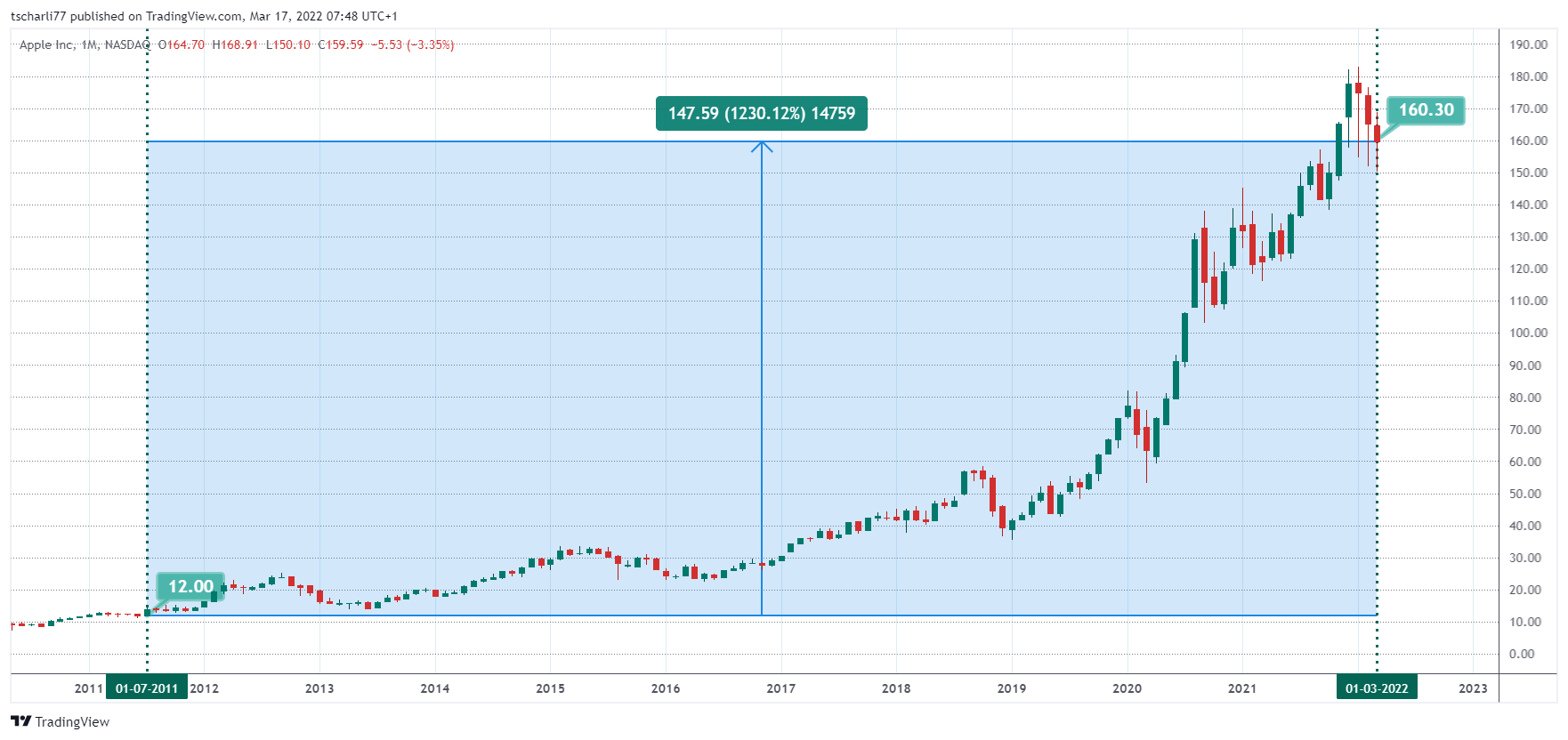

Figure 2: Apple share 2011-2022 - Apple share price performance 2011 to today: anyone who joined on 01.07.2011 at a price of $12.00 per share can look forward to a whopping 1230.12% gain on 01.03.2022 - despite a small setback.

The financial markets hardly need to be observed. Only drastic events (such as the current war in Ukraine) require increased attention with this strategy - and possible need for action.

1.3. Swing Trading vs Day Trading

Day trading is short-term trading. A day trade is short and financial assets are only held for a few hours. It is bought and sold within one day. Holding a position overnight is an exception.

1.4. Swing Trading vs Scalping

Scalp trading is even more extreme: Trades are only held for minutes. A scalper trades on short-term price explosions such as those that occur in the decisive minutes before the publication of a relevant economic report, a company announcement or political news.

While the day trader uses the hourly or even the 30-minute chart, the scalper looks at the 1-minute chart or, in extreme cases, the order book.

The following table provides a comparison of the three basic approaches.

| Scalping | Day trading | Swing trading | |

|---|---|---|---|

| Holding period | Seconds to a few minutes | Minutes, few hours, no positions overnight | A few days to a few weeks |

| Trading frequency | Very high, many trades per day | High, several Trades daily | Low, no "intraday" positions |

| Time required | Very high, permanent presence at the screen during peak trading hours | High, permanent presence at the screen during peak trading hours | Low, daily check of open positions & opening of new positions according to end-of-day data, 20-30 minutes daily. |

| Mental load | Very high | Relatively high | Low |

| Profit margin/trade | Marginal | Low | Can be relatively high |

| Note | High position sizes necessary due to a high trading frequency with simultaneously low profit margins, thus increasing costs and risk | As no permanent presence at the screen is necessary, great attention must be paid to risk management | |

| Suitable for professionals | No | No | Yes |

2. What are the advantages of swing trading for professionals?

Those who choose day trading or scalping must be permanently present during trading hours and observe the markets on the computer. Traders who trade in this way are mentally challenged and under psychological strain.

The profit margins per trade are small, often in the range of a tenth to a hundredth of a cent. The consequence: correspondingly large positions are required in order to be able to book a profit at all after deducting fees and commissions. Day trading and scalping are not suitable for professionals.

Swing trading is less time-consuming, which is mainly limited to evenings when the stock exchanges close, and less mentally demanding than other trading styles such as scalping and day trading. Therefore, only swing trading is a viable and profitable trading strategy for professionals and busy people.

3. What are the risks of swing trading?

Swing traders do best to stay away from highly volatile market phases and illiquid markets.

3.1. High volatile market phases

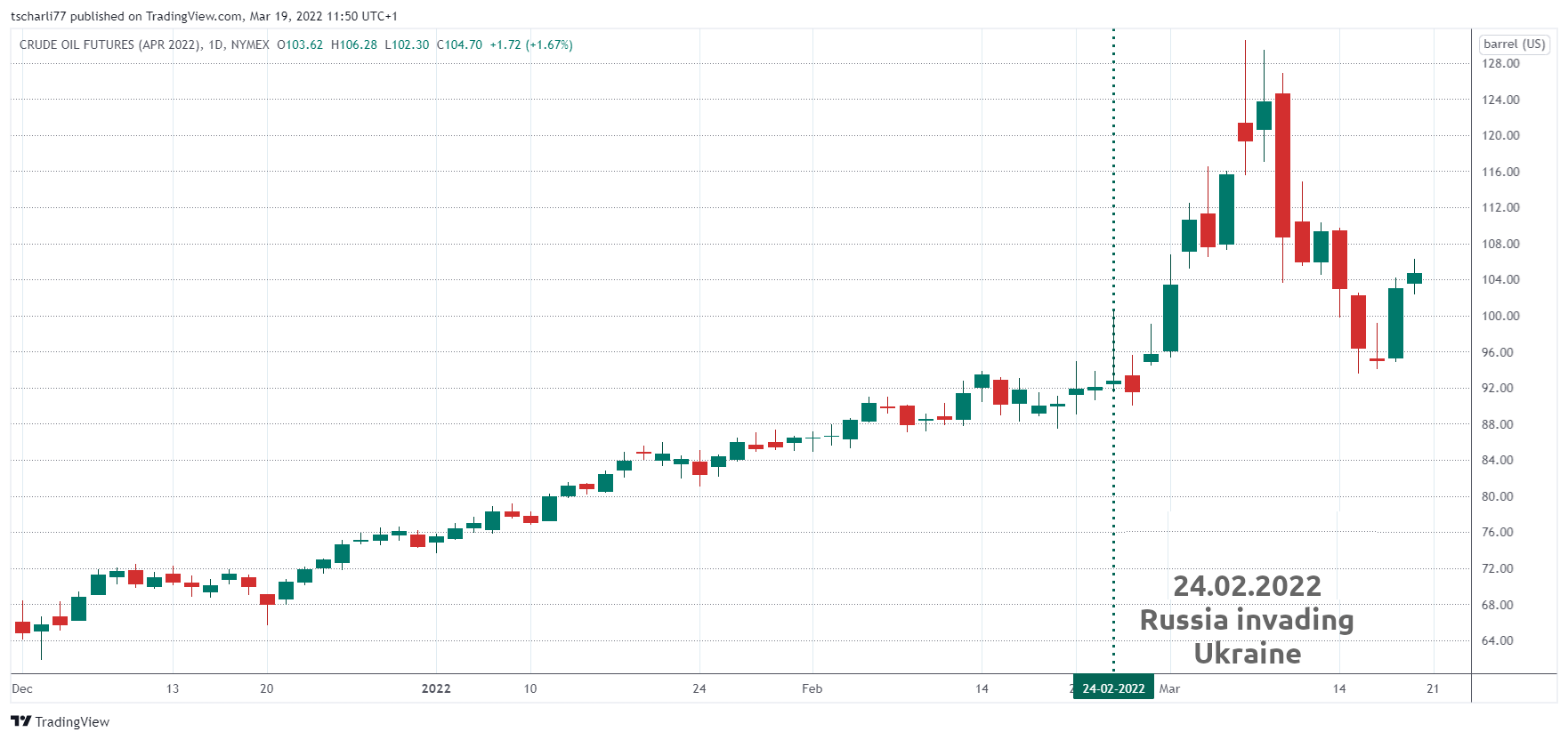

Markets or market phases in which the daily ranges show extreme spreads expose you to an increased risk of being stopped out of a position. Or they require stops so wide that your risk-reward ratio (CRV) becomes irresponsibly small.

Figure 4: CrudeOil CLJ22 - The Crude Oil Futures April22 (CLJ22), daily chart - on 24.02. Russia invaded Ukraine. As a result, the price exploded, only to crash just as abruptly. For the short-term and ultra-short-term trader, this can be a gold mine.

3.2. Illiquid markets

You avoid markets that very often show price gaps. A market that does not move for days is just as unsuitable as one that shows no movement at all for days and then opens with a huge gap. These markets cost you money.

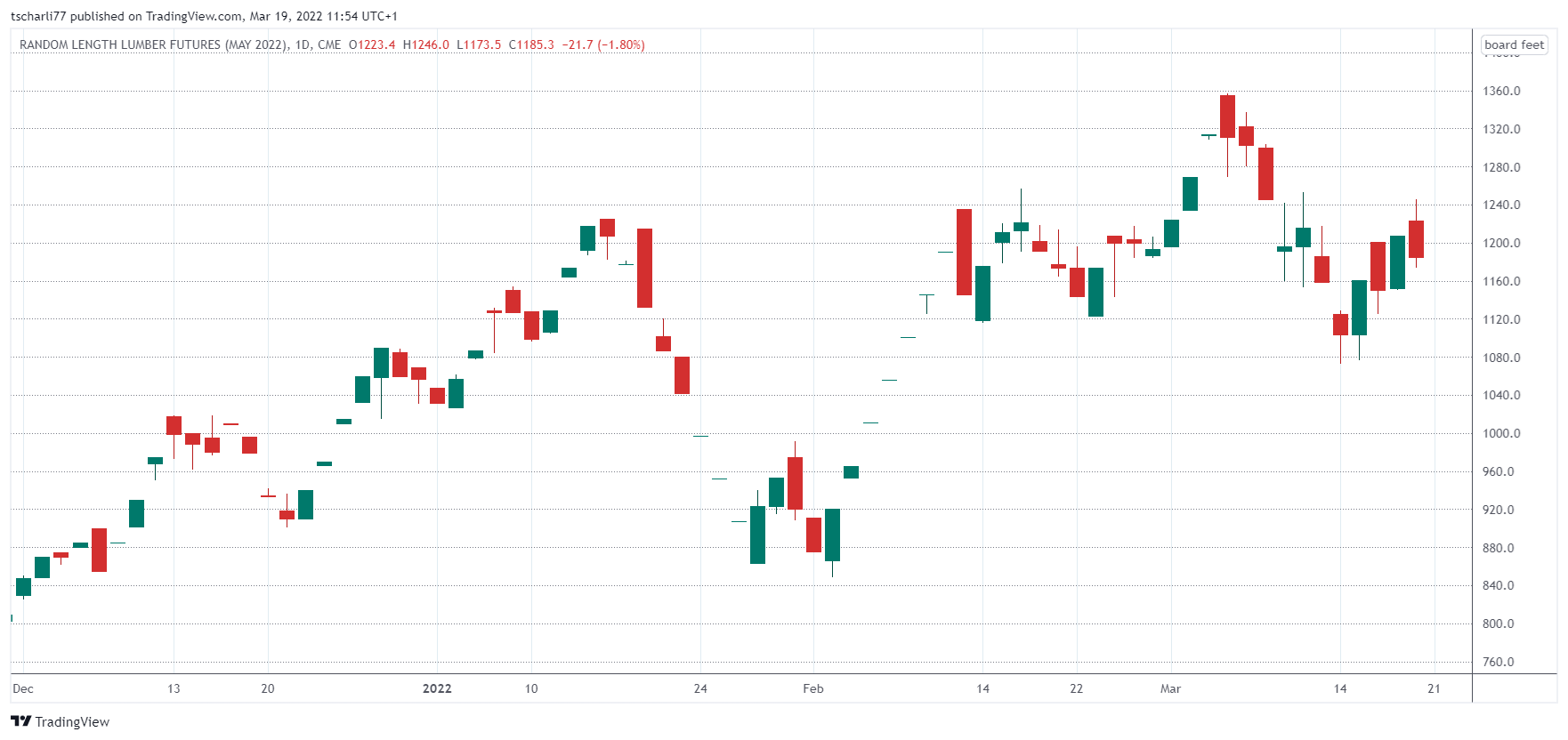

I'll give you another tip on how you can reduce your risk. Look at the charts of the markets over a longer period (3-6 months) and the seasonal trends of the prices. Decide on the markets and market phases in which the risk remains within manageable limits.

4. Which markets are suitable for swing trading?

Swing trading is suitable for every market and every financial asset. You can trade stock indices (DAX, S&P500), ETFs or CFDs as well as currencies/FOREX or futures.

5. Which trading strategies do you use to start swing trading?

5.1. Trend trading strategy - trade in trend direction

Analysis of the trend on the weekly chart and determination of the trading direction

The trend trading strategy is suitable for all financial products and all markets. If you use this strategy, you can choose, for example, forex swing trading, ETF swing trading, swing trading with shares or futures swing trading.

The trend is first analysed on the weekly chart. On the weekly chart you determine the trend direction: is it an uptrend or a downtrend.

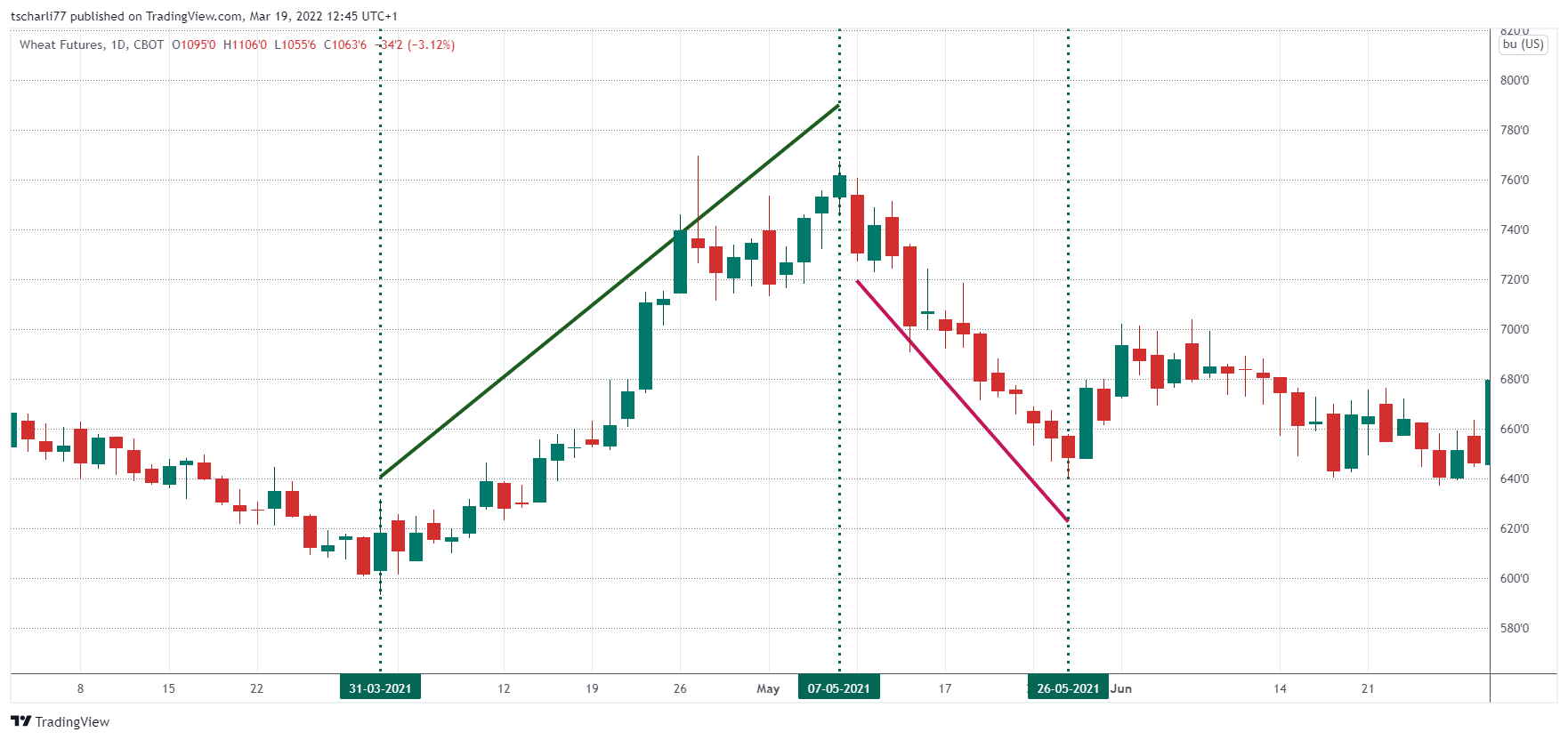

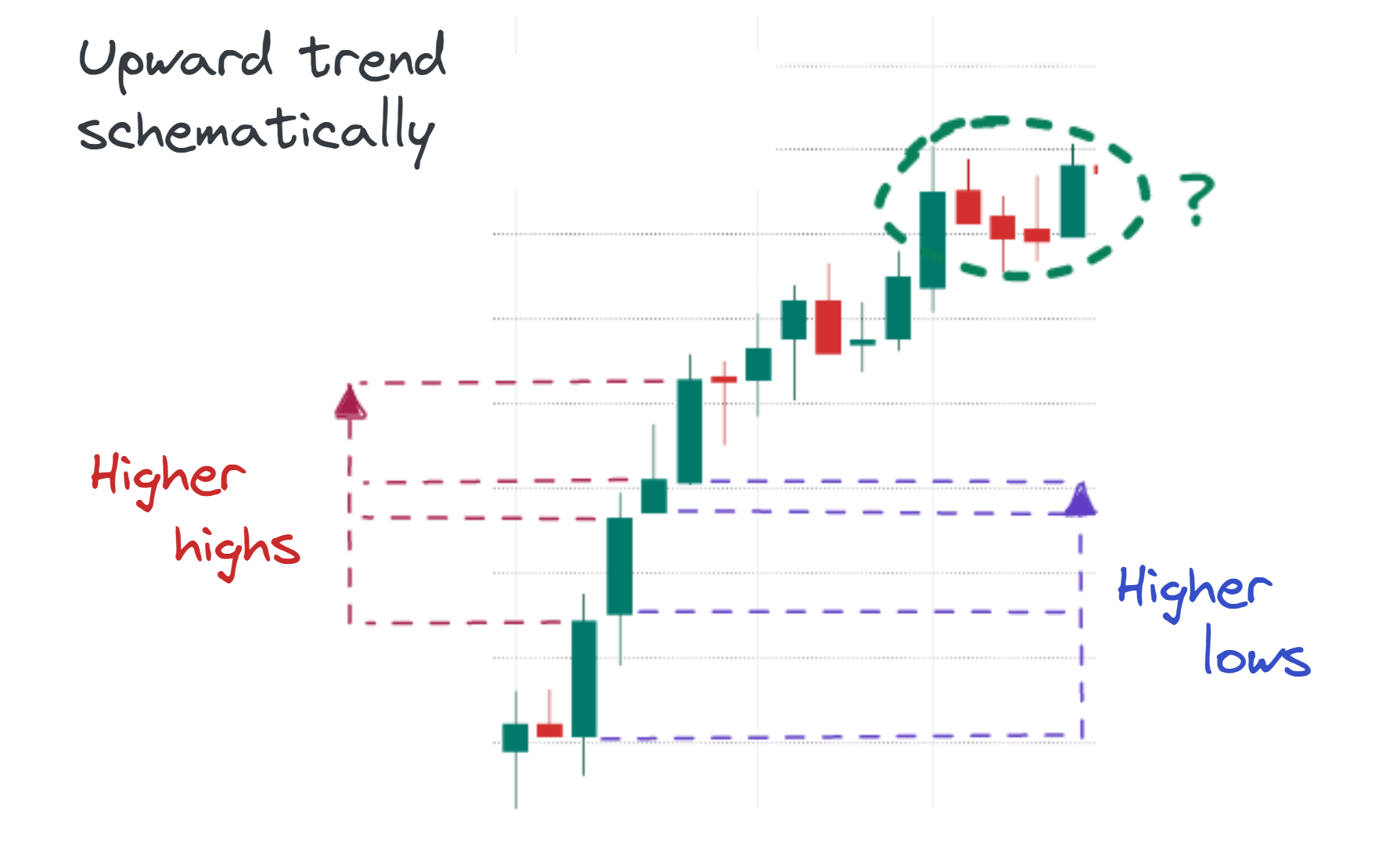

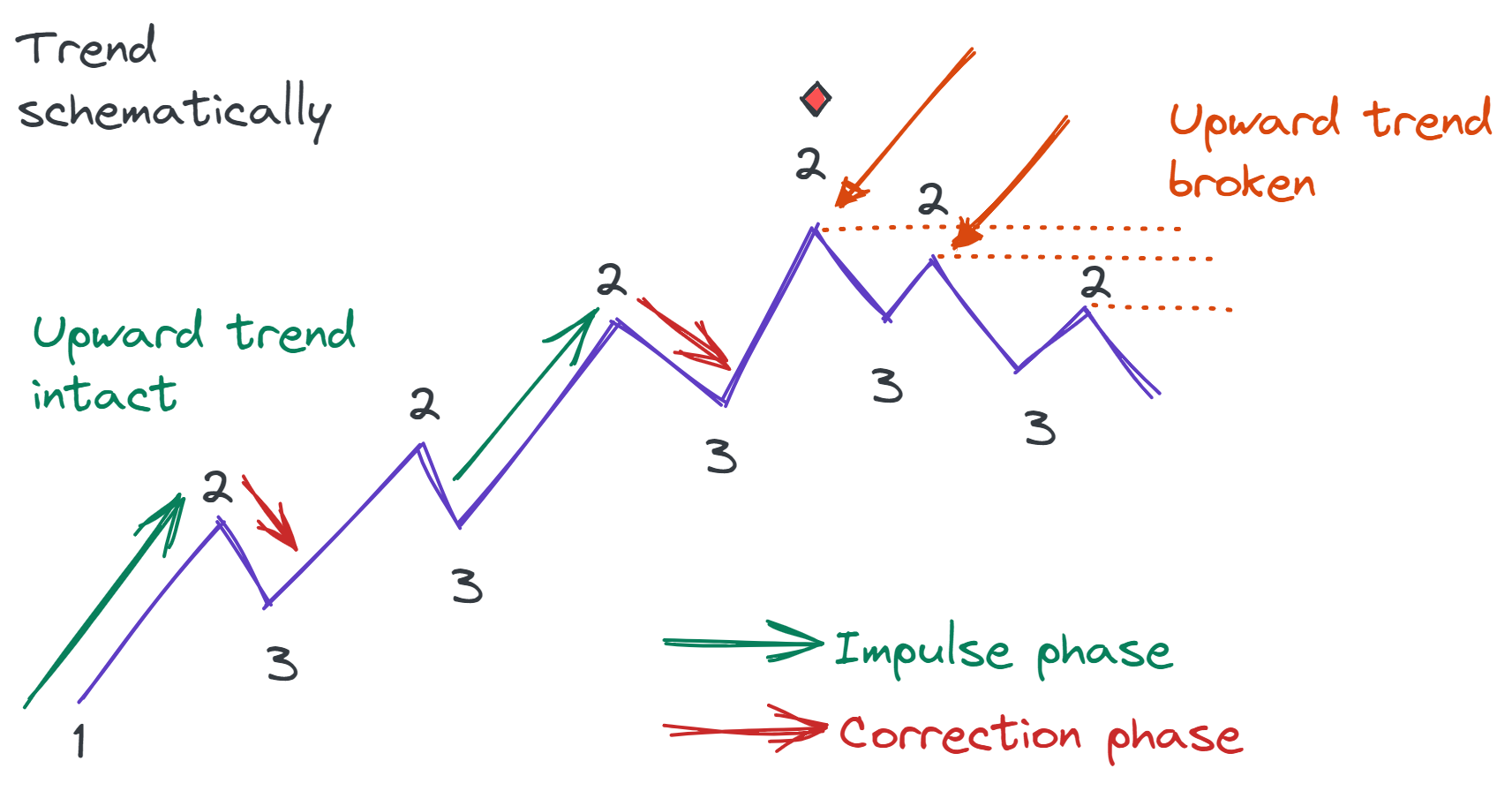

A trend is formed when the price moves in one direction, i.e. the chain of candles rises or falls. More precisely formulated: a price forms a trend when higher swing highs and higher swing lows (= upward trend) or lower swing highs and lower swing lows (= downward trend) follow one another.

The trend runs in a zig-zag line. A swing high follows one or more swing lows and vice versa. For example, if a swing high is higher than the previous high, an upward trend is created. If this is not the case, a trend change may occur.

Analysis of the trend on the daily chart and determination of the entry point

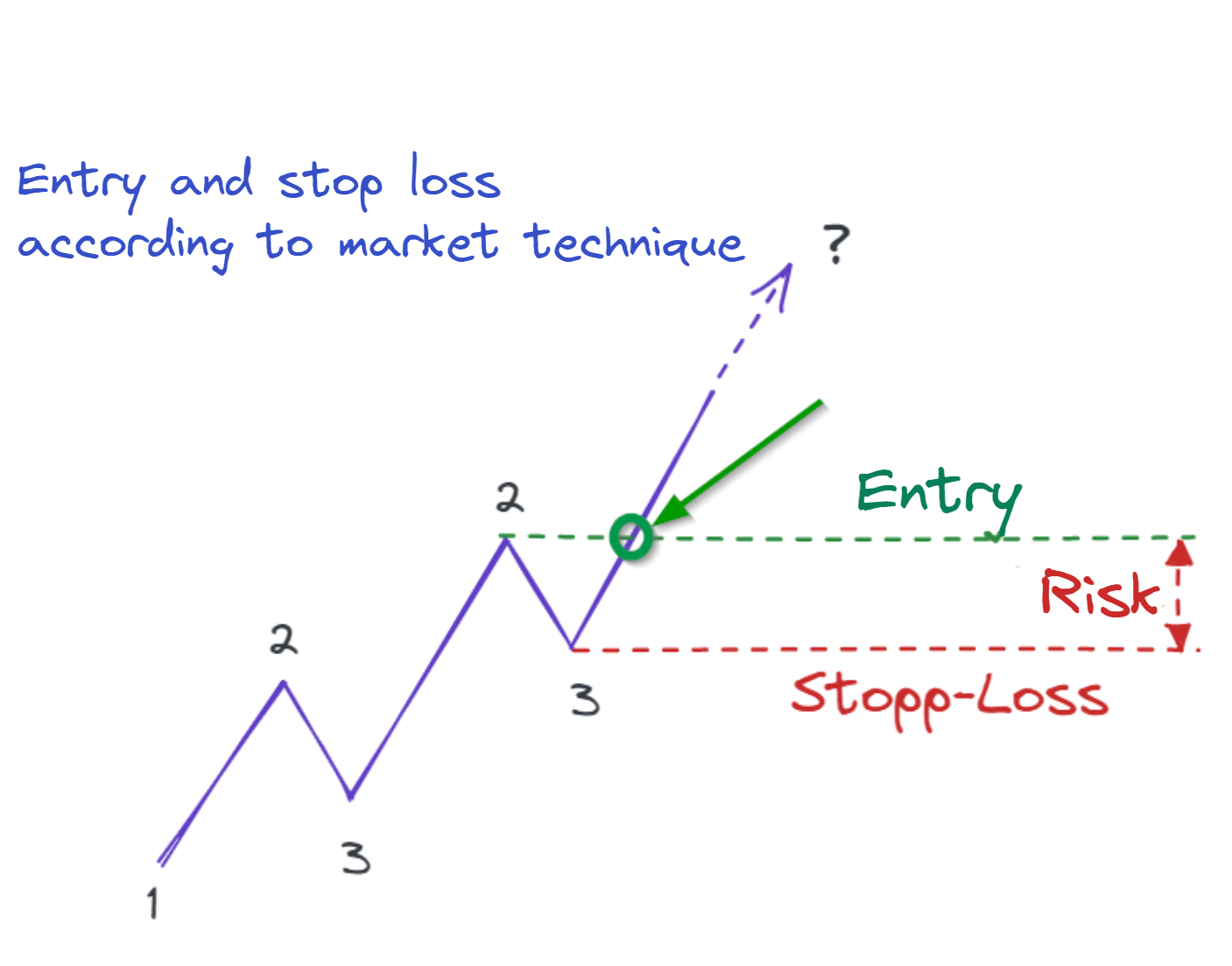

If an uptrend is visible, it is crucial how the price behaves after it has fallen. If the price rises and exceeds the level of the previous swing high, you can enter, as you can assume that the price will continue to rise. This is how you trade in the direction of the trend.

You determine this entry on the daily chart. If the price rises after a swing low, you place an entry order in the market. To open a position, you use a stop order.

You can place this stop order the day before. If the price exceeds the value the next day, your order is executed. If not, it remains in the market or is automatically cancelled, depending on the order.

If the price falls instead of exceeding the level of the previous swing high, you have the option of hedging with a stop-loss order. This stop-loss order is set at the level of the previous swing low. This reduces your risk should the price actually fall further.

5.2. Range trading strategy – Trading range markets

In the range trading strategy, range markets are analysed. These occur mainly with currencies and commodities. Stocks and etf's are rarely range markets. If you use this strategy, you can choose between futures swing trading and forex swing trading.

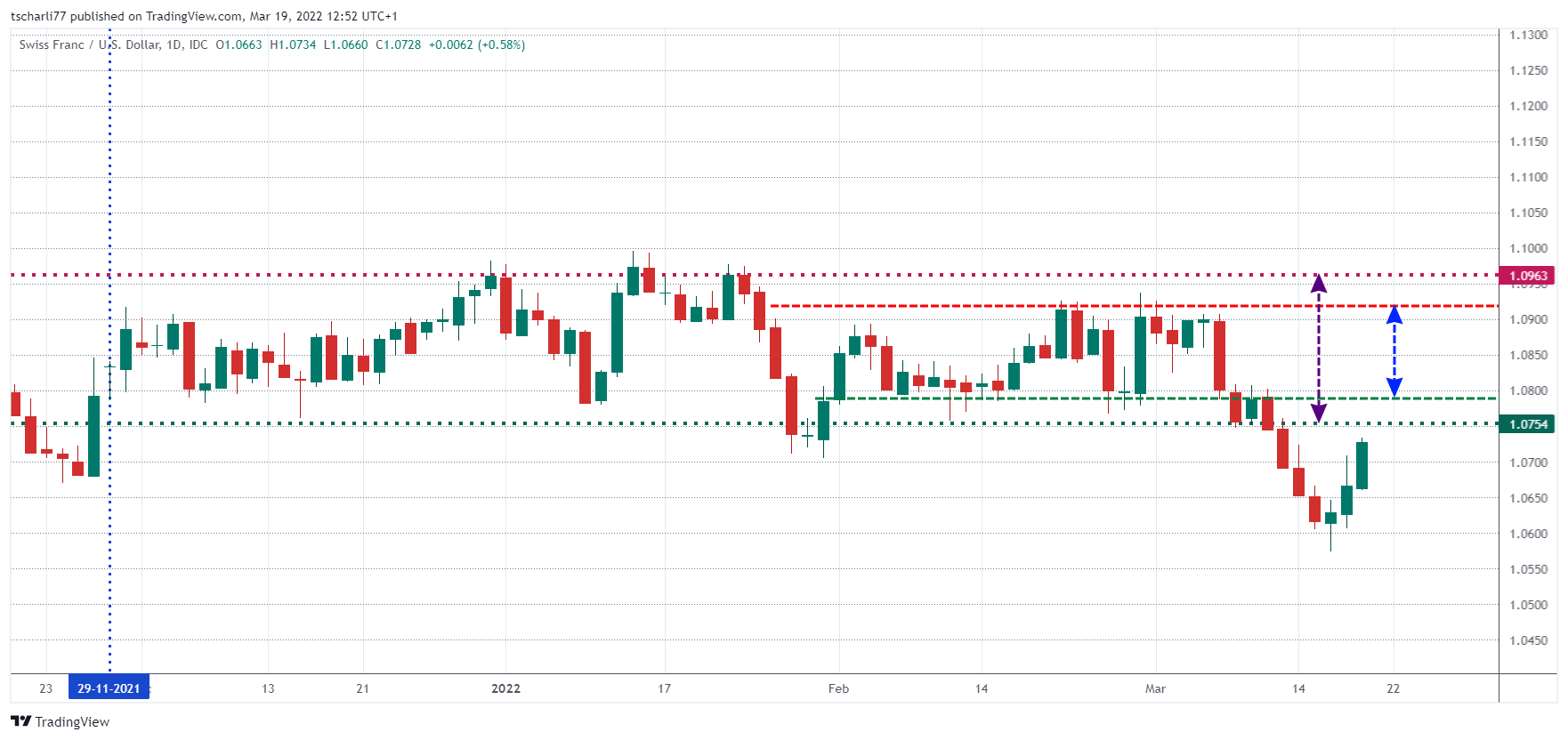

Figure 10: CHF-USD - The CHF-USD currency pair has been moving in a range since December 2021, the upper and lower limits of which have been tested several times.

Identifying limits

If you recognise that the market is moving in a range, you determine the upper limit of this range (resistance) and its lower limit (support). If the price now moves upwards towards the resistance, you can open a short position at this level.

Opening positions with a stop-limit sell order

You then open this position with a stop-limit sell order. The limit protects your position upwards if the price actually breaks out of the range and enters an upward trend.

In order to trade range markets profitably, other confirming factors can be taken into account. These include COT data, but there is one fact that must be taken into account:

COT data are published on a weekly basis. Since range markets sometimes have a much shorter "frequency", these data can often only serve as a fundamental basis for the overall characteristics of the market.

As already mentioned: Trading range markets requires experience. If you are new to trading, you can easily "burn your fingers".

Conclusion from trend trading strategy and range trading strategy:

These two strategies are part of the basic toolkit of every trader. However, they are based exclusively on technical analysis. However, if you want to trade successfully in the long term, you need to include fundamental analysis in your "toolbox" in addition to technical analysis.

The following trading strategy uses this fundamental analysis!

6. COT report trading – Trading according to COT data

This trading strategy is only suitable for futures swing trading. You trade the futures market, which includes indices, commodities, bonds and currencies. Trading futures is particularly interesting for professionals, as the futures market has advantages over other markets such as stock markets or bond markets:

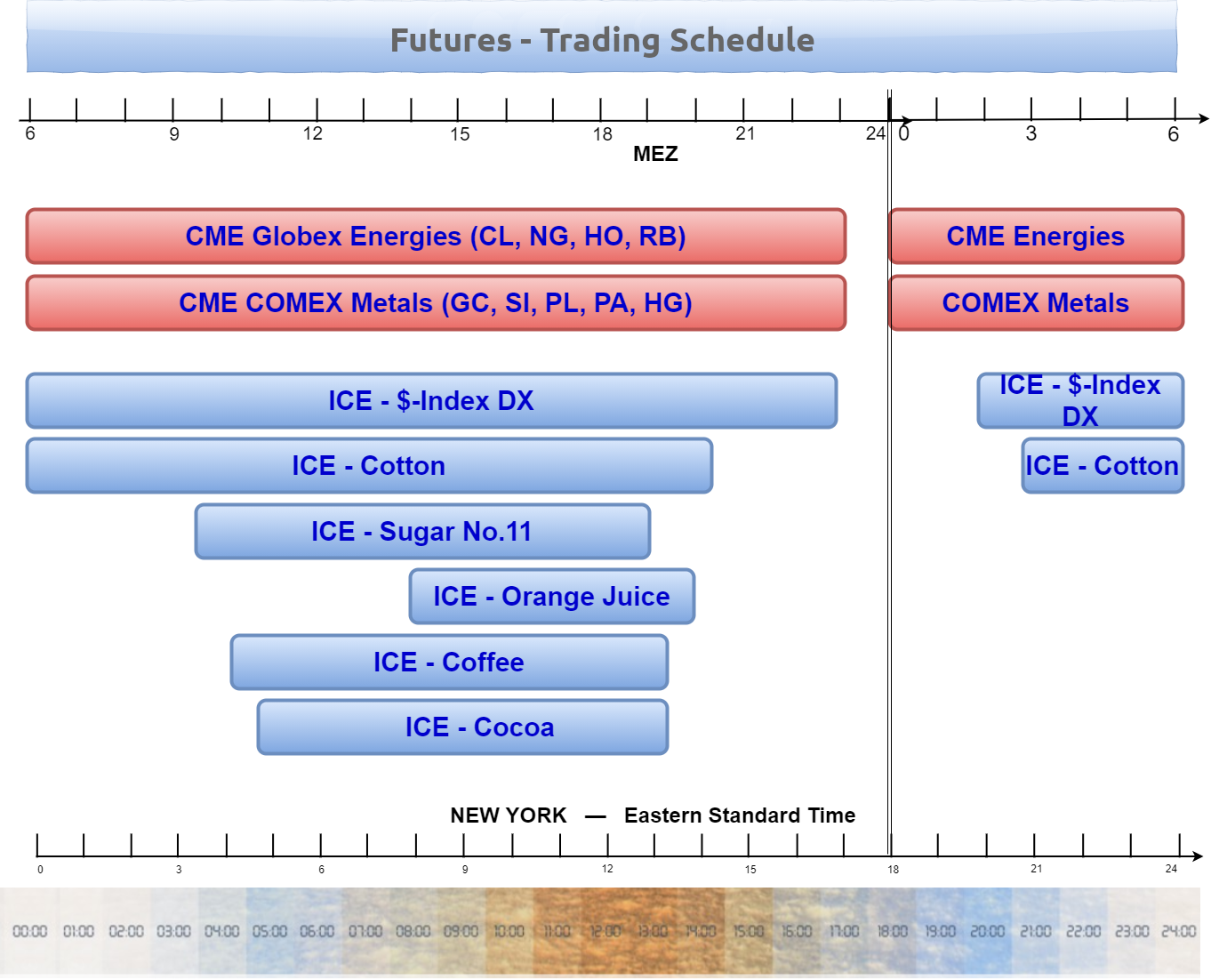

The times when you trade are in the evening hours, as the important futures exchanges are in New York and Chicago. When the exchanges close in New York and Chicago, it is late evening in Germany.

You can plan your swing trades at the weekend because you can use the COT report as a basis for your trading. During the week, you need about 20 minutes per day to enter orders, monitor markets and check your open positions.

Analyse COT data at the weekend

COT data is the positioning of the major market participants, i.e. producers or processors (commercials) as well as large speculators, hedge funds, banks or financial traders (non-commercials). These data are listed in the freely available COT report. The Commitments of Traders Report (COT Report) is published every week on Friday.

In order to be able to read the data of the COT Report correctly, they are displayed graphically. Our COT data chart helps you to understand the COT data. You evaluate the current COT data on the weekly chart at the weekend, which takes no more than two hours after a little practice. You plan your trades for the following week, determine which markets you will observe and under which conditions you will enter this market.

In the evaluation of the COT data, the aim is to find buy or sell signals. These signals are the basis for further trading decisions.

Examine timing

During the week, you examine the timing on the daily chart, i.e. the best time to enter the market. You trade with the trend and enter, for example, when the price exceeds the last swing high (see Trading with the trend). You determine the stop and the trading target.

Risk money management

COT report trading also includes money risk management. You determine your risk depending on how big your account is and what risk you want to take.

Manage the trade

You have entered the trade and defined your risk. From now on you manage the trade. This means that you may move the stop or wait for the price target.

7. Summary

Let me summarise the key points for you:

- Swing trading is the only trading approach that allows you as a professional to trade part-time and profitably at the same time: the focus on end-of-day data allows you to reduce your time burden during the week to a minimum.

- Trading the futures markets gives you an essential fundamental information advantage: the weekly COT report shows how the real market-determining forces are behaving and allows you to align your trades accordingly.

- The weekly publication of the report in turn allows you to standardise your workflow: the weekend is used to plan the following trading week, your task during the week is limited to controlling and adjusting your positions.

- The COT report strategy is a robust and profitable trading strategy.

You want to learn futures trading and trade the markets as a swing trader, then check out our trading education!

Thank you for your interest!

Curious to learn more?

Get your hands on Max Schulz’s book by downloading it today! Free of charge.