Trading psychology - your professional trading mindset

The trader‘s battle with the market

"The market is out to get me! He wants to break me! But he won't succeed! I will beat the market!"

Surely you've heard these or similar phrases before. Or even used them yourself? When you hear these statements, you think a trader is in a constant battle with the market.

Is that really the case? And if so, how can you change that? In this post, I will analyze what psychological traps lurk in the market and how to prepare your mindset for them.

The trader in the field of tension

As a trader you are in a constant field of tension between the internal and external influences that affect you.

The inner influences are your psyche, i.e. your EGO. It is your emotions that determine your actions. Your perceptions of the world, beliefs and thought models. These influences prevent you from becoming successful.

You try to get them under control. You can do this with a sufficient amount of discipline. However, you can only develop discipline if you know what you are lacking. So you need the necessary self-knowledge from which you can work on your behavior.

And for this it is necessary to observe yourself. You become an explorer of your own self.

On the other hand, there is the external framework of trading: the market. That is, the price development of your traded financial instrument or commodity.

This is determined by the interaction of supply and demand. To understand the price development, you have to understand what determines the supply and demand of your trading object.

And you have to include another, very important aspect in your calculation:

The price on the stock exchange is not only influenced by real supply and demand. The price is much more intensively influenced by the behavior of traders, the masses of market participants.

An accidentally or deliberately spread rumor about a failed harvest in soy or a production shortage in oil can cause the price to shoot up or down without any real change having occurred.

Gustave Le Bon wrote what is probably the most important book on the market about this back in 1895: Psychology of the Masses ① . We are also dealing with this in the stock market.

The trader in conflict with the market

So the trader is in a dichotomy with the market. He wants one thing, but the market delivers something else instead, something completely different!

Who is surprised that a trader sees the market as hostile?

A first step out of this dilemma is to change your view of the market.

"THE MARKET" is not your enemy who wants to do you "bad", wants to see you devastated. "The market" doesn't care about you at all! He doesn't even know that you exist!

I found a very impressive illustration of how you should look at the market by Alexander Elder in his book "Trading for a Living" ②:

The Market as OCEAN

A few quotes from the introductory chapter of this book ...

The market is like an ocean - it rises and falls regardless of what you want it to do. The tide does not ebb and flow according to what we would like it to be. ... One may feel joy, ... One may melt into fear, ... these feelings have nothing to do with the market - they exist only within oneself. After all, the market does not know that we exist. There is nothing you can do to influence it.

The ocean doesn't care about a person's well-being, but it's not out to harm them either. The only thing you can control is your own behavior.The market constantly goes through its cycles, up and down, like an ocean that goes through storms and lulls.

A sailor cannot control the ocean, but he can control himself. He can study currents and weather patterns, learn proper seafaring techniques, and gain experience. He can learn when to sail and when to stay in port. A successful sailor uses his intelligence.

Dr. Alexander Elder: Trading for a Living

What does this mean for the trader?

Adapt your idea of trading to the reality of the market

You need to rethink your idea of trading on the stock market.

The goal of every trader is, of course, to make a profit. And every trader hopes and expects that this profit will be easy to earn.

An inexperienced novice believes the statements and promises of marketing. He sees the colorful pictures on the Internet with the successful traders in their Lamborghini, on their yacht, surrounded by beautiful girls.

But if trading were SO easy, the Lambo drivers would have real parking problems!

I want to show you a few points of view here, which will be very demotivating at first sight! But only if you are fully aware of these facts, you will be able to go your way towards success.

► Review your goals and expectations.

If you enter the market with the goal of generating consistent profits, you will quickly become disappointed and frustrated. Especially for the beginner, the primary goal must be market survival!

And unrealistic expectations are the companion twin of the obsession to make profits. You expect a minimum profit margin that fails to materialize. You start trading too much and taking too much risk.

High expectations are often accompanied by high losses!

► Accept that the market cannot be predicted.

The market is a game of probabilities.

It gives you clues about its future performance, but no guarantees. As a trader, you must recognize these clues, but you must be prepared for the fact that things may turn out differently in the end.

► Be aware that losses are inevitable.

Every trader loses! Over and over again. The most successful trader is not the one who makes the most profit, but the one who suffers the least loss. And that permanently.

The successful trader plans his loss. He accepts it and does not panic when it actually occurs.

► Look at your markets

- Markets are not completely predictable. What has worked in the past does not necessarily work now.

- Intensive study of a market is a basic prerequisite for trading in that market. It is not a guarantee for success.

- A critical examination of the current market situation is necessary for survival, despite all the tools of technical analysis.

- Markets can be influenced by unpredictable events

or

- by predictable ones, but whose timing and intensity of occurrence can be uncertain.

Note

Now here comes the most important slide. Write this sentence on cardboard with a thick Sharpie and hang it next to your desk!

You can't predict your profits, but you can pinpoint your maximum possible losses.

Don't focus on maximizing your profits, focus on minimizing your losses.

But how do you do that?

The "secret" behind it is called risk and money management.

Manage your risk

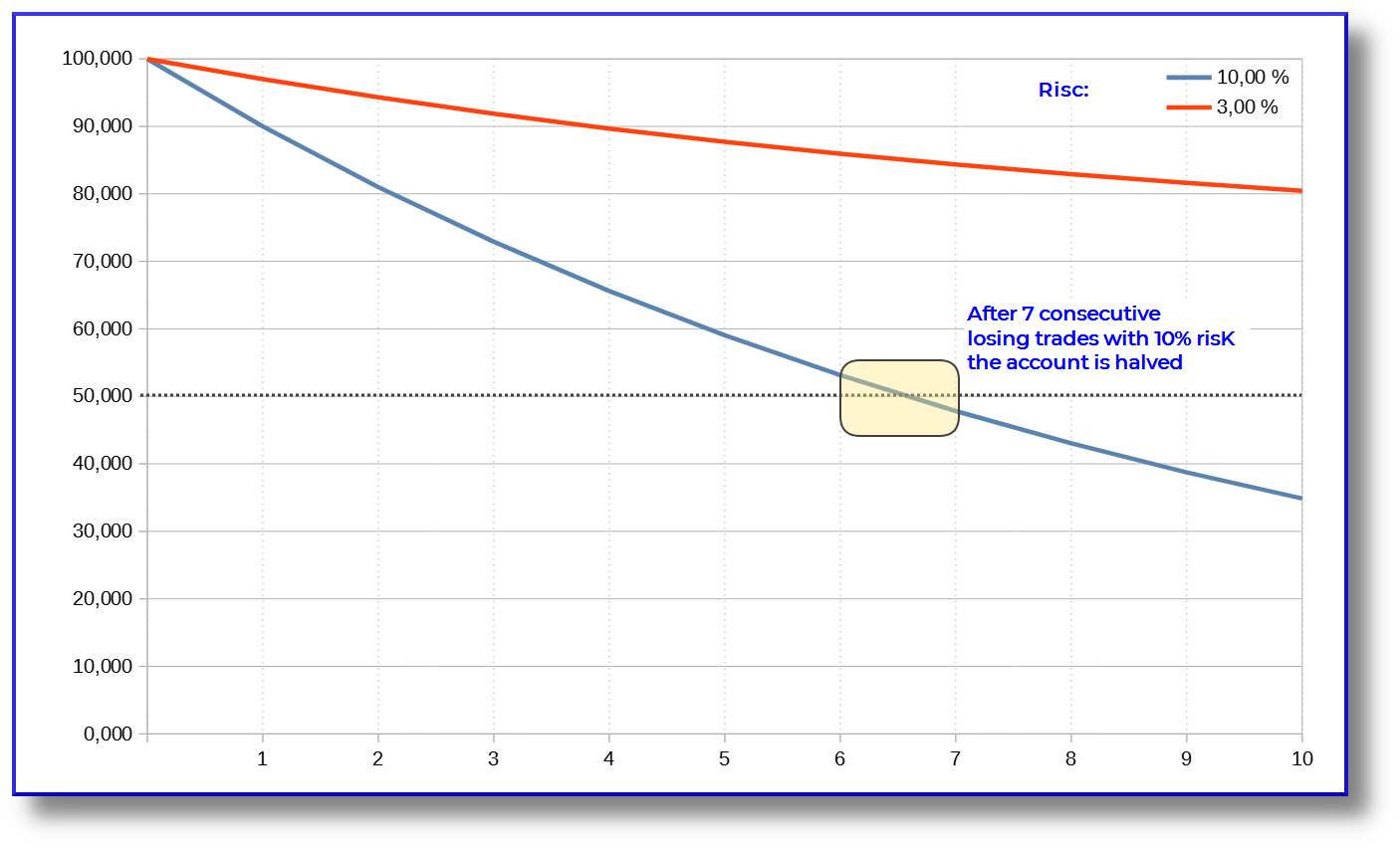

Your most important task in trading is to protect your capital!

You must determine from the outset what percentage of your available capital you can risk.

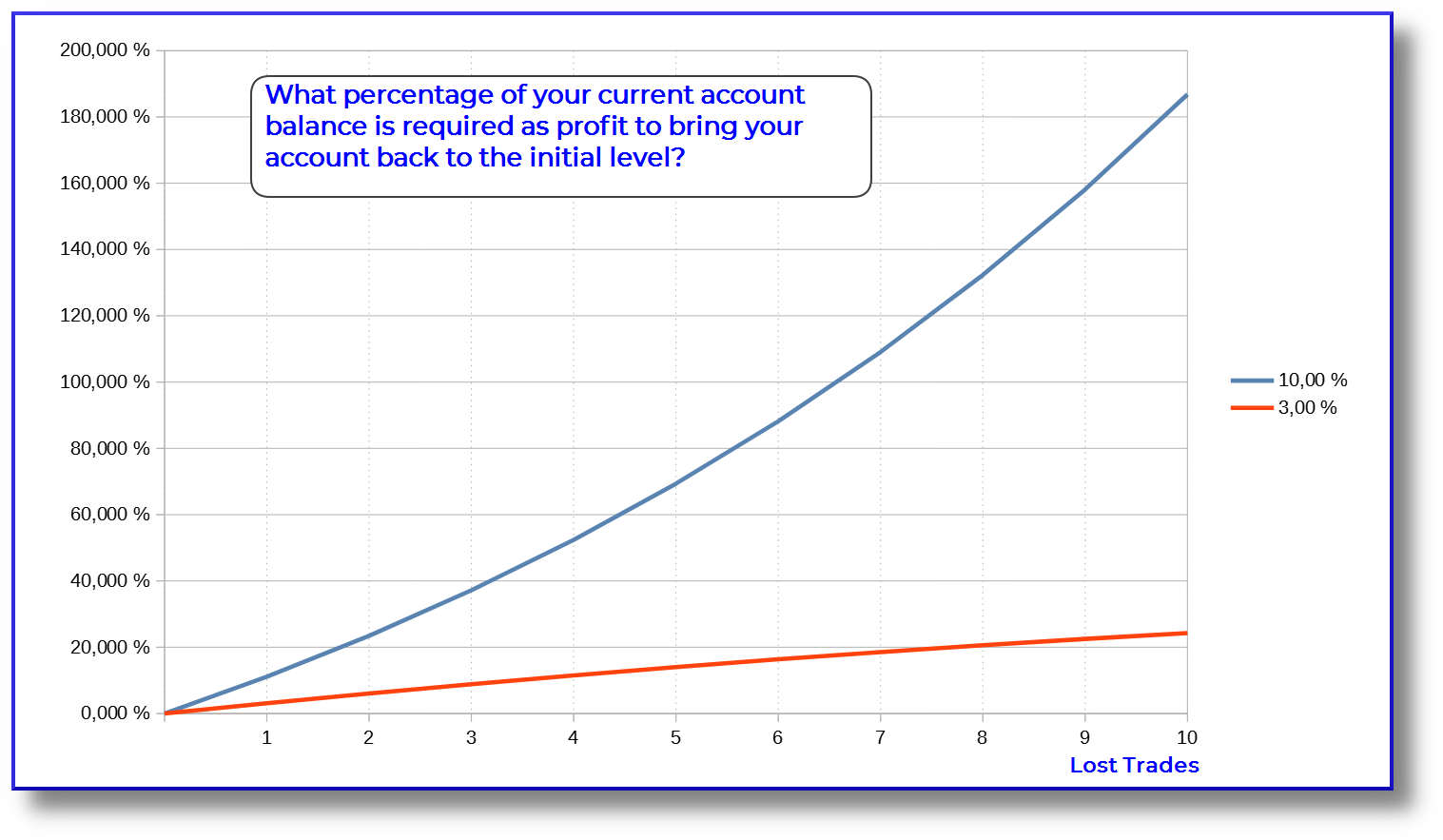

You must also realize that losing trades are rarely loners. They tend to appear in packs and often bring a few buddies with them.

With each losing trade, your capital cover decreases. OKAY - that's nothing new, you would have figured that out without my help, right?

Fig.3: The development of the trading account after successive losing trades at 10% risk and 3% risk.

But what does it mean? It means

- The capital you can risk in the next trade is smaller

- The capital you need to make up for that loss is growing

The urge to "revenge trades" - those "Now I'll show the market, I'll get the money back" - actions often lead to a total crash!

Here you can see how many percent of your remaining capital after X losing trades are necessary to replenish your account to the initial level.

And here's another saying to pin next to your trading desk:

Manage your risk, but HOW?

And how is that supposed to work now, this "risk management"?

- Determine your maximum risk: What is the maximum percentage of your capital you can risk per trade?

- Determine BEFORE each trade the risk associated with the planned position.

- If this risk exceeds your defined maximum LEAVE THE TRADE !

- Make sure that your actual loss CANNOT EXCEED this defined risk!

The only way to achieve this: Use a stop loss.

Setting your stop loss can be done in different ways. The most common is to set it according to market technique. On our website you can find articles ③.

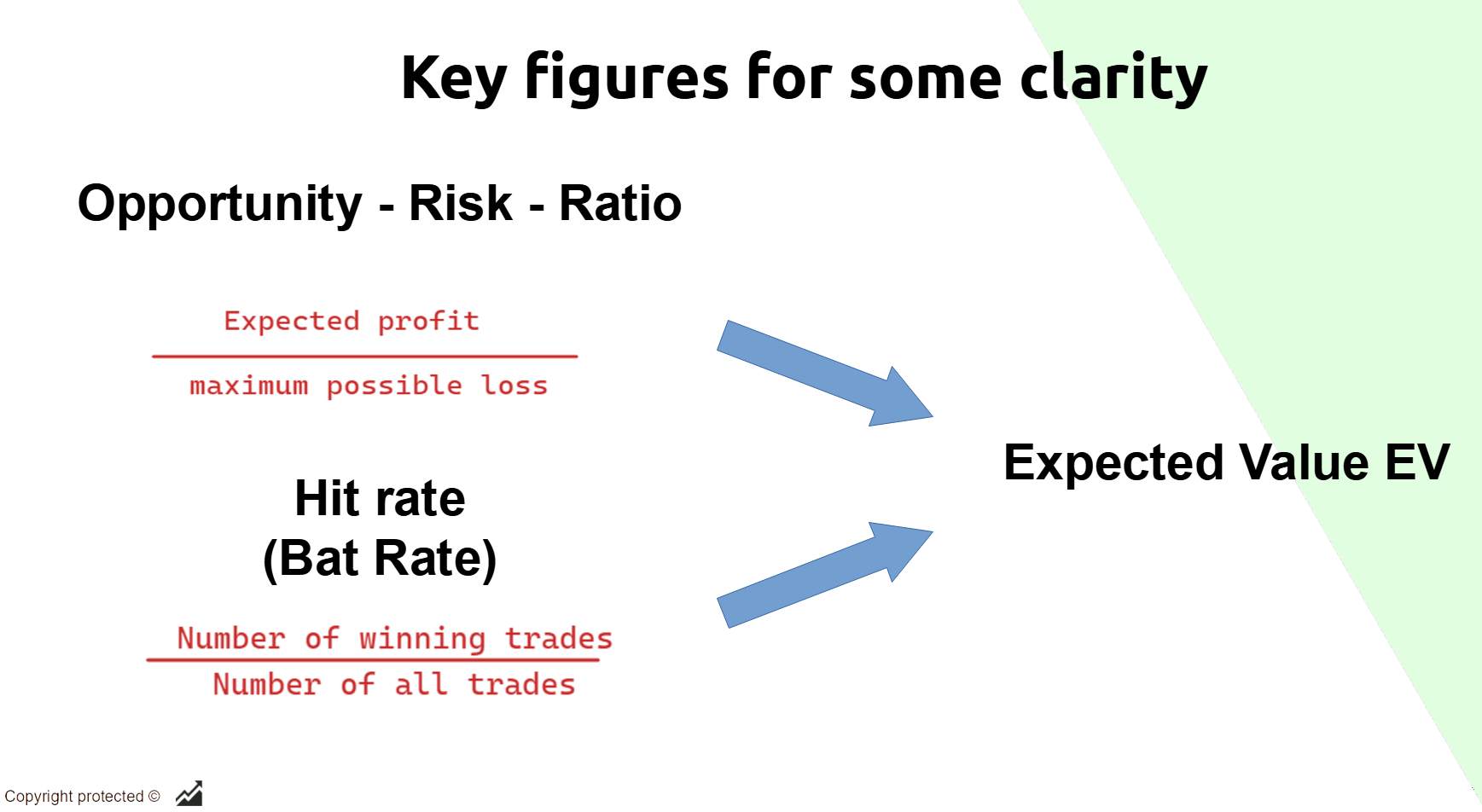

Key figures that can give you some clarity

In your trading preparation, be sure to determine the following metrics. They will give you some insight into the probability of achieving your desired result.

① The risk-reward ratio ("CRV").

The CRV is simply the quotient of your hoped-for profit and your maximum expected loss.

After you have planned your market entry, you determine the maximum risk using a strategically sensible stop loss.

Then you set your trading target. Like your stop loss, your target can be determined in different ways: here, too, a market-technical approach is recommended.

You put these two values in relation to each other.

If you expect a profit of 1500 with a maximum risk of 1000 then you have a CRV of 1.5:1.

STAY AWAY FROM TRADES WITH CRV BELOW 1 !

② The hit (Bat) ratio.

It is the ratio of your winning trades to the total number of all trades.

Of course, the more trades you look at, the more meaningful this number becomes.

If you have 5 trades, one of which you won, you have a hit ratio of 0.2 (=20%). However, this value is not meaningful! If you have 300 trades, 140 of them won, things look better. Your hit rate is now 14/30 or 46.6%.

③ The Expected Value (EV)

From these two values, your expected value can now be determined: In 47% of all cases (i.e. in about half of your trades) you will win the desired 1500. And in the remaining cases you will lose 1000.

This can be summed up in a formula. The expected value is the hit rate for winning trades times the expected profit MINUS the hit rate for losing trades times the expected loss (where the hit rate for losing trades is equal to 1 MINUS the hit rate for winning trades).

Or:

Your expected value in the above example is

0.47 x 1500 - 0.53 x 1000 ═ 175

In other words, based on your statistical profit frequency and your profit expectation that you have budgeted for this setup, if you repeat this trade very often, you can credit a purely hypothetical profit of $175.

Granted, statistics and probability are not for everyone, but according to the "Law of Large Numbers" they come closer to reality than some success stories on the internet.

Above all, they give you a tool to estimate your chances more accurately than with "PI times thumb" and gut feeling.

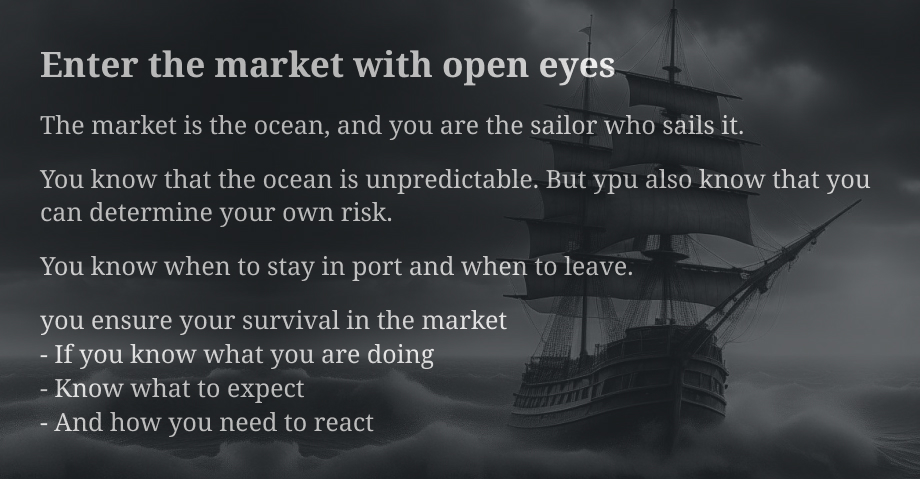

Enter the market with open eyes

These remarks are not intended to rob you of your motivation, but to open your eyes! As Alexander Elder writes:

The market is the ocean that you sail as a sailor. A good sailor knows the ocean, he knows that the ocean is often unpredictable. But he knows how to assess his own risk. And he knows when he can sail and when he has to stay in port.

Work on your emotional alignment and enter the market with open eyes and the necessary self-confidence. Know your emotions and keep them under control. Knowing what you are doing, what to expect in the market and how to react in certain situations will ensure your survival in the market.

Annotations:

- Gustave Le Bon (1841-1931): Psychologie der Massen, Erstausgabe 1895, © 2009 Nikol Verlagsgesellschaft mbH & Co. KG, Hamburg

- Dr. Alexander Elder: Trading for a Living, Wiley Finance, 1993

- insider-week.com: Grundprinzipien der Markttechnik – Teil 2: Stopps und Zeitrahmen

Stock Images are from Pixabay

Quotation Alexander Elder „Der Markt“

Back to Advent calendar