World Cup Trading Championships – a great success not once but twice

The Competition

The World Cup Trading Championships, hosted by the US-basedRobbins Financial Group LTD, are the unofficial world championships of forex and futures trading. The trading elite from all over the world meet here to compete for the number one spot and further coveted trophies.

The World Cup Trading Championships were established in 1983. They are held regularly and split into two categories: The World Cup Championship of Futures Trading® and The World Cup Championship of Forex Trading®. Other categories are offered, but on an irregular basis. The organizer, Robbins Financial Group LTD, invites traders from around the world to participate. And many traders accept this prestigious invitation. For a trader, it’s the ultimate opportunity to test his skills and earn the respect of the trading community.

The participants come from different countries spread over all continents. Some of the participants from the last few years include:

Sadanand Kalasabail, Australia

Kousuke, Japan

Petra Ilona Zacek, Czech Republic

Wayne Wan, Macau

Stefano Serafini, Italy

Yuwen Cao, Hong Kong

Max Schulz, Germany

Michael Cook, United Kingdom

Paige Williams, United States

Jan Smolen, Slovakia

The rules of participation are quite simple: each participant trades on his own account with his own money. The minimum deposit on the account is 5,000 for the FOREX event. There is no entry fee in either category. Traders can register at any time during the entire contest period, which runs from January 1 to December 31 each year.

There are no rules relating to which system, trading approach or strategy a trader can use. You will find day traders, swing traders or traders who hold their positions for weeks and months all taking part in the competition. Some use discretionary methods, while others enter the market automatically using computer systems. Every single trader has the same, single goal: to achieve the highest possible net profit by the end of the competition. The only rule to bear in mind is that at least 10 “round turn” trades of any amount must be made in order to qualify for a price.

What prizes are up for grabs?

- The top three each receive a coveted “Bull and Bear” trophy

- All competitors benefit from international recognition through press releases, interviews and magazine articles

- Finally, and most lucratively, the opportunity to join the WorldCupAdvisor.com team of advisors

A position on the World Cup Advisory team can be a career-boosting opportunity. Top performances from the competition can become material for presenting live trading programs on the WorldCupAdvisor.com platform. Here, the public is offered the opportunity to make the same trades as the WCA Advisor on a monthly subscription basis.

Which result will earn you a trophy?

This can vary significantly from year to year. In 1987, Larry Williams won the competition in futures trading with an incredible net return of 11,376%. His initial investment of 1,137,000. This makes Larry Williams, the first futures trader to use the COT report as a basis for his trading, the undefeated champion.

On the other hand, a modest return of 53% was enough for David Cash to win the futures trading event in 2001. In the same year, Larry Jacobs emerged as the winner of the equity competition with a net profit of 3%.

You want to find out more? Visit the World Cup Trading Championships website. Find the actual standings here.

2017: My turn!

In 2017, my trading results were good, my trading account was growing and my profits were stable. Only the year before, I had quit my day job to earn my living as a professional future trader. I was trading a COT strategy that I had learned from Larry Williams.

Larry Williams was himself a participant in the World Cup Trading Championships. In 1987, his strategy won him the competition and an incredible 11,376% net return!His starting capital of 1,137,600; a figure that should last a long time.

By then, participating in the championships had been a dream of mine for a long time. Not only did I want to emulate my role model and teacher Larry Williams, I also wanted to show that good returns can be achieved through controlled risk and a rock-solid strategy. And I wanted to break out of my comfort zone, demonstrate my skills and compete with other top traders.

Here we go!

The participant’s stamina is put to the test even before the competition gets going. The registration process involves so much paperwork that it is advisable to start the registration formalities six weeks before the planned start date.

And then it really got going…

Right from the start, I caught a market phase that was not favorable and I immediately got into a drawdown that lasted eight weeks. It was not until the end of February that I managed to turn the situation around.

Due to my strict risk management, my small starting capital allowed me entry to trades with a maximum stop loss of 750 in the first three months, which meant that my account could only increase very slowly.

I knew that if I wanted to win, my account had to grow faster. But increasing the risk was not an option for me. After all, I am a trader and not a poker player. So I decided to integrate an additional trading system into my approach. This also allowed additional diversification, which reduced the fluctuation of my capital curve. And I got more trades at a reasonable risk.

I traded my plan consistently and, by the middle of the year, I had achieved 50% capital growth. Then, at the beginning of August, I made my first appearance in the top five with a net profit of 62% and, immediately afterwards, I made it onto third place for the first time.

I continued to stick to my plan in the period that followed. The account grew steadily without any major fluctuations, and on December 11, I was able to break the 100% return barrier. I had doubled my starting capital!

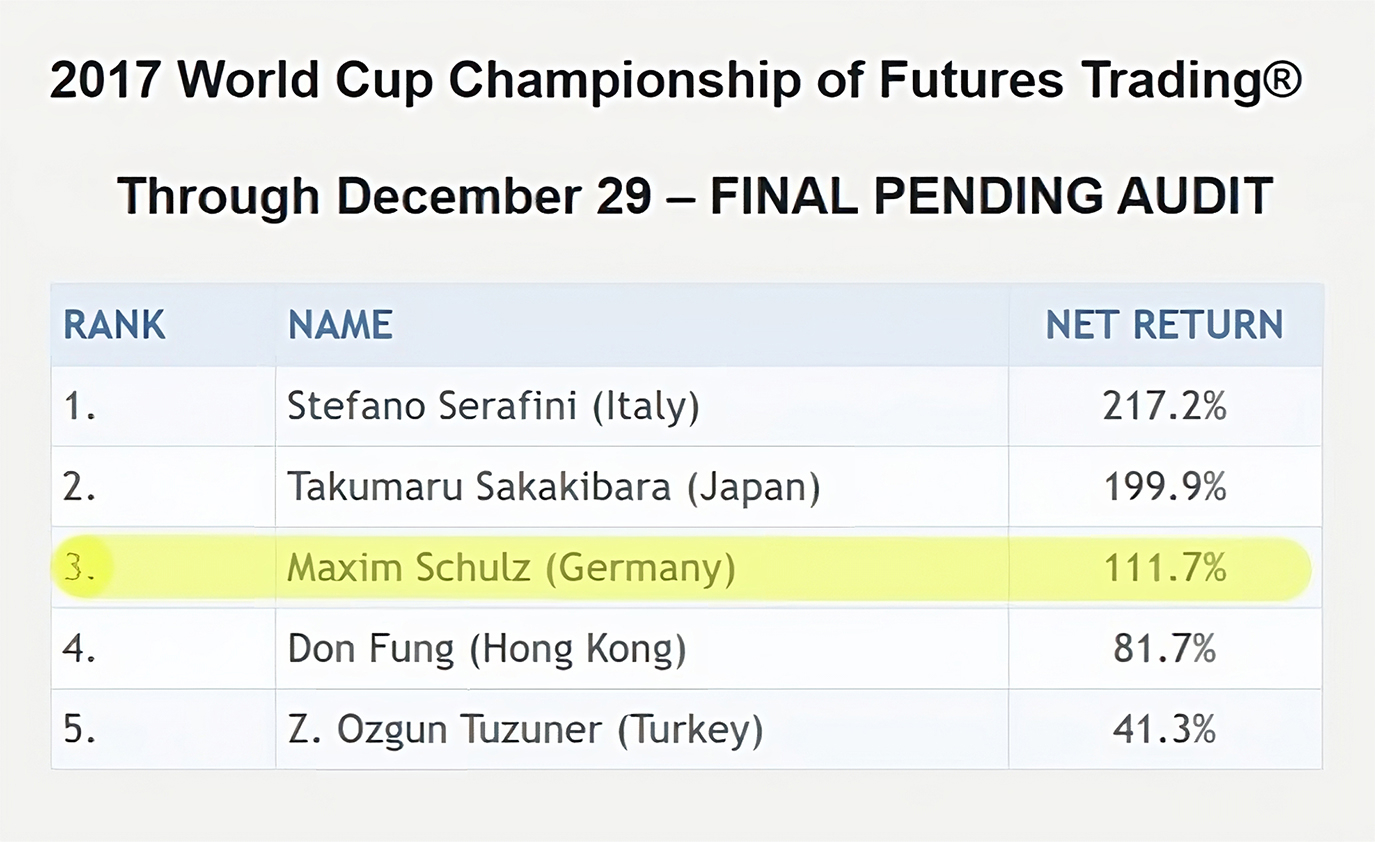

By the end of the year, I finished third in the competition with a net profit of 111%.

2019: Back in the game – again I participate in the Worldcup Trading Championship

After taking some time off in the following year for personal reasons, I returned to the competition in 2019.

This time, however, it was a completely different kettle of fish:

The “Global Cup Derivatives Trading Championship” combined futures and options trading. I, however, decided to stick with trading futures exclusively. The competition ran for the usual twelve months, but with a different start date.

I had reworked my strategy from the previous event. After having conducted a thorough evaluation, I slightly adjusted a few approaches based on my experience from the 2017 World Cup.

In contrast to my first attempt, this time I got off to a very good start. After only a few trades, I had already advanced to the top five. Although there was steady fluctuation the whole time, it was not part of my plan to leave the top five after having secured a place there.

Only two months later, at the beginning of August, I led the board for a short time. After that, I slipped back to fourth place and things got interesting again towards the end of the event:

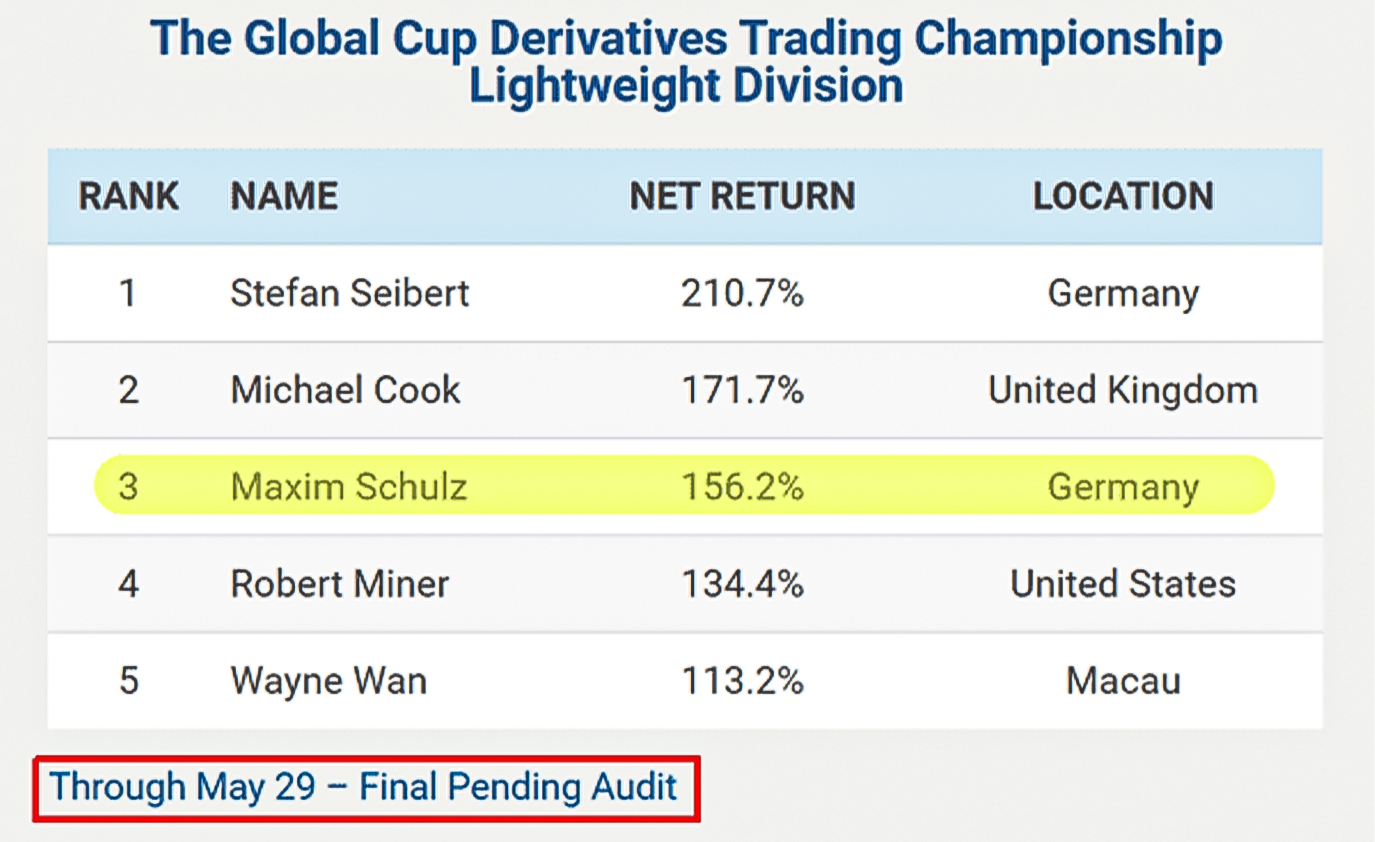

This penultimatepublication of the leaderboard is dated from May 28, 2020 – two days before the official end of the competition. I was in 4th place, merely 1.1% behind Robert Miner. But we both had open positions which had to be closed the next day!

Who would win the race for third place?

The final ranking looked as follows:

While my competitor took a loss on his last trade, I was able to secure a win and thus make third place with a clear lead.

Once again, I was taking home one of the coveted trophies. I reached third place for the second time, but with a significantly higher profit.

There is still some room for improvement, however, and I am looking forward to the next competition!

20/21. For the third time: Success at the Trading Championships

This year’s round of the World Cup Trading Championships ended on May 28, 2021. We took part in the competition for the third time and for the third time we are in the top group of the five best traders in the final evaluation.

This is worth talking about!

In 2017, we participated for the first time and got the third place. In 2019/20, we also achieved the third place. When we started the current round in 2020, the global corona lockdown was in full swing.

After the declaration of the Corona pandemic, the financial markets experienced a “super-GAU” and futures market was not an exception. Another World Cup Trading Championship was to start in June and it was not a good sign.

We had to get through an extremely volatile phase at InsiderWeek. In the second half of the year we got into a longer-term drawdown, which we only got out of in the second quarter of 2021. And of course, trading in competition wasn’t a lot easier.

Nevertheless, it was possible to end the competition with a net profit of + 78.8%.

Check out our video and learn more about it.

What we are really proud of

The markets were extremely volatile. Some participants managed to advance into the top group with fantastic results at short notice – only to give up their leading places again a week or two later and say goodbye to the ranking. That’s not what we do at InsiderWeek

Quick wins usually go down just as quickly. We rely on constant, long-term profitable trading. For the third time in a row, we have now been able to show that our trading approach based on the COT data meets these expectations.

Our strategy is based on a trustworthy and tested foundation. During this difficult market phase, it became apparent at times that the COT data could not give reliable signals either. Then it was just a matter of waiting as well as exercising discipline and patience. The repeated success has proven us right!

What’s our future plan at InsiderWeek?

When we are done with one championship, we are getting ready for the next one!

We will compete again at the next championship. We will end up in the top group again. We have one more goal to drive us:

In our champion coaching at InsiderWeek, we convey the special features of our championship strategy to our participants who have already successfully completed our intensive coaching. This strategy represents an optimization of our COT strategy, which is geared towards short-term trading with a position holding period of 1 to 3 days.

The coaching is to prepare our participants specifically for participation in the trading championships and to give them the tools they need to be on the top.

And what could be nicer for a coach than being over-performed by his own students?

THREE traders from Germany are represented in this year’s top. This proves that trading on the commodities and futures markets is also gaining popularity in this country. Maybe we will soon see the first FIVE ranks occupied by German participants and some of them being InsiderWeek trainees?

Wouldn’t it be GREAT?

Curious to learn more?

Get your hands on Max Schulz’s book by downloading it today! Free of charge.