What are futures and how to trade them?

Futures or forward contracts are standardized tradable products on the stock exchange, with prices derived from actual trading commodities.

Content

- 1. What are futures?

- 2. What futures exist?

- 3. What are futures exchanges?

- 4. How is the price of a futures contract determined?

- 5. Where do I start in futures trading?

- 6. Are futures a risky financial product?

- 7. How to trade futures?

- 8. Things to consider in futures trading

- 9. Why trade futures?

- 10. Are you all ready?

What are futures?

A futures contract, also referred to as a futures or forward contract, is a derivative instrument that is traded on the stock exchange. These contracts are based on underlying assets like commodities, currencies, or stock indices. It's important to note that futures trading does not involve the physical trading of actual commodities. Instead, traders engage in contracts that are settled in cash, eliminating the need for physical delivery of the goods.

Why did futures trading begin?

Initially, two trading partners entered into a contractual agreement, known as a forward contract, to ensure reliable expense/revenue calculations. This agreement included specific details such as:

- The quantity of a particular commodity

- A future date

- A price valid at the current time

Upon reaching the agreed-upon date, the specified amount of the commodity was delivered or received, and payment was made at the predetermined price.

As time passed, futures contracts emerged from forward contracts. The conditions of these contracts were defined by exchanges (market operators) and became standardized. This standardization enabled the trading of futures contracts as a separate entity on exchanges.

In addition to producers and processors, speculators also became active participants in futures trading. Unlike commercial participants, speculators are primarily motivated by profit and engage in buying and selling futures contracts on futures exchanges without the intention of physically trading commodities.

The presence of speculators contributes to a liquid futures market with transparent pricing at all times. Thus, futures trading, involving the exchange-traded trading of standardized futures contracts, was born.

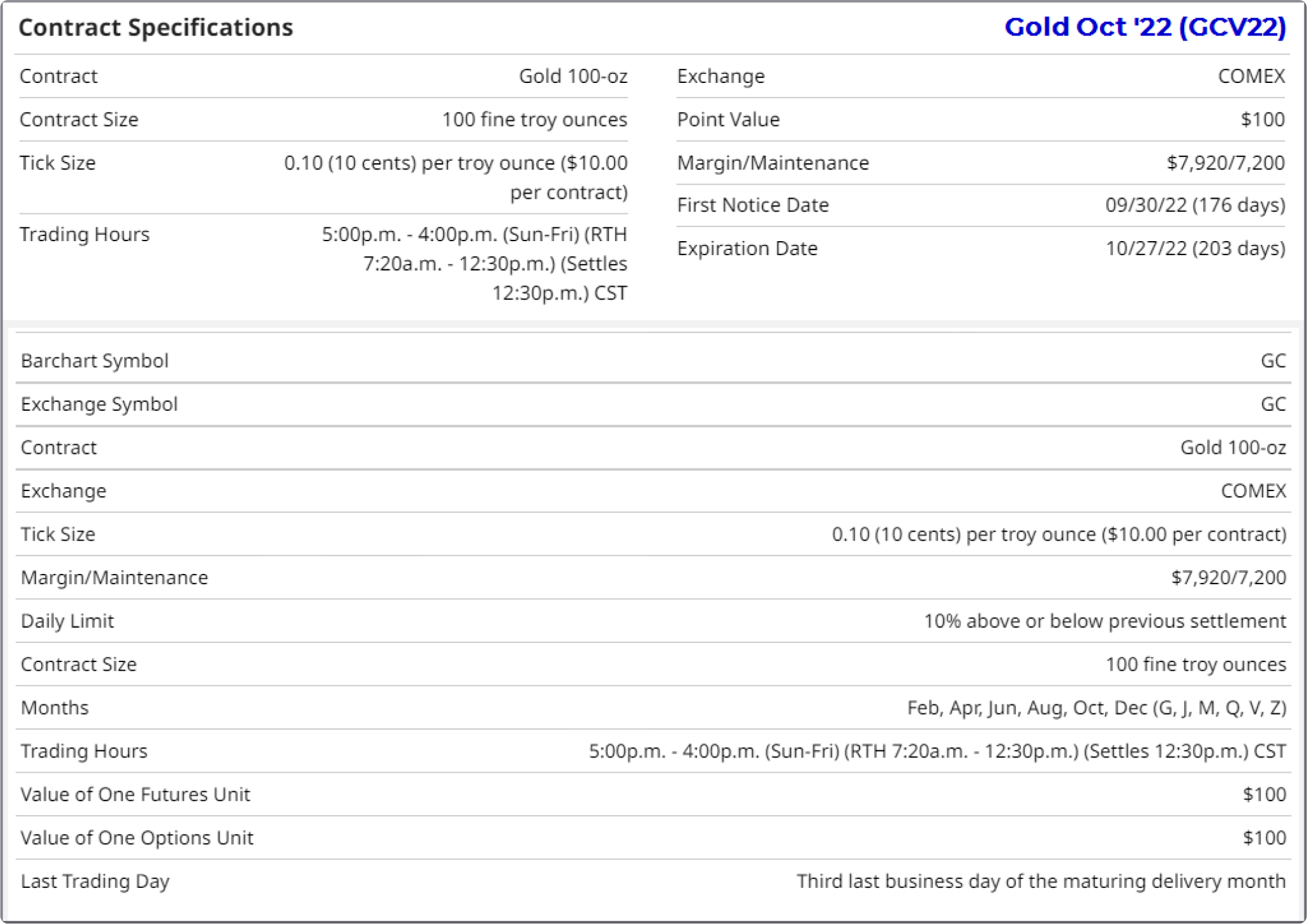

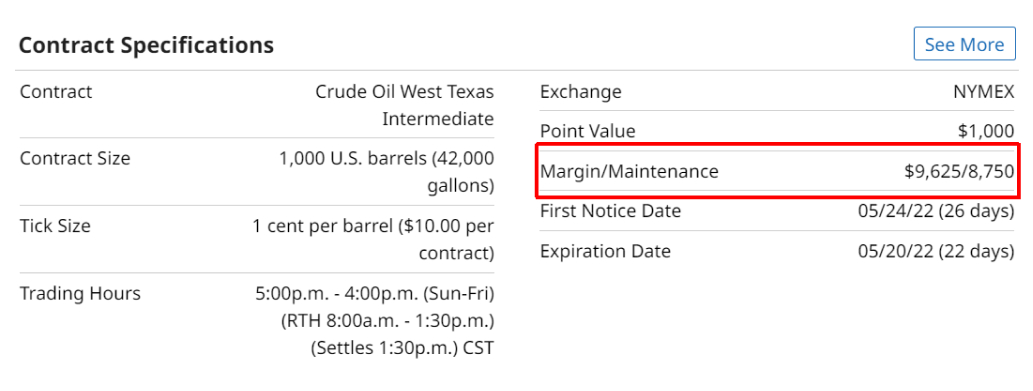

The key distinction between futures and forwards lies in the fact that futures are traded on a futures exchange, which sets and standardizes the contract specifications. As a futures trader, you should pay close attention to essential contract specifications such as margin requirements, tick value, and expiration date. These factors play a crucial role in futures trading.

Here, we present the contract specifications for the October'22 gold contract as an example:

What futures exist?

There are various types of futures contracts available for trading. The classic sector for futures trading is the commodity sector, which encompasses agricultural commodities, energy commodities, and metals. Additionally, futures contracts can be traded on currencies, indices, bonds, and cryptocurrencies.

- Agricultural commodities: Wheat, corn, rice, coffee, lean hog, etc.

- Energy commodities: Crude oil, natural gas, heating oil, gasoline, etc.

- Currencies: Dollar, euro, yen, etc.

- Metals: Gold, silver, platinum, palladium, etc.

- Indices: S&P 500, NASDAQ.

- Government bonds: T-Notes, T-Bonds.

- Cryptocurrencies: Bitcoin.

At InsiderWeek, we specialize in trading futures contracts within the sectors mentioned above. While there are other futures contracts available, such as those related to milk, butter, eggs, coal, and steel, they may be less liquid. It is even possible to trade weather derivative futures on exchanges like CME in Chicago or LIFFE in London.

What are futures exchanges?

A futures market, also known as a derivatives market, serves as an exchange where futures contracts are traded exclusively. These futures exchanges often specialize in specific sectors and markets. For instance, the Chicago Board Of Trade (CBOT) facilitates the trading of agricultural products such as wheat, corn, and soybean futures, as well as financial futures like E-mini Dow Jones, micro E-mini Dow, T-Bonds, and T-Notes. Similarly, the New York Mercantile Exchange (NYMEX) focuses on energy futures, including crude oil, and metals.

Noteworthy futures exchanges include:

- CME Group: Comprising individual exchanges like CME, CBOT, and NYMEX/COMEX.

- ICE (Intercontinental Exchange): Operating multiple trading venues, including ICE Futures U.S., ICE Futures Europe, and ICE Futures Singapore, among others.

- EUREX: A European Exchange serving the futures market.

- LME (London Metal Exchange): Establishing daily reference prices for the global cash market of metals.

Trading on futures markets has transitioned to electronic platforms, enabling round-the-clock trading, unlike many stock markets. However, it's important to note that not all futures exchanges operate 24 hours a day.

How is the price of a futures contract determined?

You're already aware that a futures contract represents a tangible product. Consequently, the price of the futures contract is directly linked to the price of the underlying product and largely mirrors its movements.

The prices of commodities and other sectors are influenced by key market participants, including commercials and large speculators. Unlike with CFDs, for instance, prices are determined based on the principles of supply and demand. When demand exceeds supply (creating scarcity), prices rise. Conversely, when supply surpasses demand (resulting in oversupply), prices decline.

In the case of CFDs, options, and certificates, the pricing is typically determined by the bank or issuer. While banks claim to provide transparent pricing based on the underlying financial product, it is important to note that during critical periods like stock market crashes or highly volatile market phases during crises such as wars, pandemics, or economic downturns, this transparency may not hold true.

When trading CFDs, options, and certificates, you are essentially engaging with the bank or issuer rather than a genuine market participant. It's essential to understand that the bank's primary interest lies in generating profits rather than ensuring your financial success.

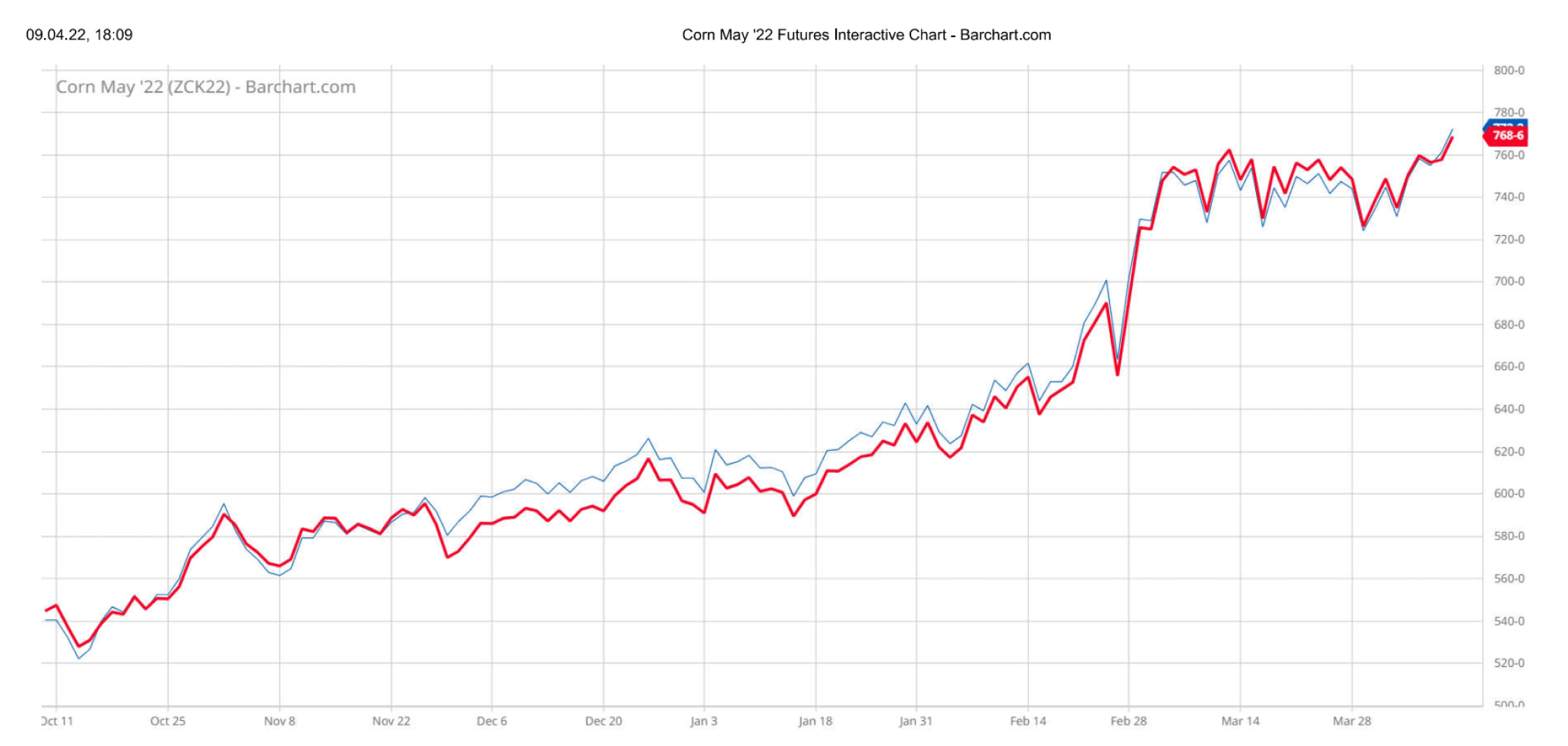

The supply of commodities is influenced by various factors. Agricultural commodities, for instance, exhibit seasonal price trends and can be further affected by external elements like weather conditions and biological factors such as crop diseases and pests. Similarly, weather patterns impact the production and extraction of other commodities like metals and energy resources.

On the demand side, social factors such as customs, fashion trends, and social movements, along with significant events like the coronavirus pandemic, play a role in shaping consumer purchasing behavior.

In addition, commodities, whether agricultural or energy resources, are used as political leverage and pressure. Embargoes, sanctions, or trade restrictions in the form of tariffs and levies largely steer prices.

Where do I start in futures trading?

For beginner traders, it can be challenging to consider all the factors that influence futures contract prices in their trading strategies right from the start. Even experienced traders may not always incorporate all the aforementioned factors due to the time-consuming nature of comprehensive analysis.

At InsiderWeek, we have a team of analysts specializing in different areas, such as weather conditions and news analysis. Additionally, we leverage various proprietary trading tools that expedite the process of identifying profitable opportunities. This approach has allowed us to achieve an impressive average annual return of 77%, surpassing the average annual return of 10% for the S&P 500.

We provide daily updates and share the results of our analysis in our membership area. Subscribers gain insight into our trading logic, market analysis approach, and receive advance notice of our trades before executing them. Beginner traders have the opportunity to follow our trades on a demo account, which can be opened through a broker of their choice from the provided link.

Get exclusive access to our membership area

and be the first to receive notifications about our trades

AccessAre futures a risky financial product?

In the world of financial markets, every investment carries its own set of risks. The question that arises is whether futures contracts pose greater risks compared to other assets.

Futures contracts are considered less risky due to the constant demand they enjoy.

In a free market, the price of any product is determined by the interplay of supply and demand. While the supply of many commodities tends to fluctuate significantly, the demand for them remains generally steady or even experiences growth.

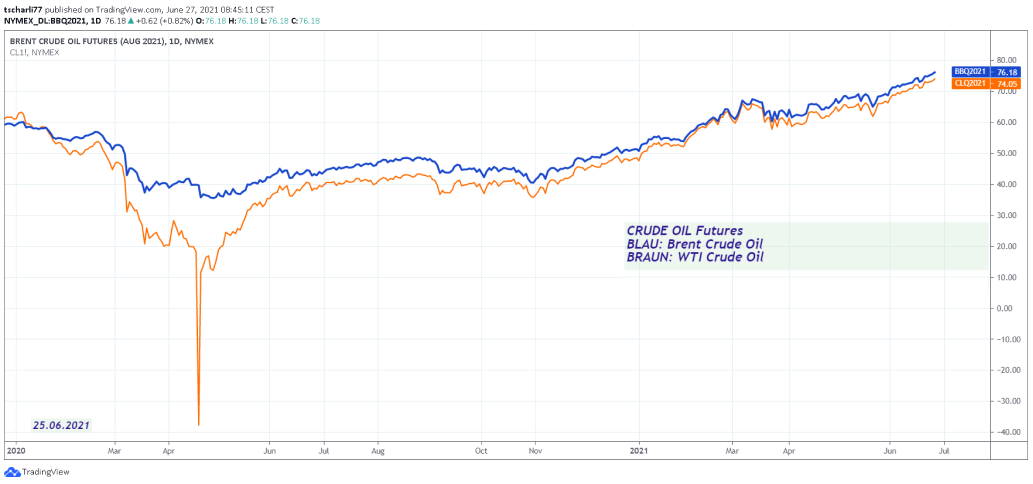

Because the demand for commodities is unlikely to suddenly vanish, the price is not prone to an abrupt drop to zero, thereby avoiding sudden and total losses. However, an exception to this occurred in 2020 when the World Health Organization declared COVID-19 a pandemic.

The decline in demand for crude oil and its derivatives resulting in an overwhelming oversupply, with storage tanks reaching capacity and no buyers in sight, led to an unprecedented crash in prices.

These events, although extraordinary, are not inherent risks specific to futures trading. By implementing a robust risk management strategy, which is essential regardless of geopolitical circumstances, significant losses can be mitigated even in such cases.

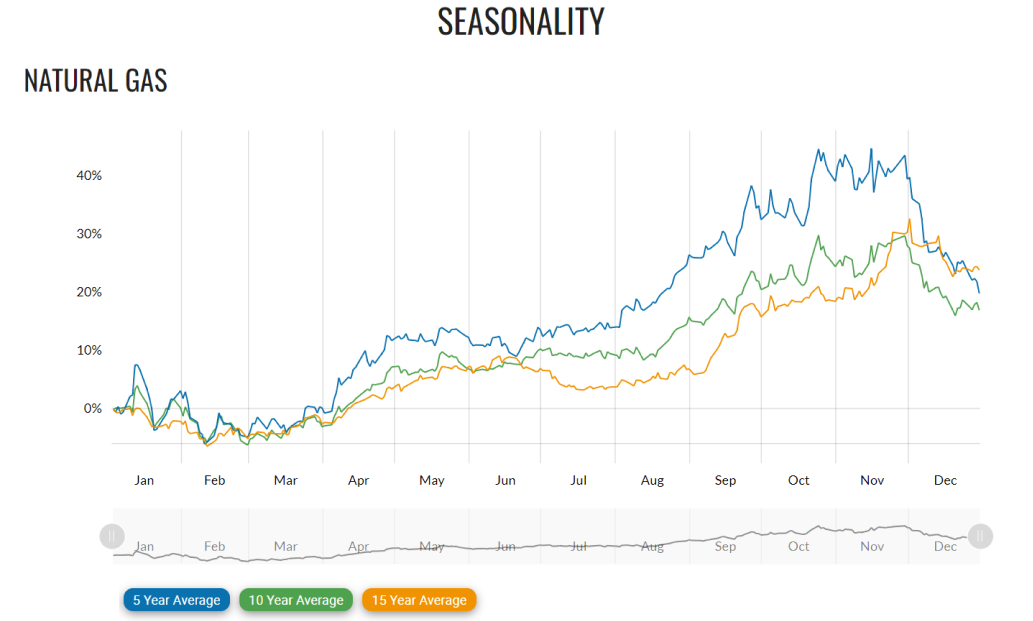

Futures contracts are considered less risky due to the predictable seasonal patterns observed in commodities.

This is particularly evident in the case of agricultural commodities, where the recurring cycles of planting, growth, and harvest directly influence the availability and pricing of the commodity.

Energy commodities such as crude oil and natural gas also exhibit seasonal patterns. During certain times of the year, there is a notable increase in demand for electricity (air conditioning) and heating oil.

Understanding and utilizing this knowledge of seasonality not only facilitates planning but also provides valuable support for making informed trading decisions.

Futures contracts are considered less risky due to their transparency, especially in the futures markets of the United States, which are the primary focus of InsiderWeek. In the U.S., all market participants holding or exceeding a certain number of contracts are required to report their positions to the Commodity Futures Trading Commission (CFTC), a government regulatory authority.

The CFTC publishes a weekly market report called the Commitments of Traders (COT) report, which provides public access to this data. This report reveals how major market participants, including commercials and large speculators, are positioning themselves and provides valuable insights into their assessment of the market situation.

Analyzing the COT report can aid in making informed trading decisions based on this valuable information.

While futures trading carries inherent risks, one factor that adds to the risk is the use of commodities as political tools.

The ongoing conflict in Ukraine serves as a clear example, and history is replete with other instances where commodities, particularly agricultural products like wheat, rice, sugar, cotton, and energy resources such as oil and gas, have been utilized for political leverage.

These circumstances can make futures trading highly volatile and risky during certain periods. However, with a proper approach to market analysis, these risks can be mitigated.

How to trade futures?

Futures trading offers three distinct trading styles, each with its own time frame and strategies.

Time frame

The shortest-term trading style is scalping, where trades are executed on a minute-by-minute basis. Next is futures day trading, which operates on an hourly basis. Swing trading involves trading futures at the end of the day after the market closes, and it can be combined with other strategies.

Trading strategies

Each trading style employs specific strategies. Popular futures trading strategies include the Pullback Strategy, Trading the Range, Breakout Trading (particularly popular in day trading), Spread Trading, Fundamental Trading Strategy, Buyer and Seller Interest, Trend-Following, and Counter-Trend Trading.

If you prefer not to spend the entire day in front of screens and wish to experience less mental stress associated with scalping and day trading, the Futures Swing Trading style with the strategy from InsiderWeek is recommended. This approach is based on the expertise and experience of Larry Williams, utilizing the COT report and COT data as a foundation. The strategy incorporates technical analysis for timing entry and exit positions, while also emphasizing robust money risk management. With this approach, you can achieve profitable futures trading results with minimal time commitment.

Things to consider in futures trading

In futures trading, it is important to consider the contract duration, margin requirements, and tick value.

Expiration date

The expiration date of a futures contract refers to the period between the current date and the contract's expiration. Your futures broker will notify you on the first notice day prior to expiration, prompting you to close your position. The specific expiration day and first notice day are outlined in the futures contract specifications.

As a trader, you do not determine the duration of the contract yourself. The futures exchanges establish standardized durations for traders. You have the freedom to choose the futures contract and can buy or sell it as frequently as desired during the term. Therefore, you have the discretion to decide when to enter or exit a position, opening and closing trades based on your trading strategy.

At the end of the term, it is possible for prices to experience significant rises or falls due to the limited participation of market players trading the futures contract just before its expiration date. This low trading volume can result in unfavorable price setting.

If you hold your position until the expiration date, your broker will automatically close your position at the prevailing price (liquidate futures). The price at which your position is closed may be less favorable than the price prior to the end of the term.

Depending on whether you are long or short, you may need to buy your futures contract at a higher price or sell at a lower price than the previous day. This can result in potentially greater losses or smaller gains compared to what you could have achieved if you had considered the expiration date.

To mitigate these risks, it is advisable to be proactive and close your position yourself before the expiration date. By doing so, you have more control over your trades and can potentially optimize your profits while minimizing losses. It is important to stay mindful of the expiration day and the first notice day.

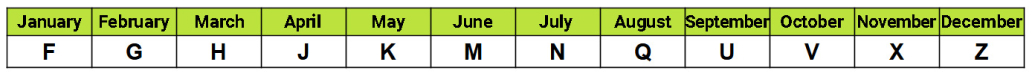

Each futures contract has its own unique expiration date, which is typically denoted by the corresponding month (expiration month or contract month). For instance, if a futures contract expires on May 13th, it is referred to as the May contract. Keep in mind that different futures have varying numbers of expiration months.

For example, wheat has five established expiration dates, or five maturity months (March, May, July, September, December). Contracts expire in these months. In contrast, natural gas has 12 expiration months, or 12 defined expiration dates.

You could, for instance, open a position in the Wheat May contract in April and would need to close that position by no later than May 13th (the expiration date for wheat - May).

The contract months are represented by an abbreviation indicating the relevant material and the corresponding year. The abbreviation for a futures contract consists of a symbol for the underlying material and a specification for the contract month. For example, the January 2023 contract for natural gas can be identified by the abbreviation NGF23.

In futures trading, margin refers to the collateral required to initiate a position, whether it is short or long. The margin amount is not actually paid but is instead held as a reserve on your trading account.

When you close your position, the margin amount is released or offset against any losses incurred. If you exit the trade with a profit, you will receive your full margin back along with the profit. Conversely, if you close the position at a loss, the loss will be deducted from the margin.

There are two types of margin. The initial margin is the amount of collateral blocked by the broker when you open a position. Additionally, many brokers require an overnight margin if the position is held overnight.

The maintenance margin refers to the minimum amount that must be maintained in your account to avoid breaching it in the event of a loss from the futures position. This margin can be up to 90% of the initial margin.

If your position moves against you, resulting in significant losses that breach the maintenance margin, you will receive a margin call. This means you must replenish your account to the original margin level, otherwise your position will be automatically liquidated. Keep in mind that this process incurs fees and costs.

Why trade futures?

Many sectors - many sectors have liquid futures that fall into categories such as stock indices, financials, currencies, grains, energies, metals, soft commodities, meats, and cryptocurrencies.

Trading futures long and short - one of the advantages of futures trading is the ability to go long or short, allowing you to profit from both rising and falling prices.

Hedging and leverage - futures are widely used for hedging long-term investments, providing an excellent tool for risk management. Additionally, you can diversify your futures portfolio by combining it with other financial products. As leveraged instruments, futures allow you to trade with a fraction of your capital, providing flexibility and maximizing your trading potential.

Calculable risk - futures trading offers a unique advantage of calculable risk, providing traders with a relatively safe and predictable trading environment.

Are you all ready?

To help beginners minimize mistakes and gain a solid foundation in futures trading, we highly recommend joining our membership.

What are the benefits for you?

- Receive daily trading alerts and insightful comments from me, Max Schulz. This will help you focus on promising markets and set a successful trajectory from the start.

- Gain in-depth market analysis on a weekly basis to help you prioritize your trading week. Our analysis includes COT Report Analysis, COT Signals & Charts, Trading Watchlist, Futures Calendar, and Trading Plan Video.

- Enhance your theoretical knowledge in futures trading with our comprehensive Futures Trading Course, Seasonal Trades Tool, Trading Plan Video Archive, and access to useful Futures Market Site Links.

- Optional strategy courseware and coaching are also available for purchase to further enhance your skills.

Access our membership area now

and enjoy a 50% discount to kickstart your futures trading journey

AccessWe wish you many profitable trades on your journey into the world of futures trading.

Best regards,

Max Schulz and the InsiderWeek Team.