Verfolge mein 1 Mio $ Tradingkonto

Seit 2014 führe ich eine umfassende Tradingstatistik über all meine Trades.

Auf dieser Seite findest du eine detaillierte Auflistung aller Trades, aufgeschlüsselt nach Strategien und Tradingkonten. Zudem werden umfangreiche Kennzahlen und Statistiken bereitgestellt, um die Performance der COT-Strategie besser analysieren zu können.

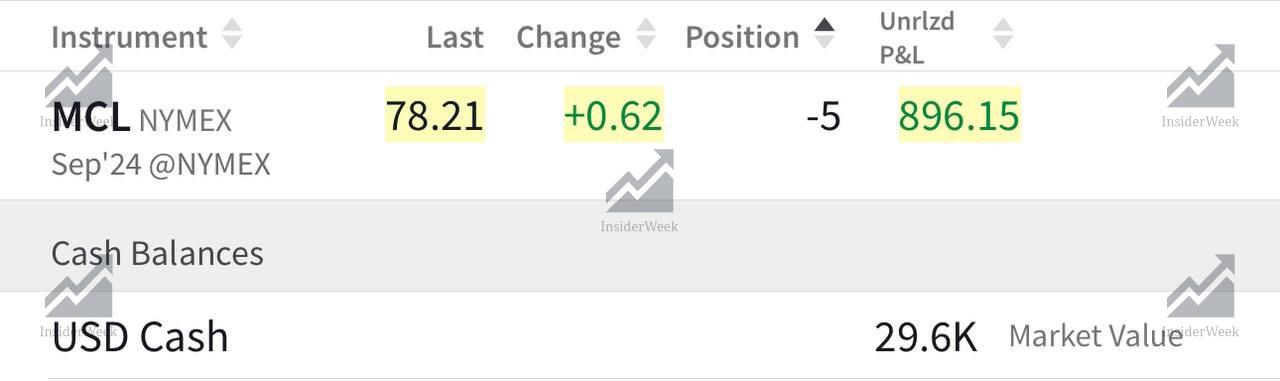

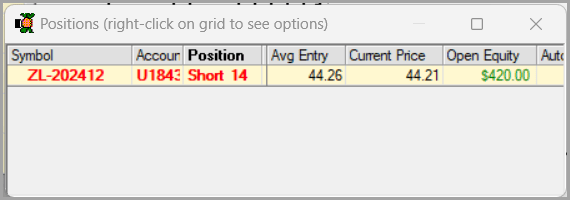

| Week | P/L | Profit, $ | Draw Down | |

|---|---|---|---|---|

| $ | % | |||

| 2024-30 | $10,612 | 1,493,777 | -62,350 | -3.62 |

| 2024-29 | -$10,496 | 1,483,165 | -72,962 | -4.24 |

| 2024-28 | $20,550 | 1,493,661 | -62,466 | -3.63 |

| 2024-27 | -$8,198 | 1,473,111 | -83,016 | -4.83 |

| 2024-26 | $6,233 | 1,481,309 | -74,818 | -4.35 |

| 2024-25 | -$5,040 | 1,475,076 | -81,051 | -4.71 |

| 2024-24 | $0 | 1,480,116 | -76,011 | -4.42 |

| 2024-23 | -$7,512 | 1,480,116 | -76,011 | -4.42 |

| 2024-22 | -$1,506 | 1,487,628 | -68,499 | -3.98 |

| 2024-21 | $15,000 | 1,489,134 | -66,993 | -3.89 |

| 2024-20 | $8,525 | 1,474,134 | -81,993 | -4.77 |

| 2024-19 | $14,189 | 1,465,609 | -90,518 | -5.26 |

| 2024-18 | $18,445 | 1,451,420 | -104,707 | -6.09 |

| 2024-17 | $250 | 1,432,975 | -123,152 | -7.16 |

| 2024-16 | -$15,582 | 1,432,725 | -123,402 | -7.17 |

| 2024-15 | $6,617 | 1,448,307 | -107,820 | -6.27 |

| 2024-14 | $12,053 | 1,441,690 | -114,437 | -6.65 |

Seit 2017 veröffentliche ich jeden Sonntag ein YouTube-Video mit einer detaillierten und lückenlosen Analyse aller Trades der vergangenen Handelswoche, aufgeteilt nach Strategien und Handelskonten. Hier kannst du meine Wochenergebnisvideos anschauen.

Du hast nun einen detaillierten Einblick in die Performance der COT-Strategie erhalten. Wenn du die COT-Strategie im Live-Handel erleben möchtest, dann abonniere die Handelspläne und Handelssignale und trade mit.